Club Monaco’s Sale

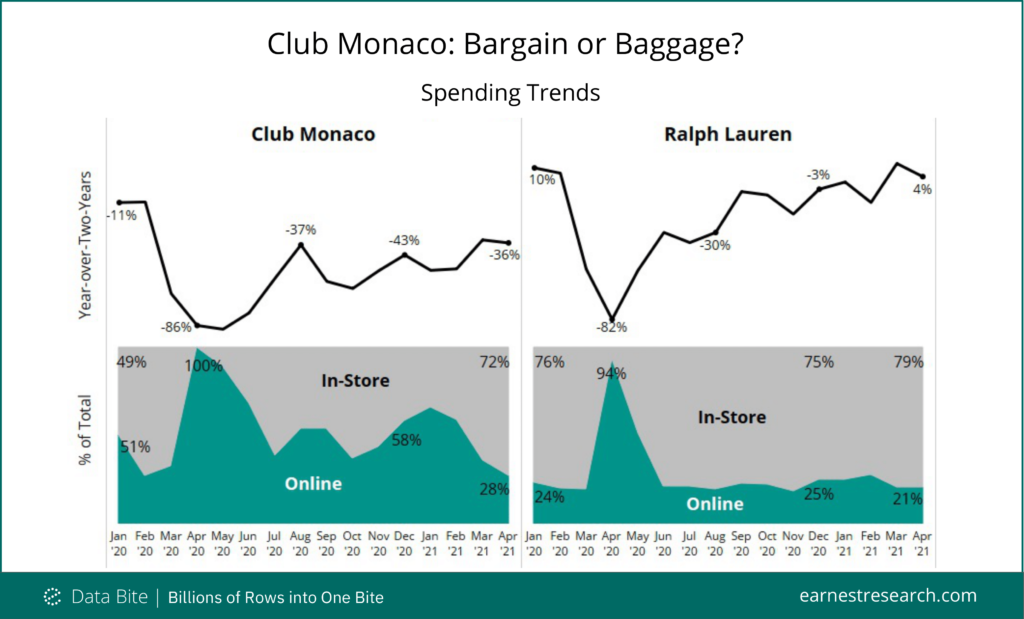

Following the news that Ralph Lauren plans to sell its Club Monaco segment to private equity firm Regent, we looked at how the two brands have performed recently.

While similarly afflicted at the beginning of the US COVID outbreak in April last year, with both seeing over 80% declines in Yo2Y sales growth, the road to recovery looks very different. Club Monaco spending (< 5% the size of Ralph Lauren) remains -36% in April, ~25 points below its pre-COVID levels, while Ralph Lauren has returned to positive low single digit growth, at just ~6 points below its pre-COVID levels.

Similarly, the online story starts with the shift to around 100% online as stores closed last spring. Club Monaco then bounced around 50% online before recently dropping to 28% share, while Ralph snapped back to pre-pandemic mid-20% levels, dipping slightly recently as consumers started shopping in-person again.

As Americans increasingly return to the office and attend social gatherings, will Club Monaco’s business casual and “elevated essentials” come back in vogue?

Note: our data represents sales at company-owned stores and online channels in the US, and doesn’t account for international nor wholesale retail partners.