Abercrombie brand turnaround resonating well with Millennials

“We’ve done a lot of work here over the years to make sure that these 2 brands are very separate, and Hollister is focused on that teen consumer and Abercrombie is focused on that millennial consumer.” – ANF 1Q23 earnings call

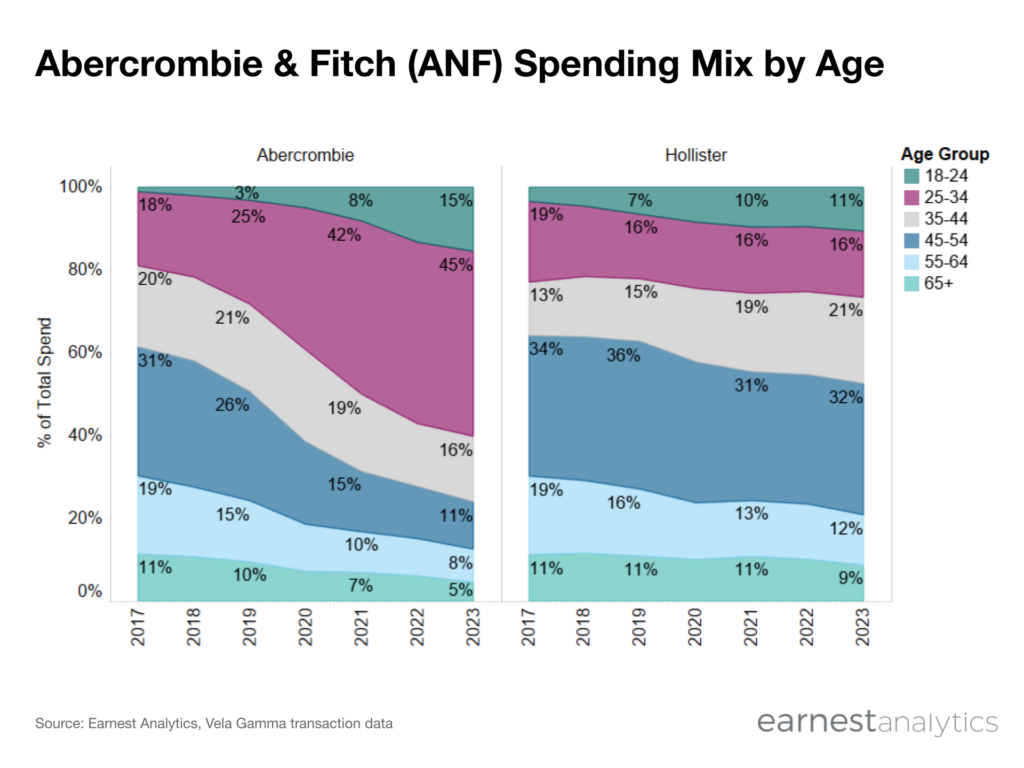

Consumers between the age of 25 and 34* accounted for 45% of spending at Abercrombie in July 2023 year-to-date according to Earnest Analytics transaction data, up from 18% in 2017. This shift in spending mix came at the expense of consumers between 35 and 54 years old, individuals who are more likely to be parents purchasing apparel on behalf of their teen children. In contrast, Hollister’s demographic mix has been much more stable, with the 25 to 34 year old cohort only comprising 16% of spending at Hollister in the year-to-date period, while 53% came from consumers between the age of 35 and 54.

The Abercrombie brand’s demographic mix shift towards younger Millennials coincides with a broader brand age up turnaround to better differentiate itself from sister brand Hollister, which primarily targets teens. While management believes the Abercrombie brand continues to be misperceived as “just another US mall-based teen retailer,” the data confirms the success of management’s turnaround efforts.

Notes:

*Age Group determined by age of consumer in 2Q23