Black Friday spending rose 0.2% YoY, shopping shifts to weekend

Black Friday results show acceleration vs early November

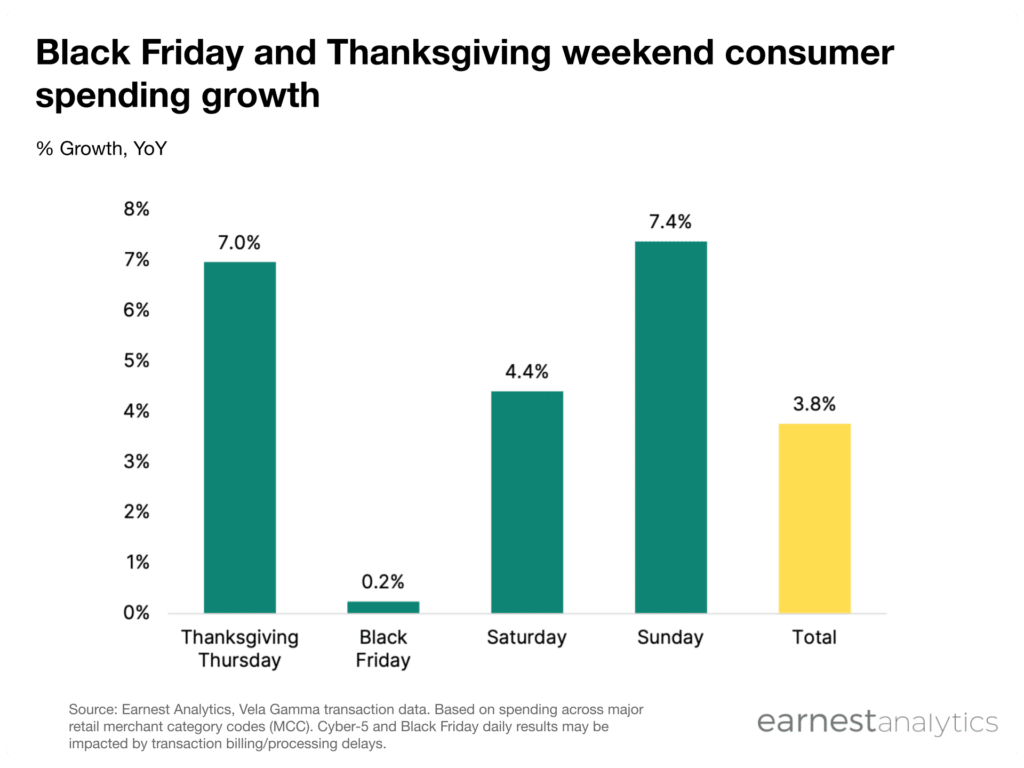

Black Friday debit and credit card spending rose 0.2% YoY according to Earnest transaction data. The acceleration comes after lackluster spending in the first two weeks of the holiday shopping season. Consumers spent 1.4% less on debit and credit cards in the first 13 days of November than in 2023.

The full weekend results suggest a much more healthy acceleration in consumer spending than Black Friday alone. Spending in the first 4 days of the highly advertised Cyber-5 shopping weekend grew 3.8% YoY.

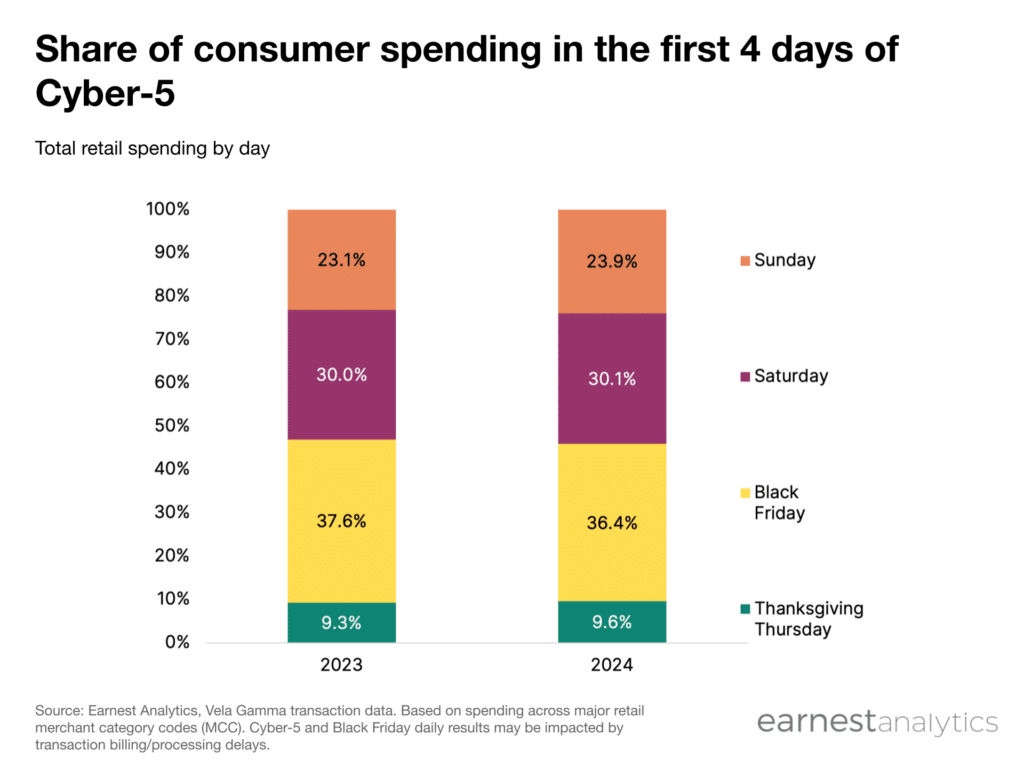

Black Friday spending shifting to Thanksgiving, weekend

Daily Black Friday results also suggest spending habits during the weekend after Thanksgiving continue to evolve. Consumers spent 7.4% more on Sunday, 7.0% more on Thanksgiving, and 4.4% more on Saturday than 2023.

Black Friday continued to be the largest single day for spending during the first 4 days of Cyber-5. Over 36% of consumer spending happened on Black Friday 2024 compared to over 37% in 2023. Black Friday’s share of sales shrank though, as shoppers spent 30 basis points more Thanksgiving Day and 80 on Sunday.

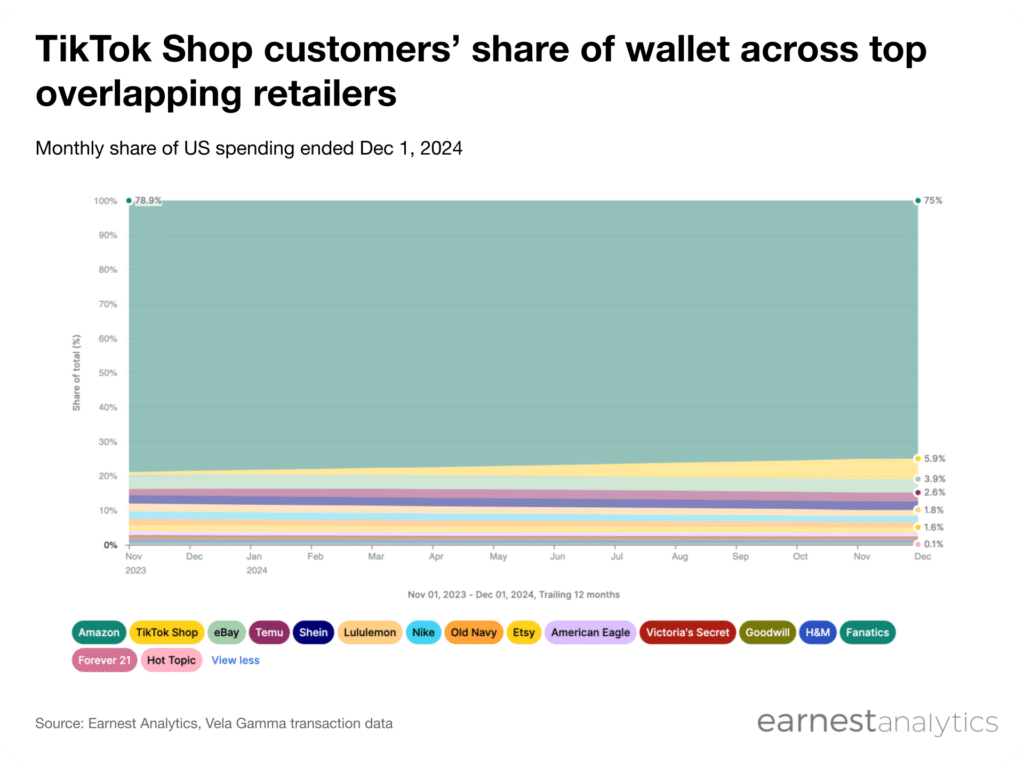

TikTok Shop grows share of wallet during Black Friday, weekend

Consumers spent 977% more at TikTok Shop in the days leading up to Black Friday than the year prior. Black Friday results show the social media channel continued to grow during the first 4 days of Cyber-5.

TikTok shoppers spent 5.9% of their holiday spending across their favorite brands at TikTok Shop. This growth ate into Lululemon (LULU), Nike (NKE), and Etsy’s (ETSY) share of TikTok shoppers’ wallets. TikTok Shop was the second biggest winner of TikTok shoppers holiday spending during the weekend across their favorite brands.

Black Friday results also show TikTok shoppers’ spent more on Temu and Shein this year’s holiday weekend (see in Dash).