ChatGPT’s consumer business has been growing more slowly than you might have thought

Assistant Professor of Marketing at Emory University – Goizueta Business School

ChatGPT has grown from a mere concept to a conversational powerhouse in a remarkably short period of time, captivating millions of its users with its nuanced dialogues and near-human interactions, powered by a blend of machine learning algorithms and massive datasets that allow it to simulate a wide range of human conversational abilities.

But how has this growth translated into consumer adoption? An analysis that Kenneth Wilbur and I conducted shows that the answer to this question is “somewhat uneven”, as it turns out.

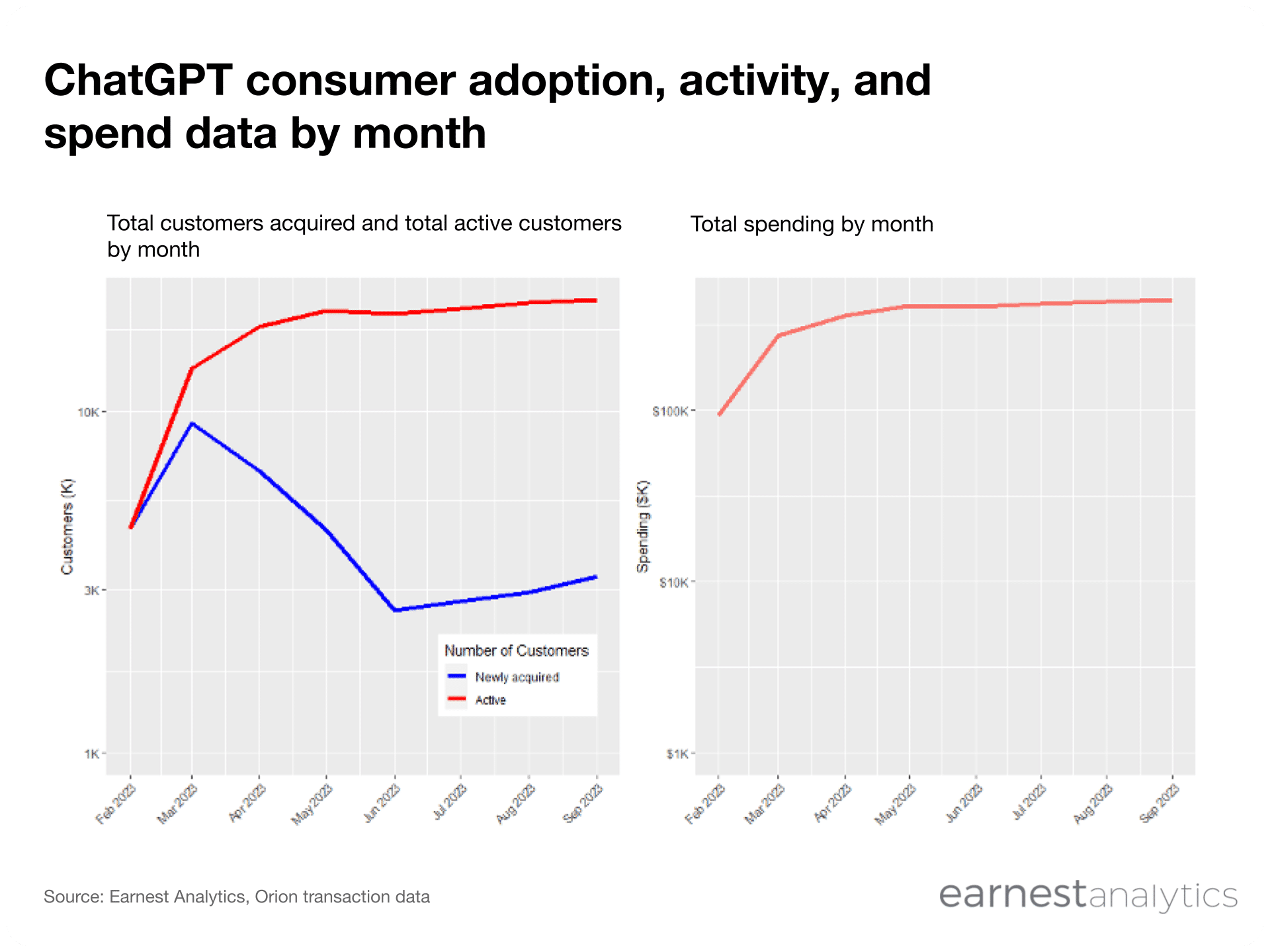

Here is a graph showing total new customers acquired (left: blue line) active customers (left: red line), and total spending (right) across all members in a large consumer transactions dataset available through Earnest Analytics.

There has been a dramatic slowdown in the number of new customers acquired, with the month-on-month growth rate averaging to -4.5% over the past 4 months.

Despite this slowdown, customer retention has been strong enough that the total number of active paying customers has continued to grow, albeit relatively slowly – the month-on-month growth rate for active customers over the past 4 months has averaged to 1.8%, or approximately 24% on annualized basis. 24% is certainly well greater than zero, but it is far from meteoric.

Total spending from consumers on ChatGPT has grown just a bit more quickly than total active customers has, with an analogous monthly growth rate of 2.0%.

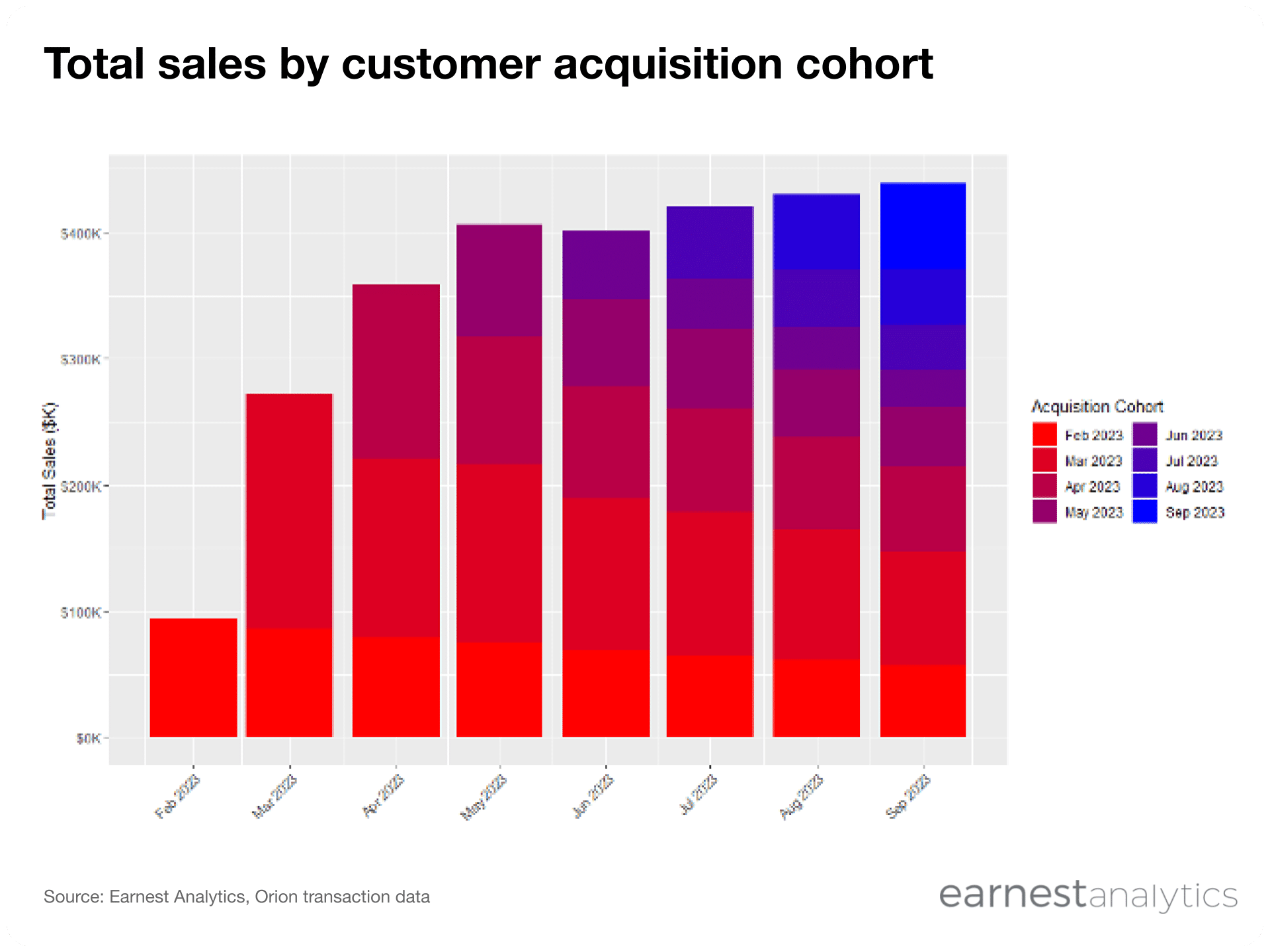

Another way of visualizing the data for ChatGPT is through the so-called Customer Cohort Chart, or C3. Those who know me know that I love this chart (for more on it, see this piece from Theta). For ChatGPT, I plotted total sales each month, broken down by customer acquisition cohort.

The slowdown in total customer acquisitions is visually apparent from the shrinking size of the top-most slice of each of the bars shown above, which represent total sales in a given month by customers that were first acquired in that same month.

The reason that revenue has continued moving up despite the rapid slowdown in new customer acquisitions is that customer retention has been good. For example, customers acquired in February 2023 were still spending 65% of what they had spent when they were first acquired six months later. Granted, this figure falls to 49% for those acquired in March 2023, but these figures are still reasonably strong for a consumer product.

This is not a knock on ChatGPT. Those who know me know that I use it for probably an hour every day, on average. I think many more will use it in the coming years, and that it and other LLMs like it are in the process of changing the world. I also would be the first to acknowledge that OpenAI’s priorities are likely more on the B2B side of its business, selling to the likes of Jane Street Capital, than on the B2C side.

All that being said, however, it still merits mention that growth in their B2C business has been somewhat meager over the past 4-5 months, and that customer adoption is consistently down.

See Jasper AI and AI Tools data for free