Tax Data indicates smaller refunds; benefits to Home Furnishing, Sports Gear, Auto Parts, & Active/Athleisure

Key takeaways:

- Average tax refund sizes fell mid single digits YoY in the 2023 tax refund season

- Home Furnishings, Sports Gear, Auto Parts & Services, and Active & Athleisure were the biggest beneficiaries of the later 2023 filing season

- Lululemon, Wayfair, Dick’s, Lowe’s, Costco, & Amazon each saw 6+ points of outspending from refund recipients

- Recipients spent more on Bix Box & Discount Grocers; less on Home, Air Travel, & Luxury

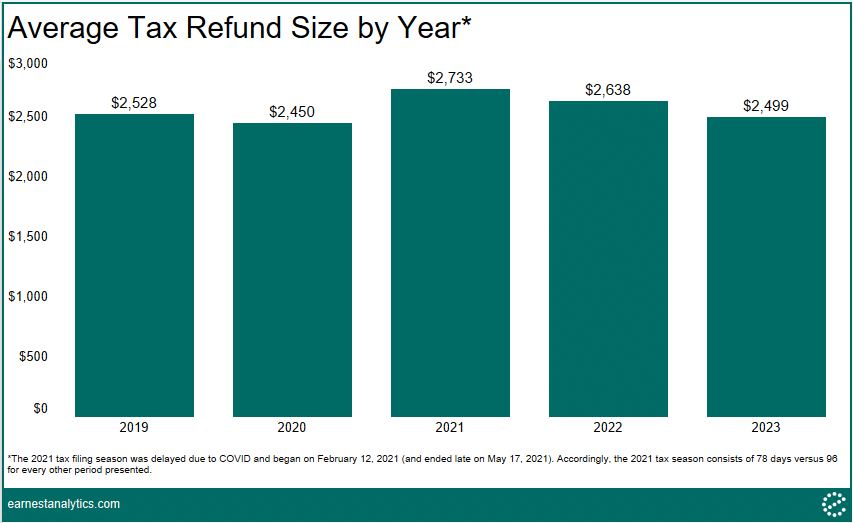

Average tax refund size falls mid single digits YoY during 2023 tax season

Average refund size was down 5% YoY in 2023 to $2,499 according to Earnest Analytics’ IRS Payments dashboard, comparable to reported figures** and roughly similar to the decline earlier in the season. The average 2023 refund size was much more in-line with 2019 and 2020 amounts following two years of inflated refunds due to the Advance Child Tax Credit and Recovery Rebate to claim pandemic related stimulus.

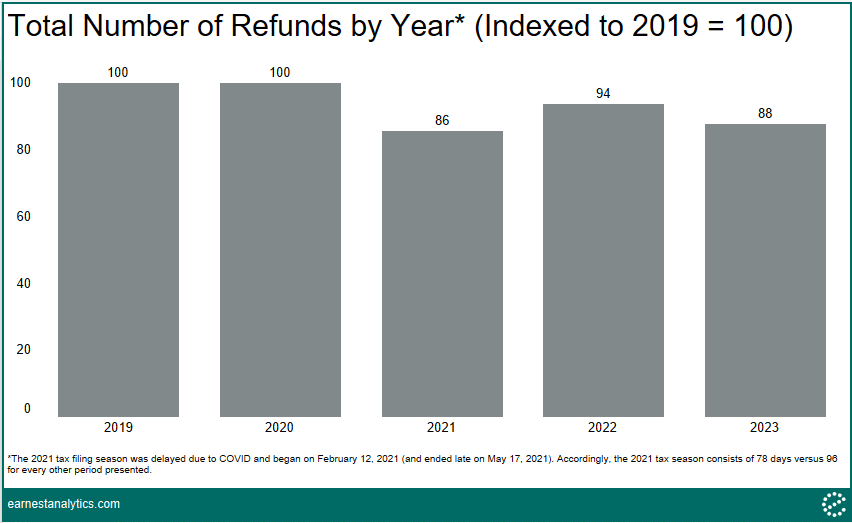

2023 refunds materially below pre-pandemic levels

In the 2023 tax filing season, the total number of refunds remained materially below pre-pandemic levels (down 12% relative to 2019 in the data vs. reported down 9%). The decline is likely a result of the IRS granting tax relief for disaster situation victims in certain states, including California, which delays the filing/payment deadline to later in the year.

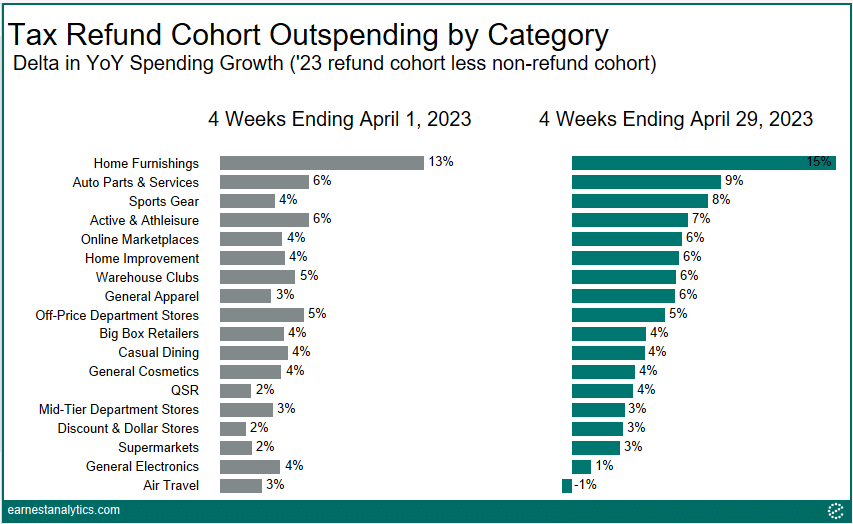

Home, Auto Parts lifted; Electronics, Department Stores lift subsides

Consumers who received a tax refund in 2023 outspent their peers on a YoY basis across most categories in the second half of the refund season. Refund recipients outspent by double digits on Home Furnishings and ~7% on Active & Athleisure after a more modest start to the 2023 tax season. Sports Gear and Auto Parts & Services continued to be among the best performing categories with mid-to-high single digit outperformance in the last two months.

However, General Electronics and Mid-Tier Department Stores experienced more muted outspending among the tax refund cohort compared to the preliminary tax season where refund recipients outspent by double-digits. Off-Price Department Stores saw a larger lift relative to Mid-Tier Department Stores with mid-single digit outspending, potentially the latest sign of consumers trading down.

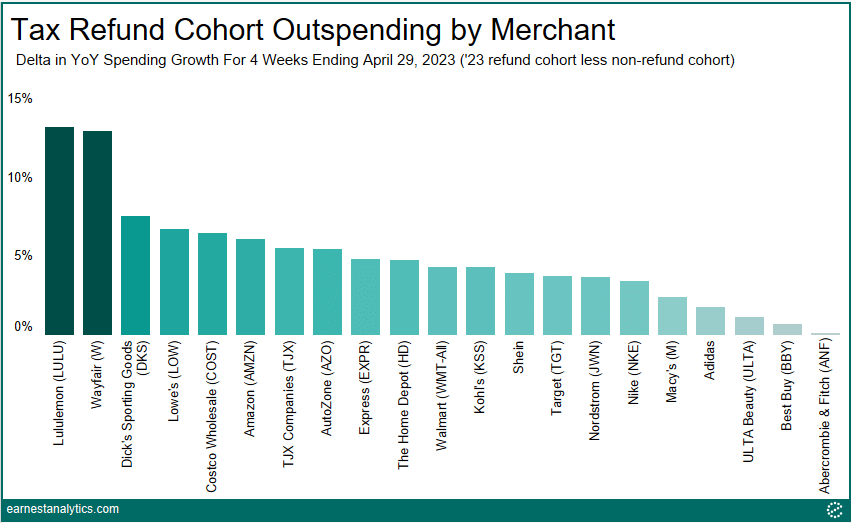

Refunds lift Lululemon, Wayfair, Dick’s, Lowe’s, Costco & Amazon 6+ points

Tax refund recipients outspent by the widest margin at Lululemon, Wayfair, Dick’s Sporting Goods, Lowe’s, Costco, and Amazon, which all experienced 6+ points of outperformance from the tax refund cohort in the four weeks ending April 29, 2023. Notably, Lululemon saw significantly more outspending from recipients than the Active & Athleisure category, as well as rival Nike. Wayfair saw a healthy level of outspending in line with the broader Home Furnishing despite also having its Way Day sale event on April 26-28. Lowe’s saw 2 points more of outperformance compared to Home Depot.

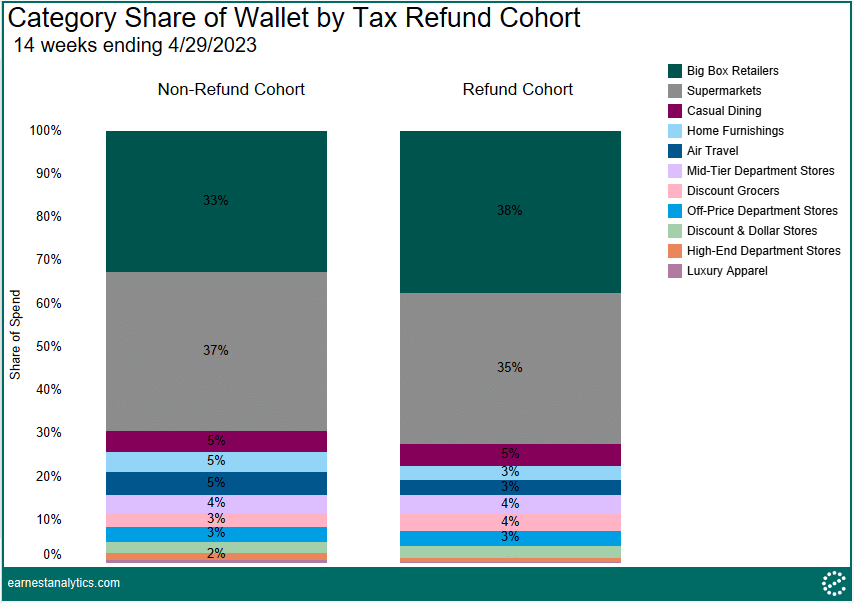

Recipients spent more on Big Box & Discount Grocers; less on Home, Travel, & Luxury

Tax refund recipients spent a higher proportion of their wallet on Big Box Retailers and Discount Grocers during the 14 weeks ending 4/29/23 but a lower percentage on Supermarkets, Home Furnishings, Air Travel, High-End Department Stores, and Luxury Apparel than their non-refund counterparts. Each cohort spent a similar amount on Casual Dining, Mid-Tier and Off-Price Department Stores, and Discount/Dollar Stores.

Data via Earnest’s IRS Payments dashboard. Contact Sales for details.

Notes

*Dates in this analysis are defined as in the IRS’ filing statistics: 1/23/23-4/28/23 for the ‘23 season, 1/24/22-4/29/22 for the ‘22 season, 2/12/21-4/30/21 for the ‘21 season, 1/27/20-5/1/20 for the ‘20 season, and 1/28/19-5/3/19 for the ‘19 season. Note the ‘21 season was delayed due to Covid and began late on 2/12.

**The IRS’ filing statistics reported that the average refund size declined 8.0% YoY to $2,777 (with the average direct deposit size down 8.2% YoY).