Alo Yoga, Vuori make inroads with Lululemon shoppers

Access chart in Dash.

Lululemon shoppers are increasing their spend at DTC Athleisure brands Alo Yoga and Vuori according to Earnest credit card data. This as student debt payments resume, reducing disposable income for younger customers, and despite a recent brand partnership deal with Peloton.

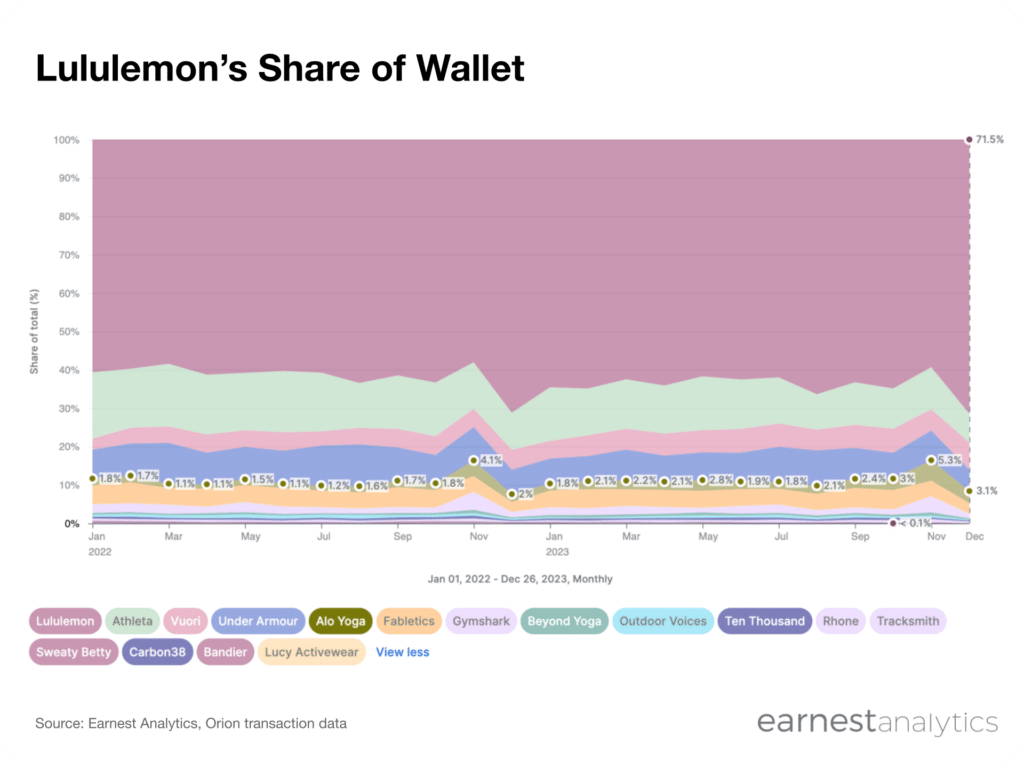

Earnest’s share of wallet analysis, which isolates spend by a brand’s existing customers across that brand’s competitors, shows that Lululemon customers spent 7.1% of their Active & Athleisure wallet at rival Vuori during the December 2023 holiday shopping period, up from 5.2% December 2022. Similarly, Lululemon shoppers increased their spending at Alo Yoga from 2% to 3% in the same period. Meanwhile, Lululemon shoppers spent less at brick and mortar incumbents Athleta, and Under Armour during the same period.

The same shift is apparent across income bands, suggesting that Vuori and Alo Yoga’s product is resonating with all Lululemon customers. Still Lululemon has a first mover advantage in the category and a robust brick-and-mortar presence that Alo Yoga and Vuori have yet to build.

Track Active & Athleisure for free