Alternative data provides clues of the future

Case Study: Beyond-the-topline transaction data on Lululemon

By Andrew Robson, President, Earnest Analytics (FKA Earnest Research)

Alternative Data has some serious brand challenges.

First off, the name. Nothing like an industry’s name conjuring the ’90s musical movement that brought us the likes of Creed and Evanescence (‘Alt Rock’ bands for the uninformed).

Alt Data…the Arms Wide Open of data…

The second challenge — and what I’ll focus on in this post — is that because it often provides real-time perspectives on company performance, alternative data can be falsely viewed by the uninitiated as exclusively for ‘fast’ money managers or high frequency trading platforms. Now, that’s not as damning as being associated with Nickelback, but it’s damn close.

The fact of the matter is alternative data is being leveraged across most investment strategies and asset classes, including longer-term use cases employed by mutual funds, private equity and longer-term hedge fund investors.

Let me help frame the long and short of it all.

Table Stakes: Backtesting

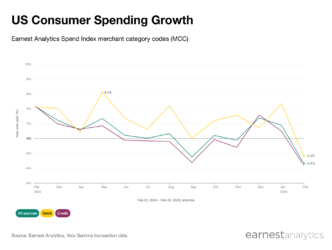

First, let’s start with data quality. If your data and data science are worth anything, your data should by definition backtest well. Meaning, your data should correlate well to what is measurable in the real world (e.g., a public company’s net sales growth, reported quarterly).

As a result, one of the more obvious or blunt applications of ‘good’ alternative data is leveraging real-time insights into company performance to inform short-term trading decisions. Earnest Analytics (FKA Earnest Research)’s Lululemon backtest — in this case, using anonymous consumer transaction data — is an example of good data and data science leading to top line insights.

We see the transaction data (green) correlating quite well with Lululemon’s reported Net Sales growth (grey). Importantly, the transaction data tracks key inflections in reported Net Sales growth and there’s generally a consistent margin between the two metrics.

An investor could understandably have confidence in this data. And sure, some will use it as a signal in intra-quarter trading.

Beyond the Quarter

But what about investors forming thesis-driven, multi-quarter investment ideas? How can alternative data help them come up with, diligence and monitor an investment that will play out over quarters or even years?

Let’s use Lululemon as a case study for more fundamentals-driven investing. No secret Lululemon has been a juggernaut since early 2017, with its current stock price (~$155) up over 300% from its 2017 lows. Imagine we’re in 2017 and place ourselves in the shoes of equities investors with a multi-quarter investment horizon. What questions would they have had in assessing Lululemon’s prospects for 2018 and beyond? Let’s take the company’s strategic focus on new customer acquisition as an example. How might an investor leverage alternative data to understand the long-term drivers of this important strategic pillar? I imagine some of their questions might have been…

Is Lululemon’s digital transformation initiative showing signs of traction?

After mostly negative growth in digital, Lululemon began investing heavily in its customer data infrastructure, web and mobile offerings. Transaction data disaggregated by channel showed early and clear indications that online was taking off. Lululemon reported online sales growth of 44% and 62% in 4Q17 and 1Q18, respectively.

Lululemon claims to have set its sights on male consumers. One pillar of this strategy is a recently piloted ‘co-location’ store remodeling, intended to establish or expand men’s departments — is it working in those remodeled stores?

Lululemon’s Mall of America location was remodeled in 2016 to expand its men’s section. Transaction data isolating that specific store location shows a drop in sales during the renovation, followed by a clear acceleration in sales growth as the store benefited from the remodeling. Insights such as these provided evidence that Lululemon could win in the men’s category as the company scaled this remodeling across its store base.

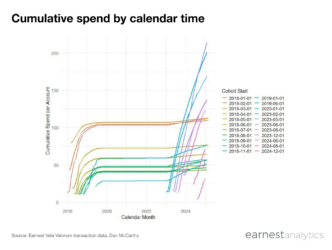

Is Lululemon’s strategic focus on customer acquisition working?

Lululemon’s management team cited plans to increase customer acquisition through digital transformation and tapping the men’s segment, but was it a viable strategy? Cohorting anonymous Lululemon customers with transaction data allows us to isolate new customer acquisition growth (light green) relative to total customer growth (dark green). The new customer data showed a clear improvement, beginning in 2017.

In review, good data and data science lead to accurate and reliable insights into myriad aspects of company performance. Yes, some investors use topline data to inform short-term trading decisions, often in advance of earnings announcements. But, for a fundamental-oriented investor, alternative data offers rich insights that go beyond sales performance. In the case of Lululemon, transaction data offered three key clues not yet reflected in Lululemon’s financial statements.

Regardless of investment horizon, no rational investor would make decisions based exclusively on ‘good’ alternative data. But an investor taking a beyond-the-top-line look at Lululemon in 2017 certainly would have had good reason to dig deeper and potentially participate in a lucrative multi-quarter investment.

For more insights on how investors are using alternative data for accurate and actionable insights, check out our post on alternative data and how it helps investors and consumer brands, as well as our article on leveraging alt-data at small to medium-sized funds.