Cobenfy launch in schizophrenia is off to a strong start in 2025

Key Takeaways:

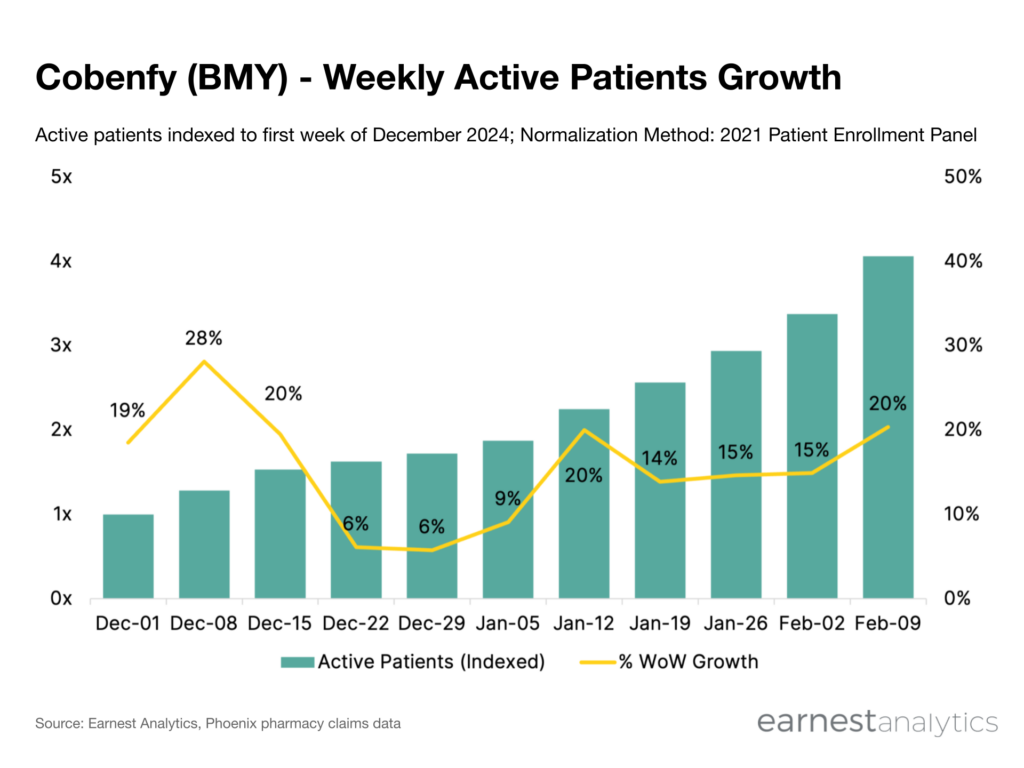

- The Cobenfy schizophrenia drug’s active patients grew 4x since early-December 2024 and has averaged ~17% WoW growth in recent periods according to Earnest pharmacy claims data

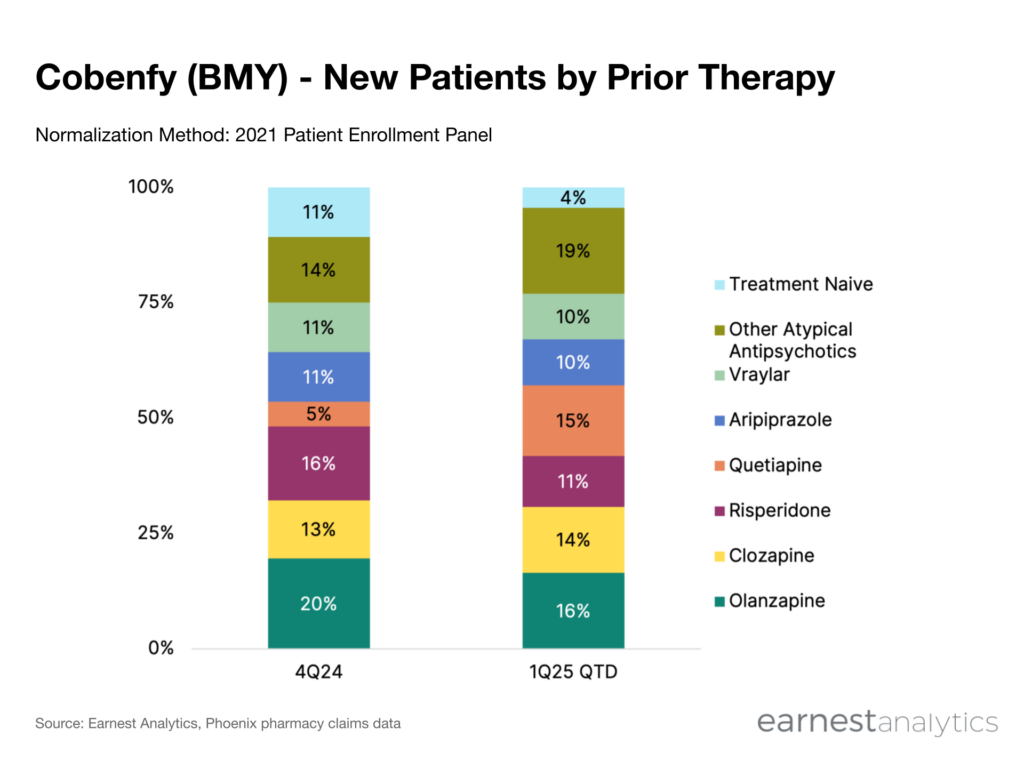

- Majority of patients have atypical antipsychotic experience and roughly ~65% of new starts are switching over from five mainstay generics (olanzapine, clozapine, risperidone, quetiapine, and aripiprazole)

Bristol Myers Squibb (BMY) acquired Karuna Therapeutics and its promising lead asset KarXT for $14B in March 2024. This strategic move paid off when the FDA approved Cobenfy (formerly known as KarXT) for the treatment of schizophrenia in September 2024. As the first novel mechanism of action for schizophrenia in over 30 years, Cobenfy could transform the current treatment paradigm. BMY reported $10M for Cobenfy Net Sales in 4Q24, which was in-line with analyst expectations.

Active patients on therapy re-accelerate after brief holiday slowdown

According to research from Earnest Phoenix pharmacy claims data, Cobenfy active patients grew 4x from early-December 2024 to mid-February 2025. After a short period of holiday-driven deceleration, Cobenfy’s launch has resumed course averaging ~17% WoW active patients growth since mid-January.

Patients are switching to Cobenfy from a wide array of atypical antipsychotics

Though effective, second-generation antipsychotics (also referred to as atypical antipsychotics) are associated with a wide range of side effects. They include extrapyramidal symptoms (EPS), weight gain, and increased risk for cardiovascular events. The Cobenfy schizophrenia drug offers a distinct side effect profile. Available data suggests lower EPS risk and lower propensity for weight gain. Earnest Phoenix pharmacy claims data indicates that Cobenfy new starts are switching over from a wide variety of drugs. The vast majority of patients have atypical antipsychotic experience. Additionally, roughly 65% of new starts are switching over from five mainstay generic options (olanzapine, clozapine, risperidone, quetiapine, and aripiprazole).

Several top-selling BMY legacy products (e.g., Eliquis, Opdivo) are approaching the end of their market exclusivity. The drugmaker is depending on growth portfolio products like Cobenfy and Camzyos to offset the impending revenue decline. Continue monitoring the Cobenfy launch and BMY’s commercial execution in near real-time with Earnest data.

Request information on Phoenix pharmacy claims