Athleisure shoppers lean into Vuori, Alo Yoga

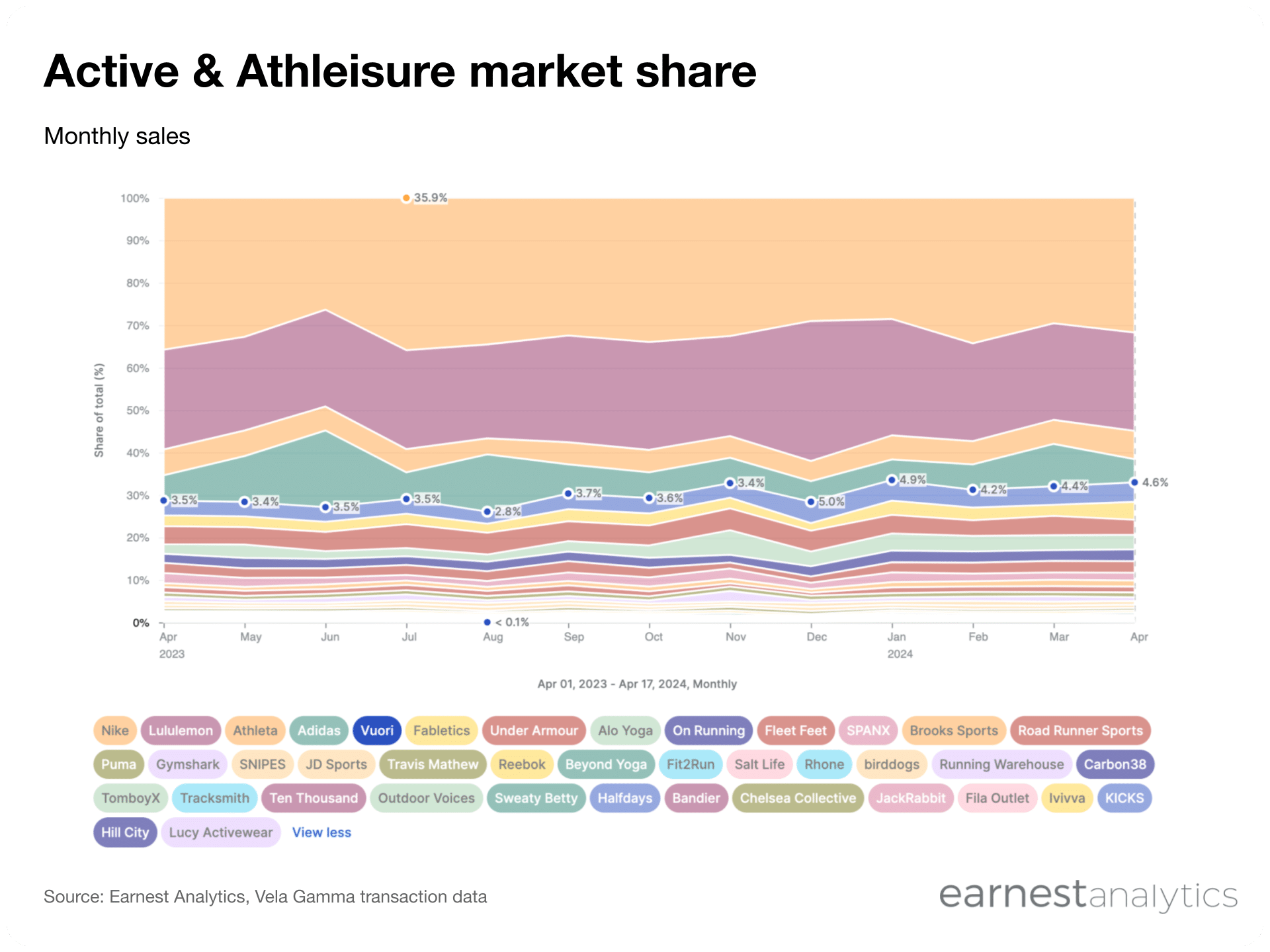

Although Nike and Lululemon continue to dominate the Active and Athleisure market, Vuori and Alo Yoga have steadily gained share, according to Earnest credit card data. Since April 2023, Vuori and Alo Yoga both gained around 1% market share, suggesting the DTC brands are increasingly resonating with athleisure shoppers. Athleta, Adidas, Under Armour, and Fabletics are also around the size of Vuori and Alo Yoga by sales. All but Under Armour were either stable or slightly higher by market share in April 2024 than in April 2023, while Under Armour lost share.

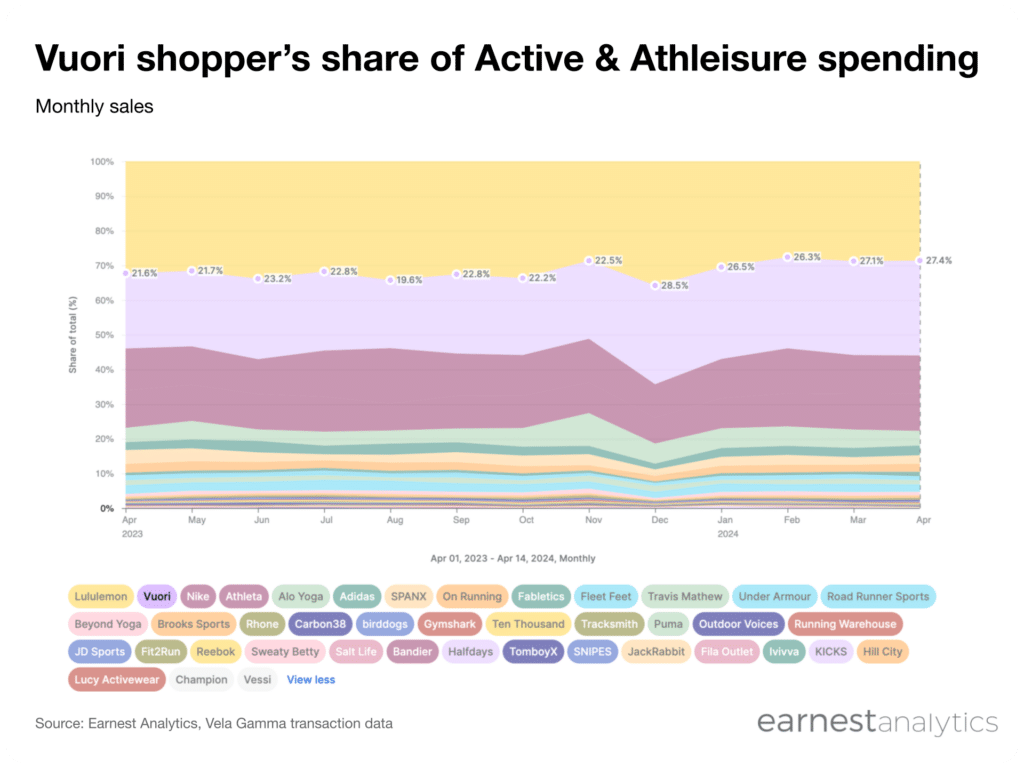

Vuori shoppers increased their share of Active and Athleisure wallet at Vuori from 21.6% to 27.4% in the last year while their spending at Alo Yoga remained unchanged. The share of wallet analysis, which isolates spending by a brand’s existing shoppers across that brand’s competitors, suggests that Vuori shoppers are increasingly loyal to the brand, at the expense of other major athleisure shops. For example Vuori shoppers spent 17% less in April 2024 in Nike’s DTC channels than in April 2023.

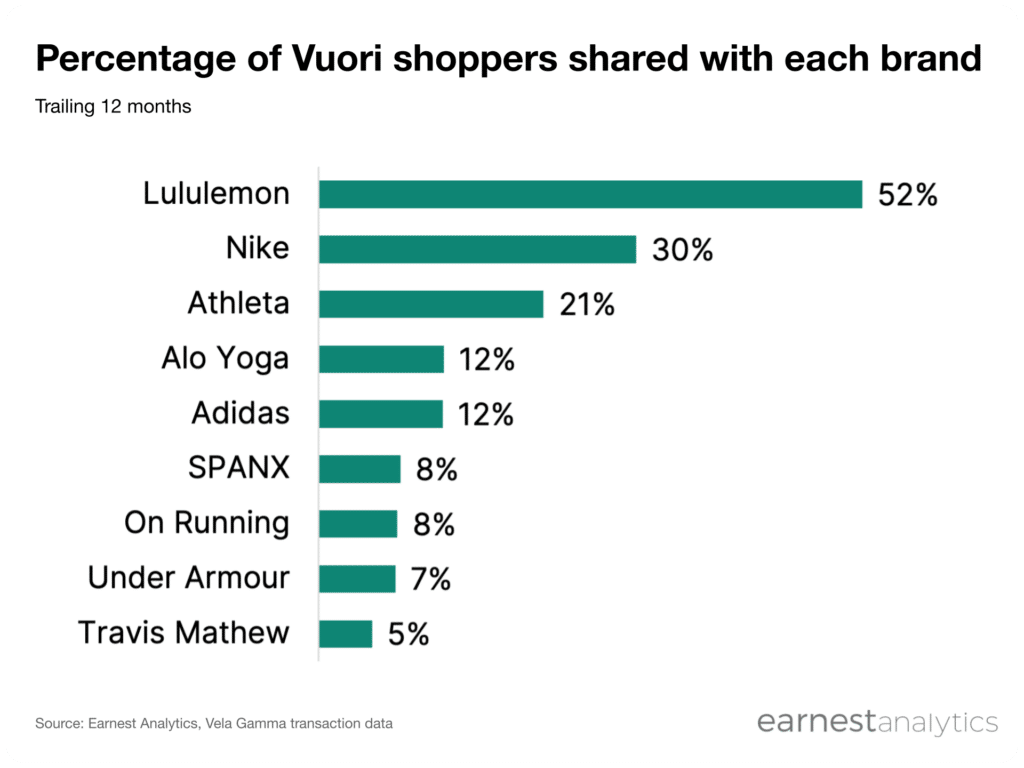

Almost 52% of Vuori shoppers shop at Lululemon, making it the highest overlapping Active & Athleisure brand. Nike follows with a substantial but lower 30%, suggesting that Vuori’s shopper base might not overlap as significantly with Nike’s. Athleta garners 21% of Vouri shoppers, while Alo Yoga overlaps with 12% of Vuori’s shoppers, indicating its presence but lesser penetration in this segment. On Running, Under Armour, and Travis Mathew all share less than 10% of Vouri’s shoppers.

Access chart in Dash.

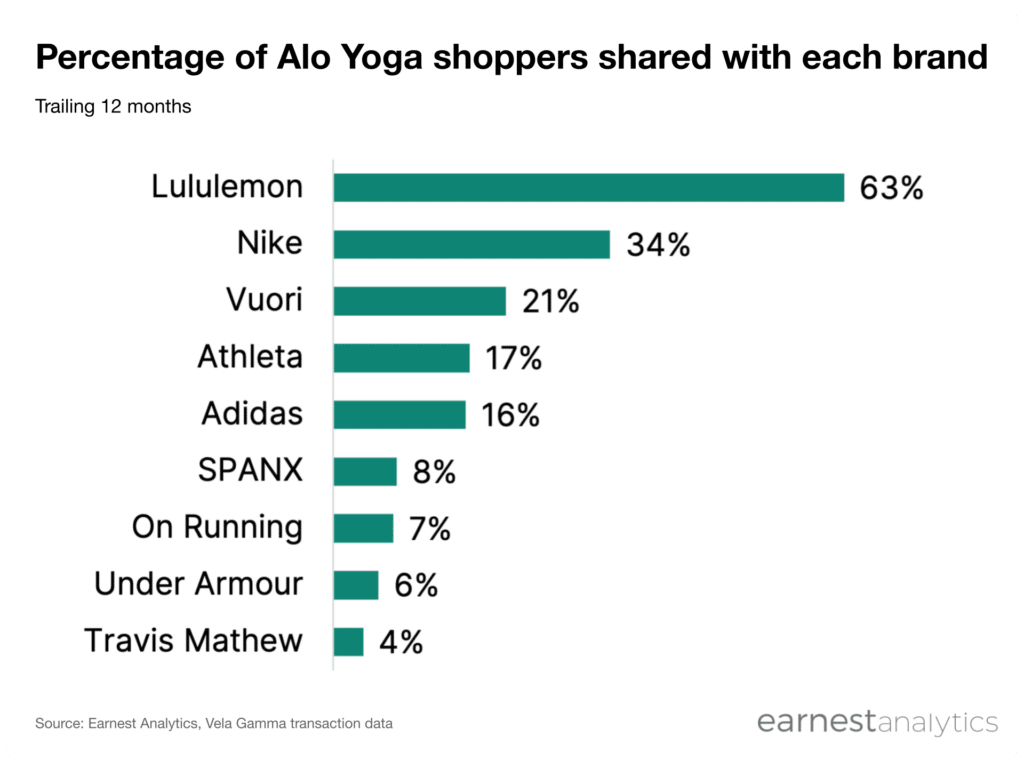

Among Alo Yoga’s shoppers, 63% also shopped at Lululemon, again the highest overlapping Active & Athleisure brand. After Nike, Vuori shares the third highest shopper count with Alo Yoga, around 21%. The high overlap highlights Vuori’s growing influence in activewear. Other brands show a lower overlap, with none matching the significant share of Lululemon and Nike.

Track Active & Athleisure spending for free