August 2021 Earnest Analytics (FKA Earnest Research) Spend Index

Earnest Analytics (FKA Earnest Research) Spend Index

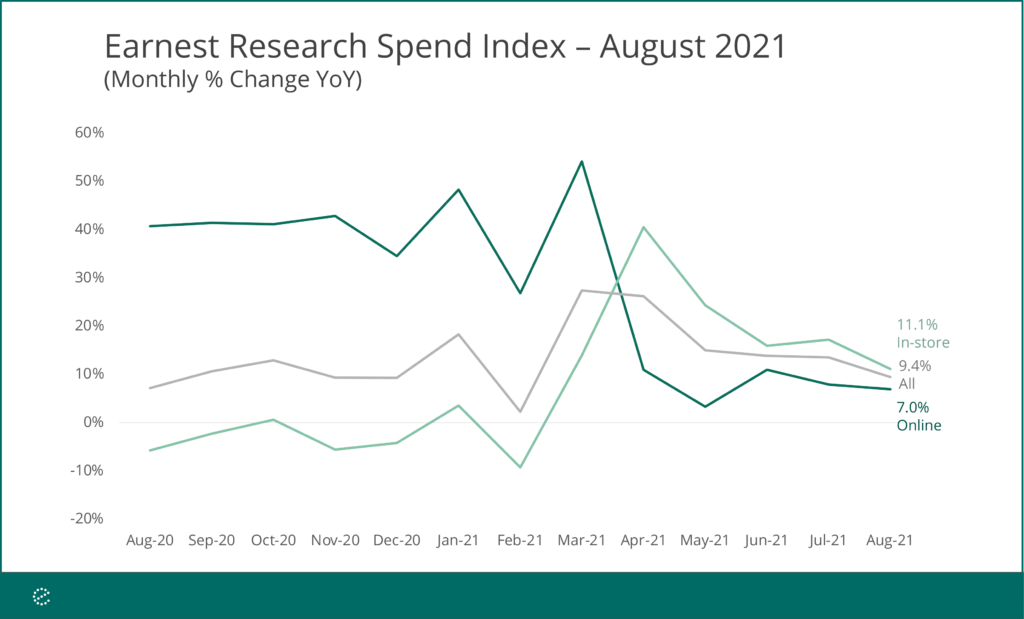

The Earnest Analytics (FKA Earnest Research) Spend Index*, a measure of sales growth for 2,500+ U.S. consumer discretionary and staples businesses, decelerated by 5 percentage points (pp) year-over-year from July (13.6%) to August (9.4%) with in-store growth weakening more than online. Year-over-2-year (Yo2Y) growth showed a similar trend with 7 pp and 3pp decelerations in-store and online, respectively (not pictured in chart).

Foot Traffic and Spend Subcategory Insights

Similarly, mobile geolocation data shows that foot traffic to consumer businesses was down versus 2019 levels for most states, which further reflected softness in consumer confidence. YoY spend growth decelerated for most major subcategories from July with travel and restaurants growth taking the greatest hits. Air Travel, Online Travel Agency, Lodging & Accommodation, and Casual Dining experienced 87pp, 86pp, 33pp, and 24pp decelerations, respectively.

See the Earnest Analytics (FKA Earnest Research) Spend Index for July. (Note: Historical numbers could vary slightly due to methodology updates.)

Follow us for more insights on the potential impact of COVID-induced changes on spending behavior in the coming months.

*About the Earnest Analytics (FKA Earnest Research) Spend Index:

The Earnest Analytics (FKA Earnest Research) Spend Index (ERSI) is an alternative data-driven measure of consumer spending that tracks spend across 2,500+ large national brands in major consumer discretionary and staples subcategories. The near real-time data is derived from the credit and debit spend of millions of de-identified U.S. consumers. Advantages of using ERSI include better representation of e-commerce spend, disaggregation by geography, and online versus in-store breakouts.