Athletic Brewing taps into Dry January, continues momentum

Surging sales for Athletic Brewing

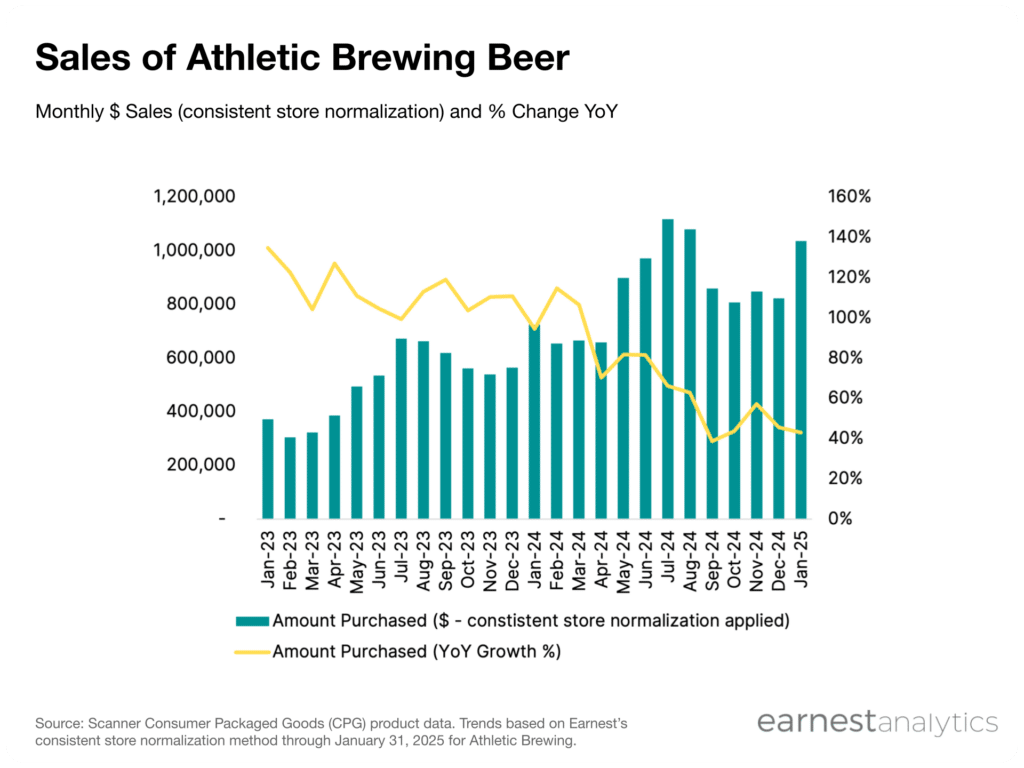

Athletic Brewing is the self-proclaimed number one nonalcoholic (NA) beer in the country. Sales at the beverage maker surged 26% in January 2025 compared to the previous month according to Earnest Scanner Consumer Packaged Goods (CPG) product data. January corresponds to a typical spike in sales for the brand driven by “Dry January.” During the month, consumers who generally consume alcoholic beverages might temporarily switch to non-alcoholic alternatives. Outside of Dry January, Athletic Brewing also exhibits seasonal patterns typical of alcoholic beer brands, with sales peaking in the summer months, and especially around July 4th.

On a YoY basis, Athletic Brewing’s sales grew 43% in January 2025. This comes after years of consistently strong sales trends for the brand which ended 2024 with a +67% YoY sales growth for the year vs 2023.

Younger, more affluent consumers

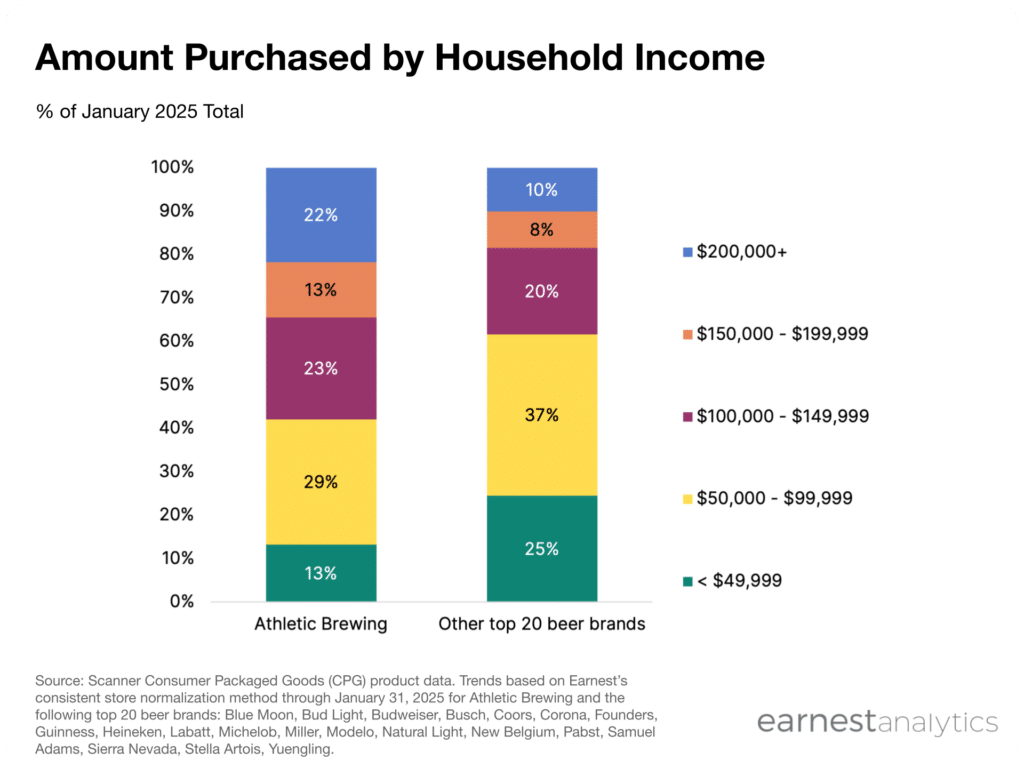

Earnest’s Scanner CPG data shows that households that purchased Athletic Brewing NA beer in January 2025 were more affluent than those that bought alcoholic beer. Over 34% of Athletic Brewing consumers had an annual household income over $150k, compared to 18% for other top 20 alcoholic beer brands.

Similarly, 34% of Athletic Brewing’s consumers were under 44 years old in January 2025. That figure compares to 28% for the other top 20 alcoholic beer brands.The company was founded in 2017. Athletic primarily targets Millennial consumers who may want to introduce moderation in their drinking. The brand does this by promoting a positive, social, and healthy brand image.

About Earnest’s Scanner CPG beer sales data

Figures on Athletic Brewing’s sales come from Earnest Scanner Consumer Packaged Goods (CPG) product data. Track share of shelf, predict revenue surprises, and drill down into brand and category level performance by household demography across thousands of brands and hundreds of manufacturers.

Scanner Consumer Packaged Goods (CPG) data is sourced from thousands of retail stores and millions of underlying US households across grocery and drugstore chains. Available exclusively to investors.

Request information on Scanner CPG data