Airbnb, #1 Among OTAs & Hotels

As summer gets underway, which travel platforms are luring eager travelers? Using Earnest spend data we reviewed how Airbnb is performing after COVID disrupted travel, and shone a light on the platform’s extended-stay and quarantine-friendly business model.

Read Earnest’s Airbnb pre-IPO analysis.

See additional Earnest analyses on the travel industry post-COVID.

Key Takeaways

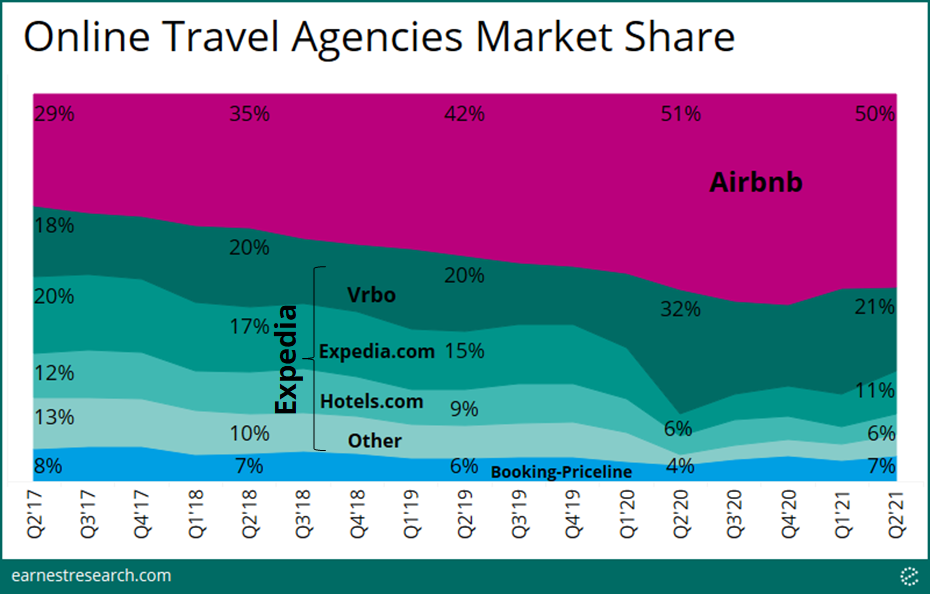

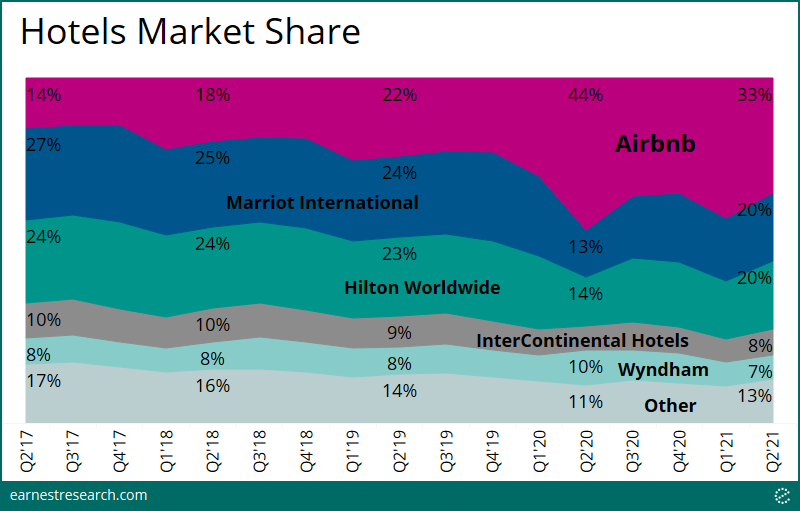

- Airbnb has maintained its stronghold in the travel market, holding 50% of the OTA market and 33% of traditional hotel bookings.

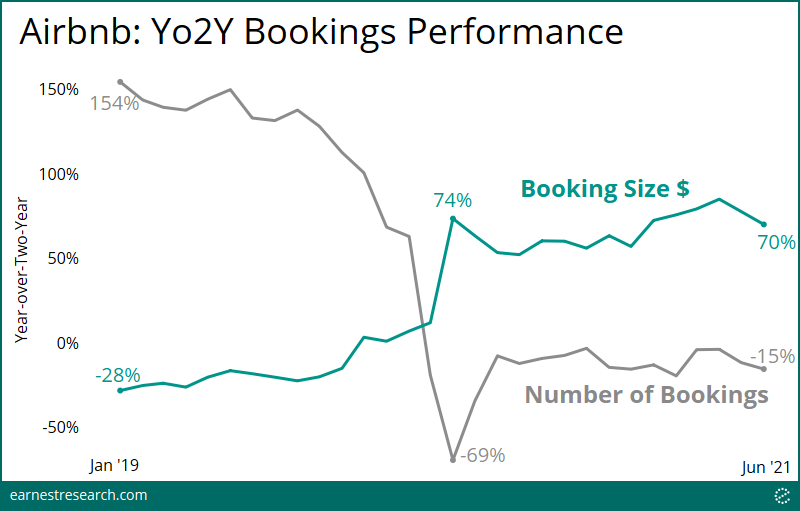

- Guests are booking less, but staying longer. Booking size growth was 70% higher in June 2021 vs. June 2019, while the number of bookings was down -15%.

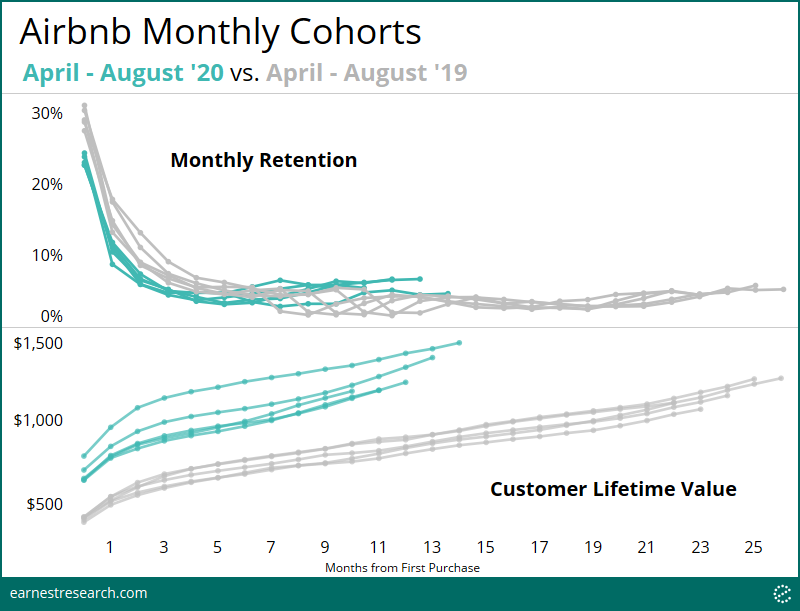

- Airbnb guest retention for summer 2020 cohorts are now roughly on par with prior cohorts, but they are worth much more.

Airbnb continues to dominate while traditional OTAs await the pent-up travel boom

With continued restrictions on international travel, it’s not surprising Airbnb has maintained its stronghold in the Online Travel Agency (OTA) market, continuing to capture 50% of the sector. By comparison, Vrbo including HomeAway, a clear beneficiary during the pandemic peaking at 32% market share in 2Q20, has since lost share, returning to pre-pandemic share of around 20%. Meanwhile, traditional OTA travel sites Expedia, Hotels.com, Priceline and others remain depressed, albeit trending positively.

Among traditional hotels, Airbnb now commands a third of the market, conceding half of the gains it made from a peak of 44% in 2Q20 when long stays were mandated. The major hotel chains meanwhile have recovered from their 2Q20 lows, but each remain a few points shy of pre-pandemic levels.

The trend of booking fewer, longer stays continues

Booking size growth has remained elevated since the outbreak of COVID in the US, at around 70% vs. two years prior. Meanwhile, the number of bookings has plateaued around -15%, after recovering from lows of -69% in Apr 2020. This trend is indicative of guests booking fewer trips but staying longer, and highlights Airbnb’s extended-stay and quarantine-friendly option for those traveling during a pandemic.

Airbnb guests acquired in the summer of 2020 spent more

Airbnb guests acquired during the summer of 2020 showed slightly lower retention levels than the 2019 cohorts, but only for the initial several months (peak pandemic); more recently however retention levels appear roughly on par than prior cohorts. Importantly, the lifetime value of the summer 2020 guest continues to be significantly higher than the 2019 guest, a product of increased ticket sizes due to longer stays.