Chili’s outperforms casual dining competitors with value focus

See chart in Dash.

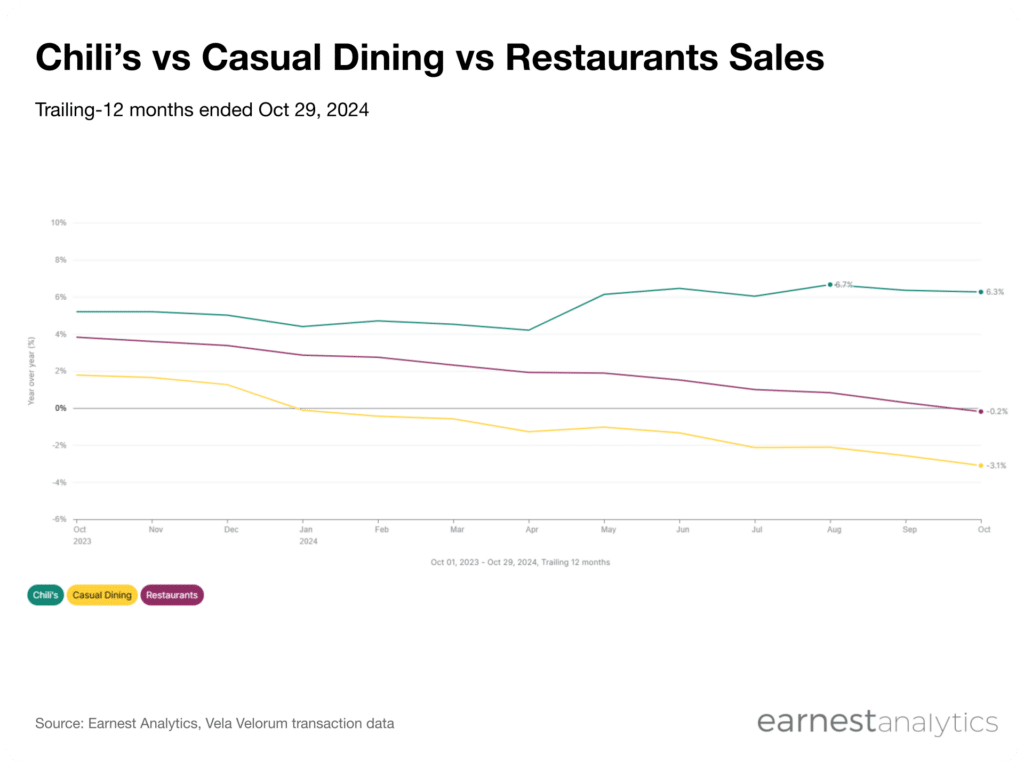

Chili’s sales accelerated 2.1% on a trailing-12 month basis from April to October 2024, according to Earnest credit card data. Chili’s sales acceleration represented a sharp divergence from the Casual Dining segment at large, which decelerated 1.8 points, and Restaurant spending as a whole, which decelerated 2.1 points.

Transactions at Chili’s accelerated 4.2% over the same period, while the restaurant category saw a -1.2% deceleration (see data in Dash). This suggests that the acceleration in Chili’s sales was mainly driven by an increase in the number of transactions rather than just higher tickets.

Brinker, the parent company of Chili’s, cited growth “with all income cohorts now.. so there’s no demographic that [they’re] not winning with” on its 1Q25 earnings call. The Brinker restaurant chain has found success in recent promotions like the Big Smasher burger, $6 margaritas, and Triple Dipper as customers increasingly seek value when making dining decisions.

Track restaurant spending for free