Affirm, other buy now pay later platforms surge after post-pandemic lull

See chart in Dash.

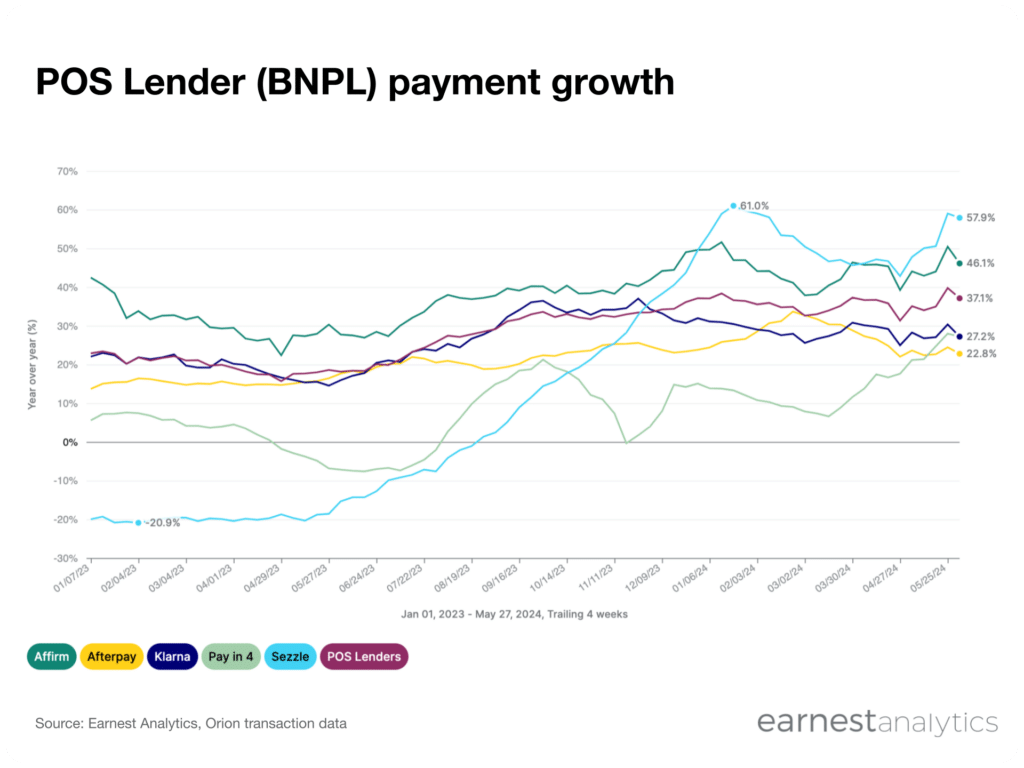

Payments to POS Lenders, also known as buy-now-pay-later (BNPL) apps, grew 37.1% in the 4 weeks ended May 27, 2024 according to Earnest credit card data. The growth represents an acceleration from 18.6% YoY during the 4 weeks ended May 27, 2023. Sezzle stood out with 57.9% YoY growth at the end of May, despite being one of the smallest US BNPL companies by market share of payments (see data in Dash). Market leader Affirm (+46% YoY) was the next fastest growing in the most recent weeks, and continued to outperform the mean BNPL performance. Klarna and Pay in 4 both grew 27.2% YoY, while Afterpay grew 22.8% YoY.

This growth in POS Lenders represents a reversal from the steep post-pandemic deceleration. The change could be further evidence of mounting pressure on consumers, as low-income shoppers are already pulling back in some areas. Shoppers making between $55k-$125k increased their BNPL spending the fastest according to Earnest credit card data, while shoppers making over $295k grew the slowest (see data in Dash).

Track POS Lenders (BNPL) for free