Alo Yoga is officially disrupting Lululemon in 2024

Alo Yoga is disrupting Lululemon’s sales

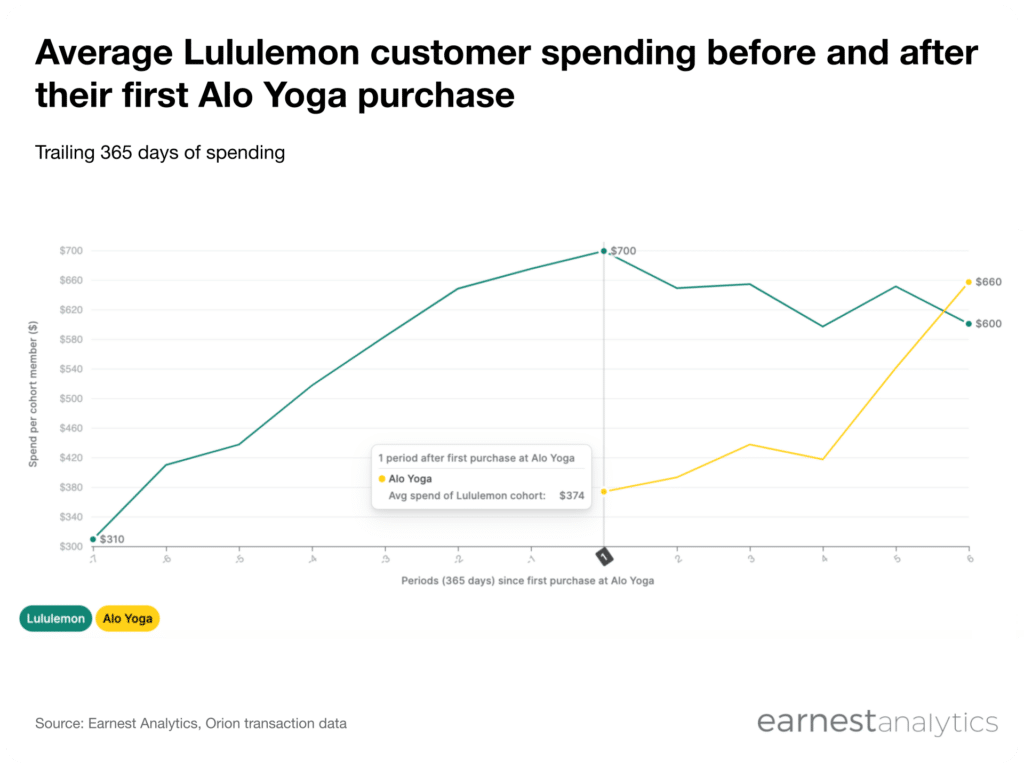

Lululemon customers are spending more at Alo Yoga than at Lululemon according to new findings from Earnest credit card data. Six years after their first Alo Yoga purchase, Lululemon customers spent $600 at Lululemon and $660 at Alo Yoga.

Historically, Lululemon customers spent several hundred more dollars at Lululemon than at Alo Yoga. The year of a Lululemon customer’s first Alo Yoga purchase, they spent $700 at Lululemon vs $374 at Alo Yoga.

In the years after their first Alo Yoga purchase, Lululemon customers steadily increase their spending at Alo Yoga until it surpasses their spending at Lululemon. After 6 years, they are spending $100 less at Lululemon than during their peak spending year, while spending $300 more at Alo Yoga.

In the 7 years prior to making their first purchase at Lululemon, the same group of customers spent $310 at Lululemon. That more than doubled to $675 in the year prior to their first Alo Yoga purchase. However, a first Alo Yoga purchase initially slowed Lululemon spending growth, shortly followed by a decline.

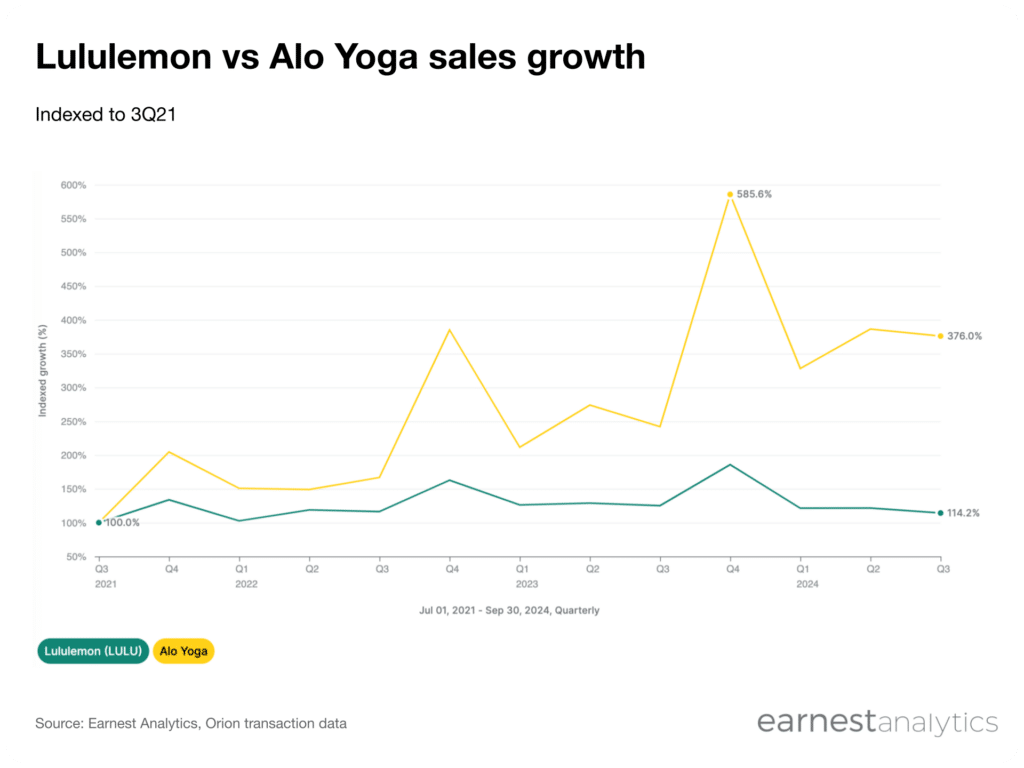

Alo Yoga has outgrown Lululemon for years

Alo Yoga’s disruption could help explain Alo Yoga and Lululemon’s diverging growth over the past four years. Alo Yoga sold 276% more in 3Q24 than in 3Q21. That growth outstripped Lululemon’s sales growth (including Ivviva, Mirror, and Like New) of 14% in the same period.

Alo Yoga also sees larger seasonal sales accelerations compared to Lululemon, suggesting the brand is better positioned headed into the 2024 holiday season.

TikTok shoppers reduced their holiday spending the most at Lululemon (LULU), Nike (NKE), and Forever 21, a Shein subsidiary. Despite falling, Lululemon and Nike sales among TikTok shoppers outperformed the broader market sales from the first 13 days of November.

Overall, TikTok Shop sales accelerated from the first 13 days of November leading up to Black Friday. Ecommerce sales typically slow relative to brick-and-mortar sales as the holiday continues and shoppers want to ensure on time delivery.

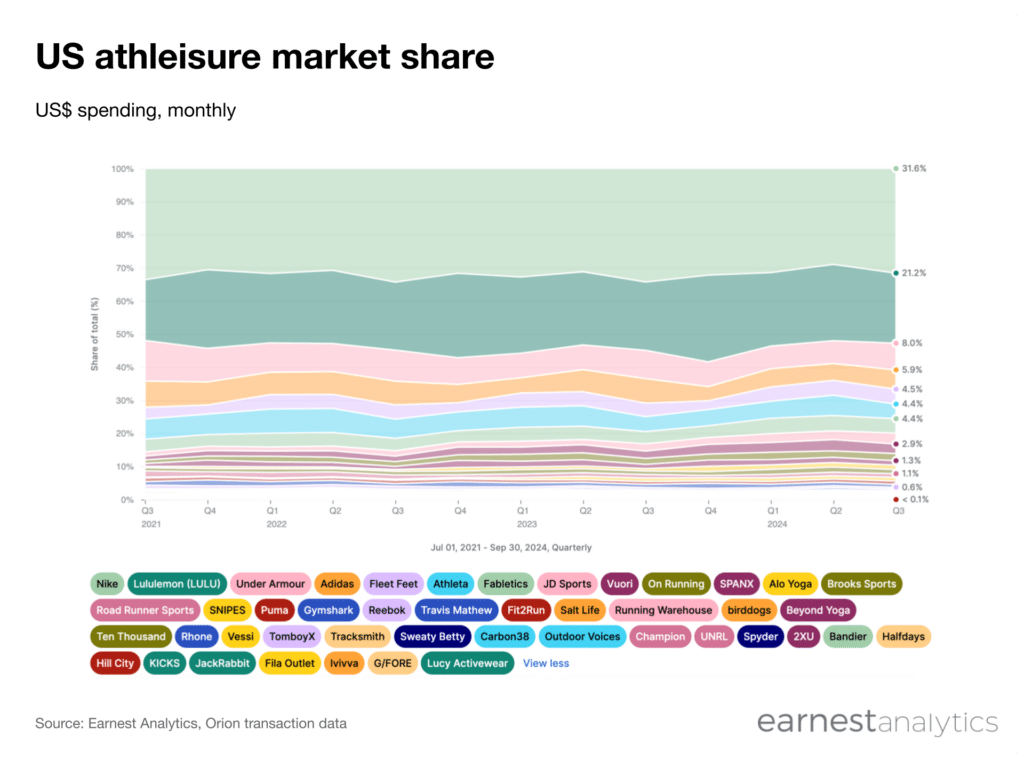

Lululemon, Nike still dominate athleisure market

Lululemon still dwarfs Alo Yoga in sales, commanding 21% of the US athleisure market in 3Q24, just behind Nike (NKE). Alo Yoga controlled just 1.3% of athleisure sales in 3Q24, up from 0.4% in 3Q21.

But among Alo Yoga customers, 63% also shopped at Lululemon in the 12 months ended April 22, 2024. That makes Lululemon the highest overlapping Active & Athleisure brand with Alo Yoga. In contrast, around 4% of Lululemon customers shopped at Alo Yoga during the same time.

Alo Yoga has a ways to go to surpass active brands like Under Armour (UAA), Adidas (ADDYY), and Athleta (GAP). Nevertheless, Alo and other DTC fitness upstarts like Vuori and Fabletics have made inroads in the market in recent years.

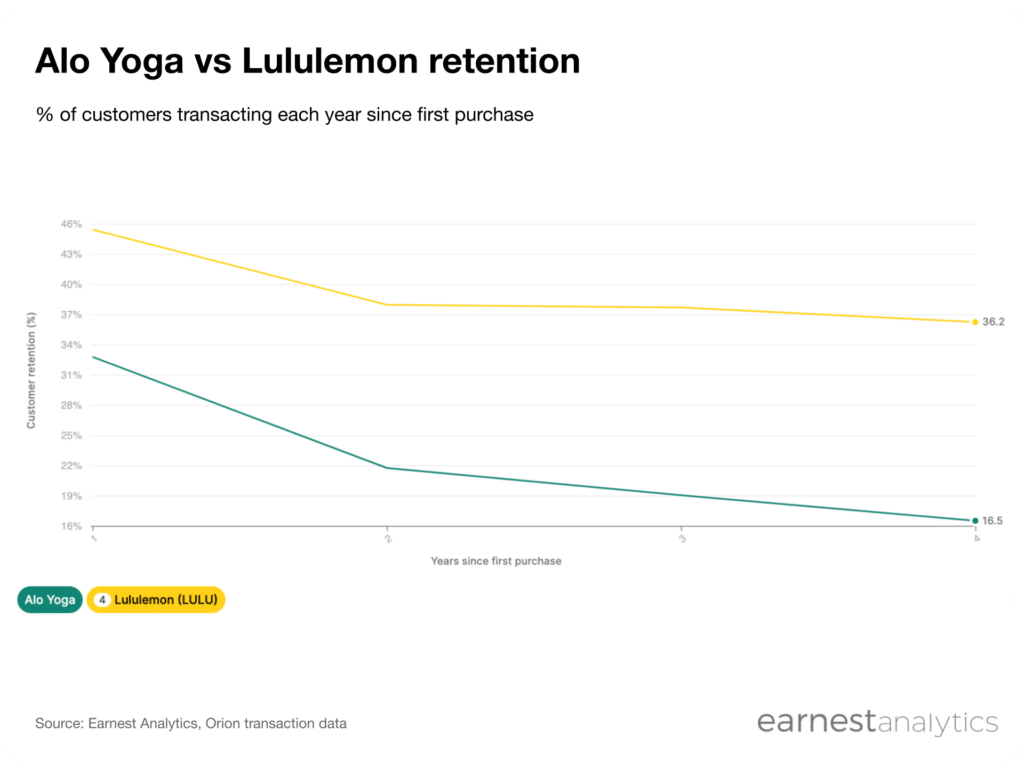

Lululemon vs Alo Yoga: retention could be key in the longterm battle for share

Alo Yoga has succeeded in taking sales from Lululemon with trendy products and influencer led marketing. However, Alo Yoga customers are still less likely to make a repeat purchase than Lululemon customers. In the long term, 36.2% of Lululemon customers continue purchasing, compared to 16.5% of Alo Yoga customers. Furthermore, Lululemon still controls the vast majority of the share of athleisure spending among its own customers.

Alo Yoga is one of the biggest direct threats to Lululemon, taking customers’ spending on trending outfits. But in the long run, Lululemon could still leverage its more loyal customer base to retain athleisure dollars.