Afterpay’s Customer Loyalty

With news that Square plans to expand its offerings by acquiring Afterpay, we reviewed customer overlap “loyalty” among in vogue Buy Now, Pay Later (BNPL) lenders.

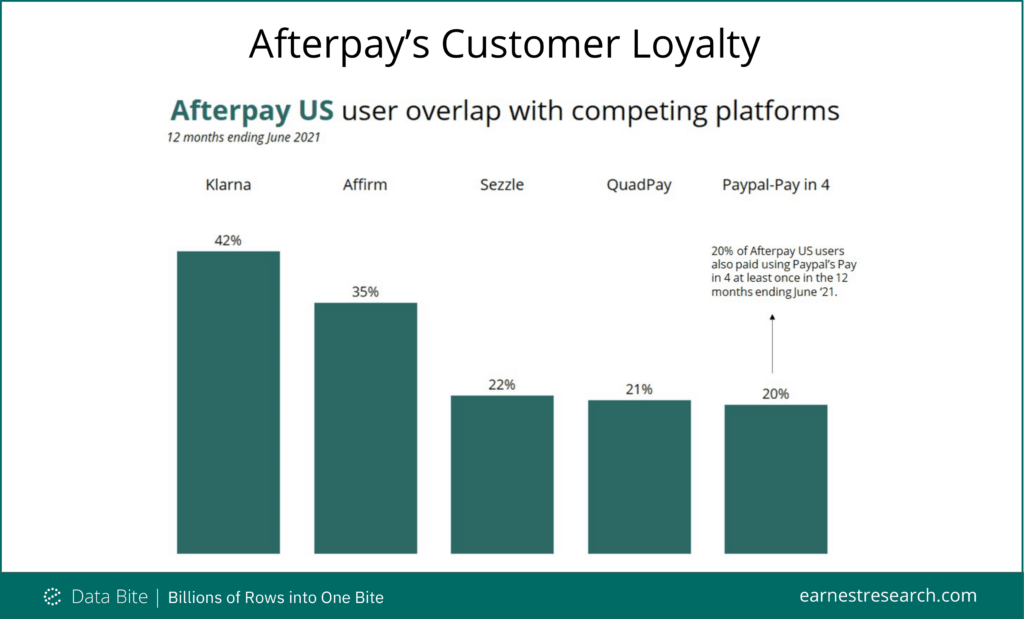

From the perspective of each individual competing platform, just ~20 to 40% of Afterpay’s US customers overlap with theirs; most of them making purchases with Klarna and Affirm, and to a lesser extent with Sezzle, QuadPay, and Paypal’s Pay in 4.

Separately (not in the chart), we also calculated that 60% of Klarna customers overlap with Afterpay, and with Affirm by 37%. Meanwhile Affirm’s overlap with other BNPL lenders was the most limited, with Afterpay at just 31%, and Klarna 23%. Customers of each also use Sezzle, QuadPay, and Pay in 4, albeit again to a lesser extent.

While it’s clear consumers value these services to spread out their payments, it seems that there is a sizable amount that are not particularly loyal to any one lender. Once Afterpay has integrated with Square’s cadre of small and medium sized businesses, it will be interesting to see whether this dynamic changes.

See our previous analysis ahead of Affirm’s IPO, and on the growth of BNPL vs. store cards.