Blueprint poised to elevate Ayvakit to blockbuster status with rapid growth in ISM

Key Takeaways

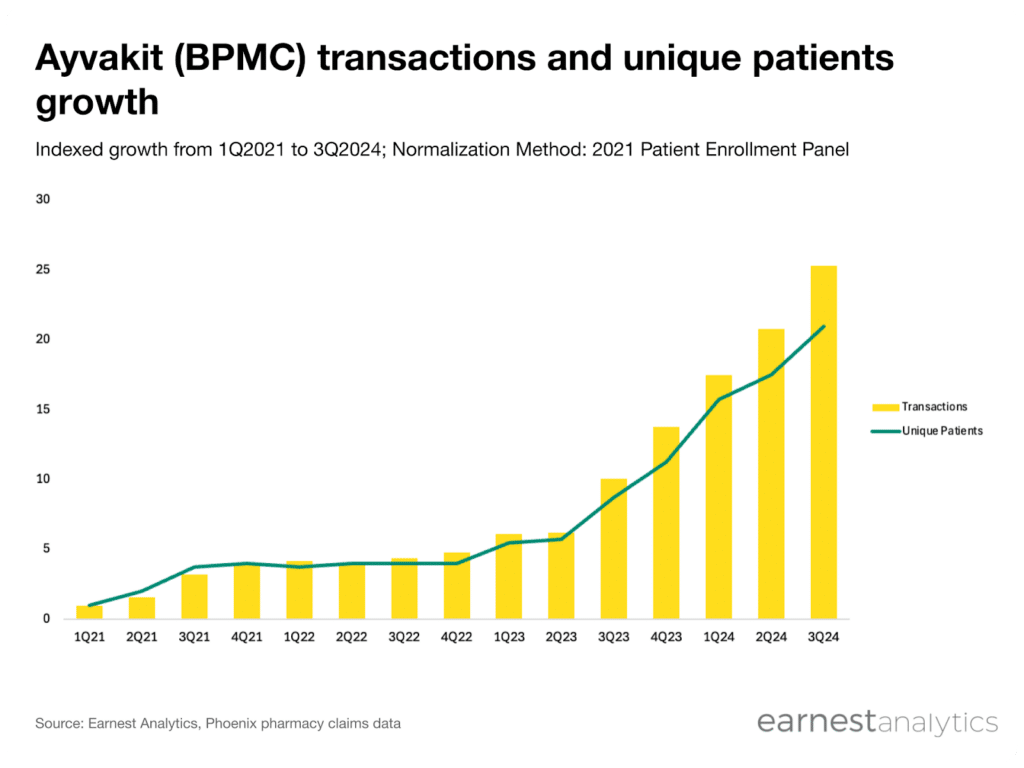

- Ayvakit growth accelerated since its indolent systemic mastocytosis (ISM) indication expansion in May 2023, with 3x growth in quarterly unique patients when comparing 2Q2023 to 2Q2024

- ISM is driving this recent inflection in growth and now represents roughly ~57% of Ayvakit unique patients according to Earnest’s Phoenix pharmacy data

Ayvakit unique patients has tripled since the ISM indication expansion

Ayvakit quarterly unique patients grew 3x from 2Q23 to 2Q24 according to new research from Earnest pharmacy claims data. Ayvakit, a tyrosine kinase inhibitor developed by Blueprint Medicines (BPMC), is used in the treatment of gastrointestinal stromal tumors and systemic mastocytosis (SM). Initially approved for advanced SM (ASM) only, Ayvakit recently became the first on-label treatment for indolent SM (ISM), a less severe but more common form of the disease. Blueprint estimates that ASM only accounts for 5% to 10% of all SM cases, implying that ISM represents the majority of Ayvakit’s commercial value.

Since the ISM expansion, Ayvakit sales have continued to exceed analyst expectations and Blueprint subsequently raised its peak sales estimate from $1.5 billion to $2 billion. Earnest’s Phoenix dataset began tracking an inflection in volume growth immediately after the indication expansion was announced. Since 2Q2023, quarterly Ayvakit unique patients has more than tripled in the Phoenix pharmacy data, closely mirroring the acceleration in company-reported U.S. product revenue.

Contact Sales for more.

ISM has emerged as Ayvakit’s largest indication in only 1.5 years

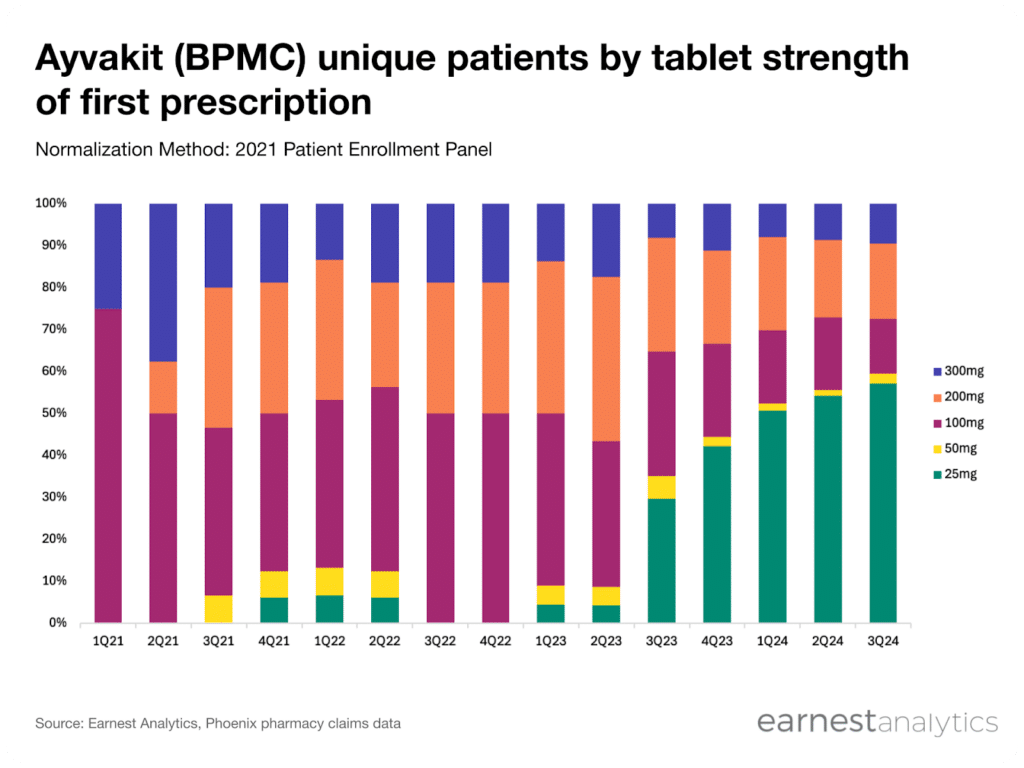

Blueprint management has highlighted that “most ISM patients start at 25 milligrams and most ASM patients start at 200 milligrams.” This discrepancy in starting dosage allows us to track indication-specific growth using tablet strength as a proxy. In the Phoenix pharmacy data, we observe that approximately 70% of Ayvakit new-to-brand transactions (NBRx) since the ISM indication expansion have initiated treatment with the 25 mg dose, closely aligning with Blueprint management commentary that “70% to 75% of new patient starts are at 25 mg.” For the most recent quarter, the Phoenix data suggests that ISM patients are now the majority, with ~57% of quarterly Ayvakit unique patients having started at 25 mg.

Contact Sales for more.

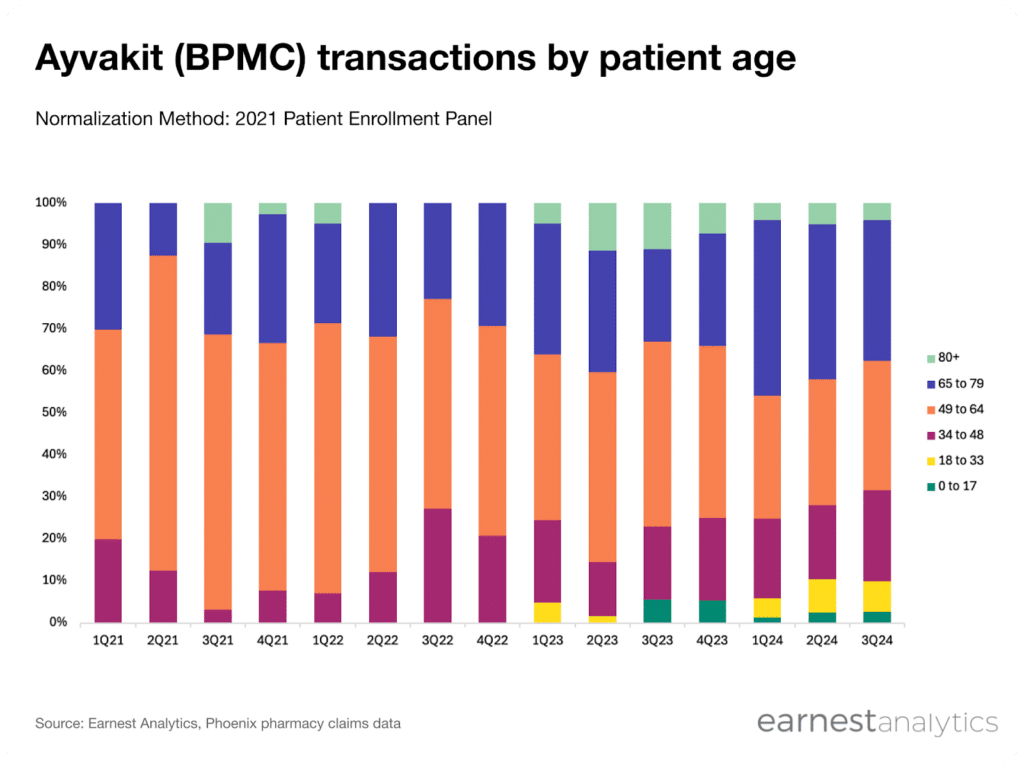

Additionally, Earnest data also indicates that ISM patients skew younger compared to ASM patients. Since May 2023, we have observed a steady increase in the proportion of Ayvakit transactions from patients under 48 from ~15% to ~32% and are also tracking a gradual increase in proportion of patients under 33

Contact Sales for more.

Blueprint management touts that they have seen patients “staying on for chronic durations of treatment” in ASM and “expects ISM durations to be even longer.” Continue tracking Ayvakit patient persistence, utilization, and growth trends in real-time with Earnest’s Phoenix dataset. Reach out to Earnest to gain access to continuous insight into the growth of Ayvakit and other specialty pharmacy products.

Request pharmacy claims data