Amazon Prime Day week lift driven by average ticket outperformance, reversing trend

Access data in Dash.

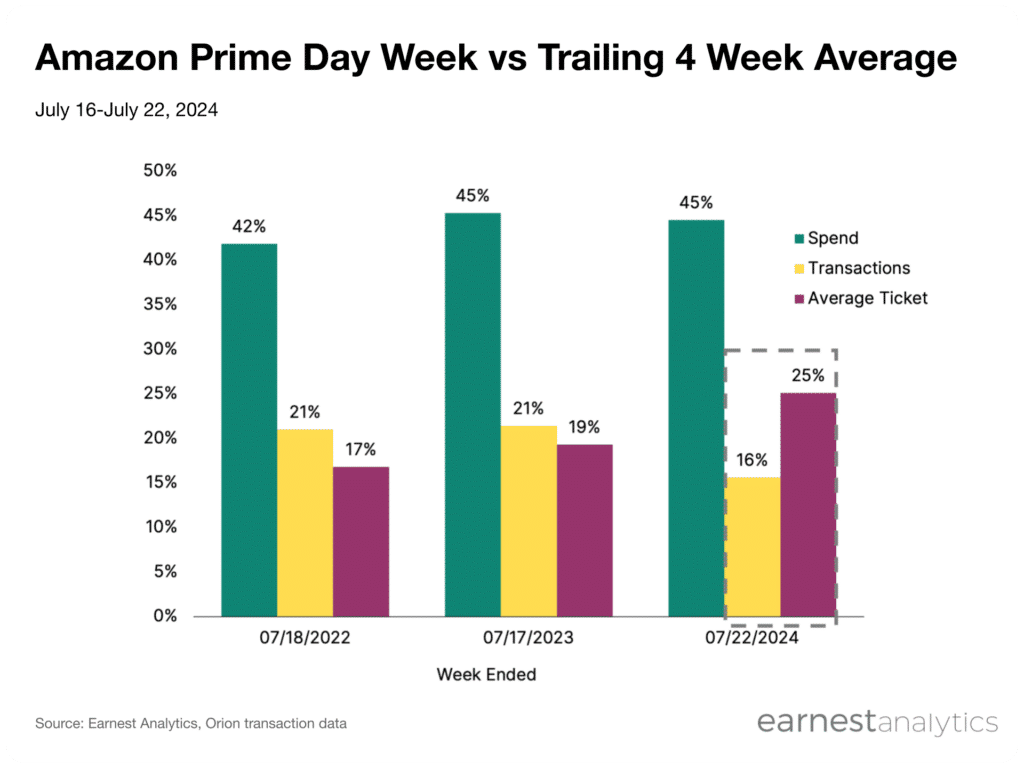

Sales during the week of Amazon Prime Day during July 16 to 17 reached 45% above the trailing 4 week average sales levels, according Earnest Analytics credit card data. This lift level remains flat from last year’s Prime Days spanning July 11 to 12, while remaining ~3% higher than the 2022 Prime Day lift levels.

In contrast to the prior two years, average ticket lift levels drove the Prime Day lift in 2024, instead of transaction lift levels. In 2022 to 2023, transaction lift outperformed average ticket lift levels which drove Prime Day Week success. However, average ticket sequentially improved by 200 bps from 2022 to 2023, which helped increase overall spend levels by 300 bps in the same period, contributing to Amazon’s historic 2023 performance. This year, the average ticket lift was the main driver of Prime Day Lift. Transactions decelerated 500 bps from 2023 levels, while average ticket increased 600 bps, suggesting a combination of Prime Day deal-seekers increasing their basket sizes and higher priced goods.

Amazon’s sale came amid a slate of summer ecommerce sales including TikTok Shop Deals for you Days, Walmart Deals, Target’s Circle Week, and Wayfair Black Friday in July.

See Online Marketplace spending free