Cyber is an Understatement

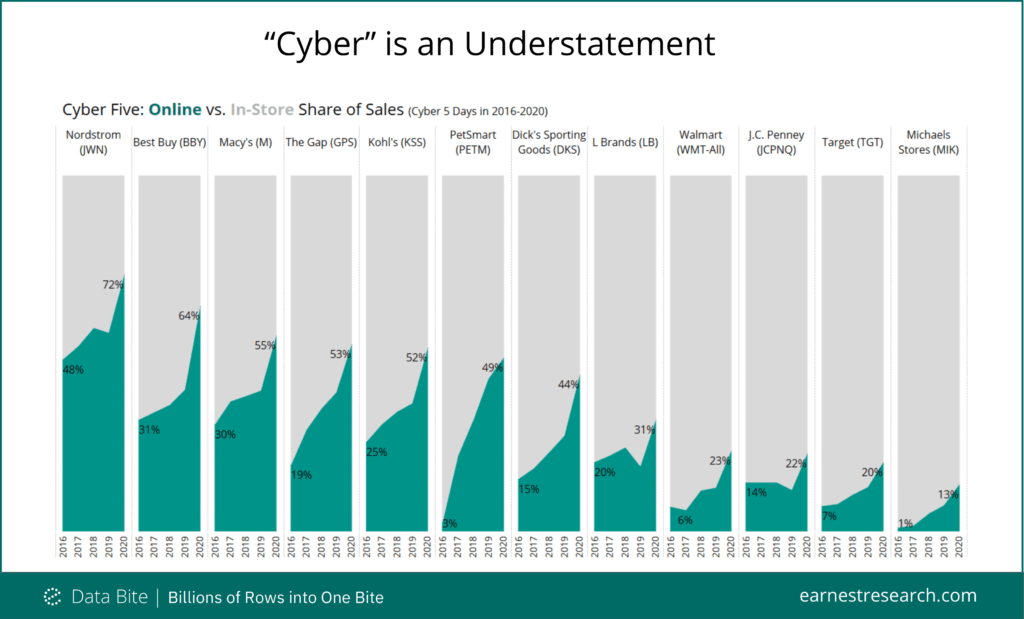

The pandemic-driven shift to online this year has undoubtedly impacted all retailers, big and small alike, but the magnitude of this shift among retailers is a particularly interesting story. We took a look at how the share of online sales has grown across a select group of large and traditionally brick-and-mortar retailers during the Cyber 5 (the five days between Thanksgiving and Cyber Monday) sale periods from 2016 to 2020.

Leading the shift online is Nordstrom with a whopping 72% of sales coming from ecommerce this year, a 24 point gain since their 2016 holiday. Next is Best Buy at 64% online share, with most of their online increase generated this year (up 24 points since 2019). Macy’s is third at 55% online share this year, up from 30% in 2016.

PetSmart saw the largest acceleration of e-commerce share over the Cyber 5 period, up 46 points since 2016, or 28 points since their April 2017 acquisition of online retailer Chewy.

At the other end of the scale are retailers with around 20% or less of sales online this season. Craft store Michaels saw the least, among this group of retailers, at just 13% of sales online—up from just 1% in 2016. Next is Target with 20% of sales online—particularly interesting given they’ve been a beneficiary of Covid-related spending. While struggling department store J.C. Penney generated only 22% of sales online, up just 8 points since 2016, they did reverse their negative online trend in 2019.