Holiday spending grew slightly as shoppers traded luxury for value in 2023

Key Takeaways

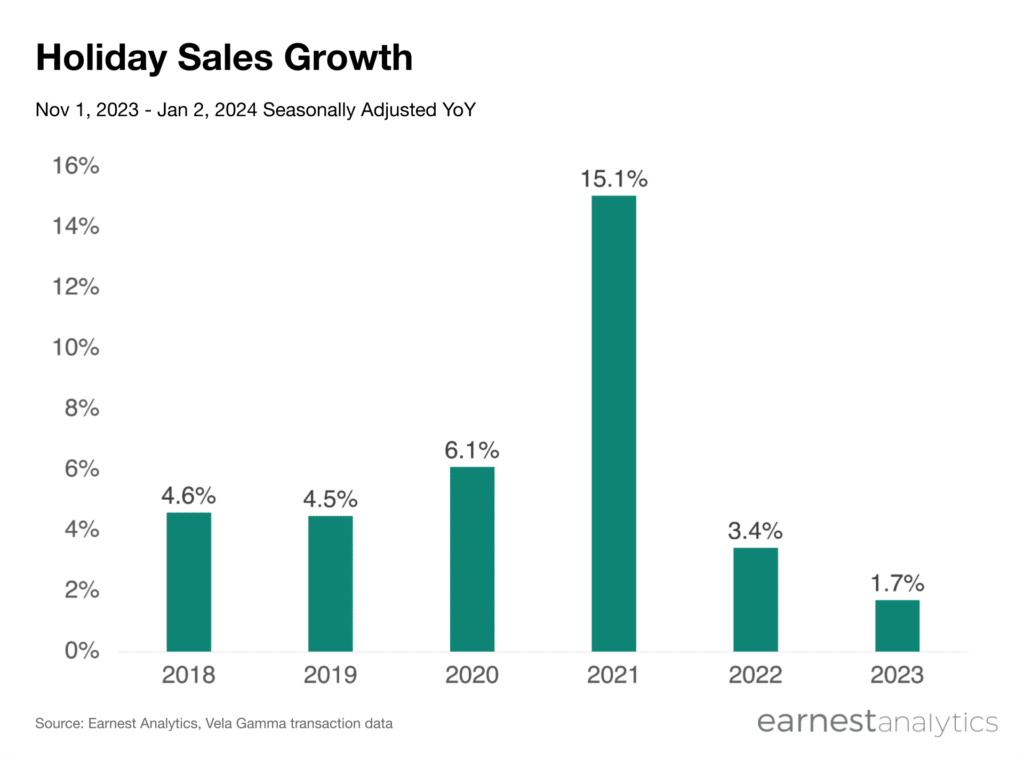

- Shoppers’ 2023 holidays spending grew 1.7% YoY, but slowed compared to 2022

- Online Marketplaces, Off-Price Dept Stores replaced Air Travel, Athleisure as top 2023 categories

- Temu, Shein, Abercrombie, Lululemon, and American Eagle posted fastest holiday sales growth

Shoppers’ 2023 holidays spending grew, but slowed compared to 2022

Contact Sales for more details.

Shoppers spent 1.7% more YoY in the 2023 holiday season than the year prior. This represented a continued deceleration from 2021 and 2022, but an improvement from mid-season YoY growth. The 2023 holiday season also grew about half as fast as pre-pandemic season 2019 (+4.5% YoY) and 2018 (4.6%) once adjusted for days per season (see note).

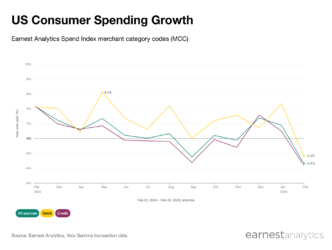

This relative deceleration during the Nov 1, 2022-Jan 2, 2024 period could be attributed to demand pull-forward. Online Marketplaces and big box retailers like Amazon and Target started their promotions early. This also comes as retailers are beginning to feel negative effects from the resumption of student loan payments.

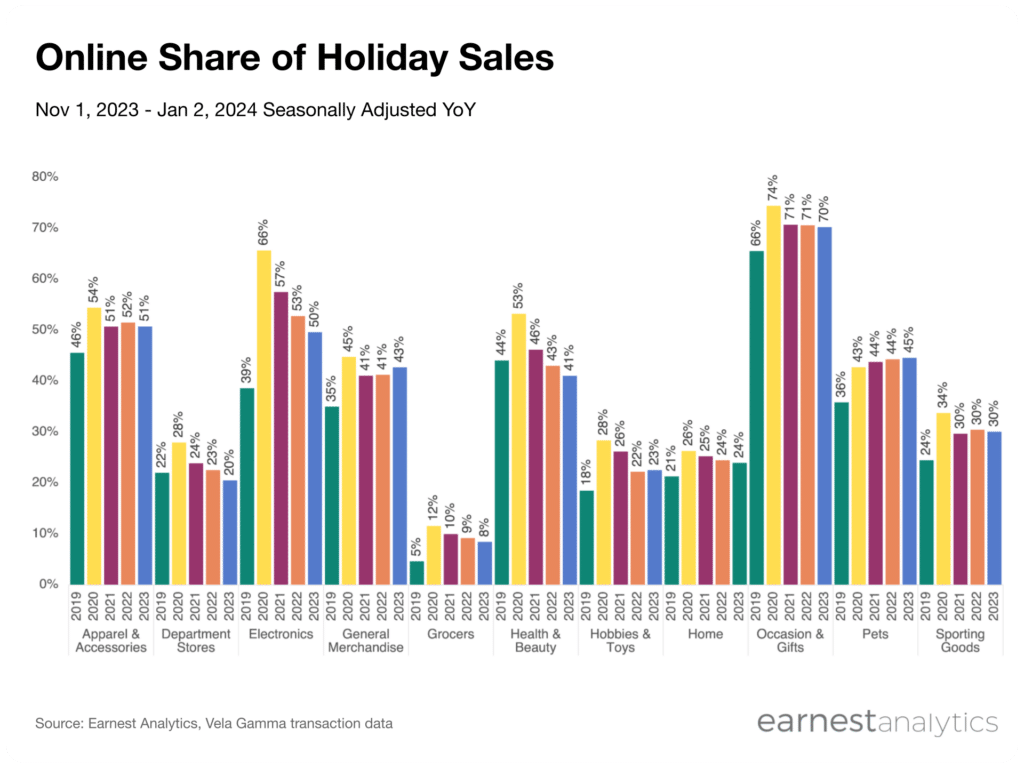

Online share increased for General Merchandise, declined for Health & Beauty

Contact Sales for more details.

The lockdown period during 2020 remains one of the highest periods of online sales share for most categories, but online sales largely remained elevated during the holiday period. Apparel & Accessories retailers, Electronics, General Merchandise, Grocers, Hobbies & Toys, Home, Occasion & Gifts, Pets, and Sporting Goods all had mid-single digit increases in share of online sales compared to pre-pandemic. However some categories’ share of online sales decreased compared to the prior year in 2023, including Department Stores, Grocers, Home, Occasion & Gifts, and Sporting Goods, suggesting most of these retailers experienced positive YoY trends in in-store foot traffic.

Occasion & Gifts, Electronics, and Apparel & Accessories all had the highest relative share of online sales. Grocers and Hobbies & Toys had the lowest share.

Health & Beauty was an outlier among categories with double digit online sales share–its online sales mix fell relative to in-store each year since 2020. This suggests that in-store still resonates with beauty buyers and is increasingly resonating each year despite the rise of online beauty channels like TikTok Shop, Shein, and Temu.

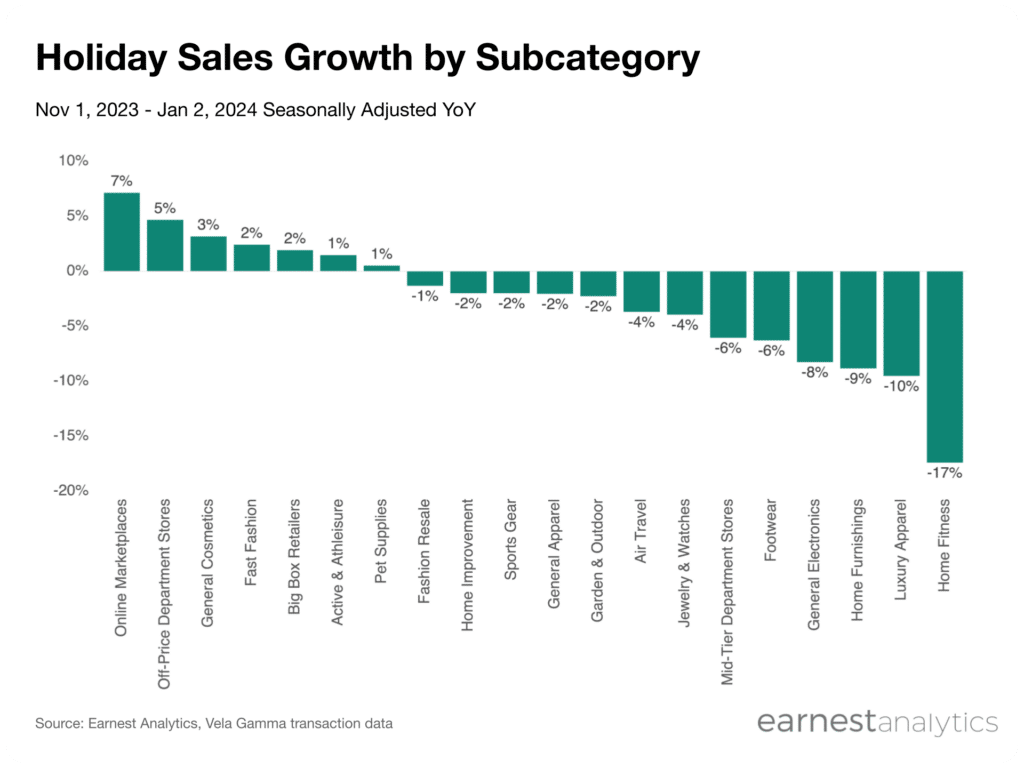

Online Marketplaces, Off-Price Dept Stores replaced Air Travel, Athleisure as top 2023 categories

Contact Sales for more details.

Online Marketplaces sales, including Amazon, Etsy, and Temu, grew 7% YoY during the 2023 holiday season, the fastest among any major retail category. This growth likely understates true holiday spending growth for these retailers, as many began their holiday promotions in October before the traditional holiday shopping season began.

Off-Priced Department Stores (+5% YoY), General Cosmetics (+3% YoY), Fast Fashion (+2% YoY), and Big Box Retailers (+2% YoY) rounded out the top 5 fastest growers. Home Fitness (-17% YoY), Luxury Apparel (-10% YoY), and Home Furnishings (-9% YoY) fell the most, continuing their declines from earlier in the year.

Shoppers also reduced their spending on Air Travel and slowed their spending on Active & Altheisure, both of which grew double digits YoY during the 2022 holiday season, suggesting a seachange in consumer priorities this year. The fact that three of the five fastest growers largely include discounters, while luxury and large ticket home categories retreated YoY suggests that shoppers were looking for attainable value in 2023.

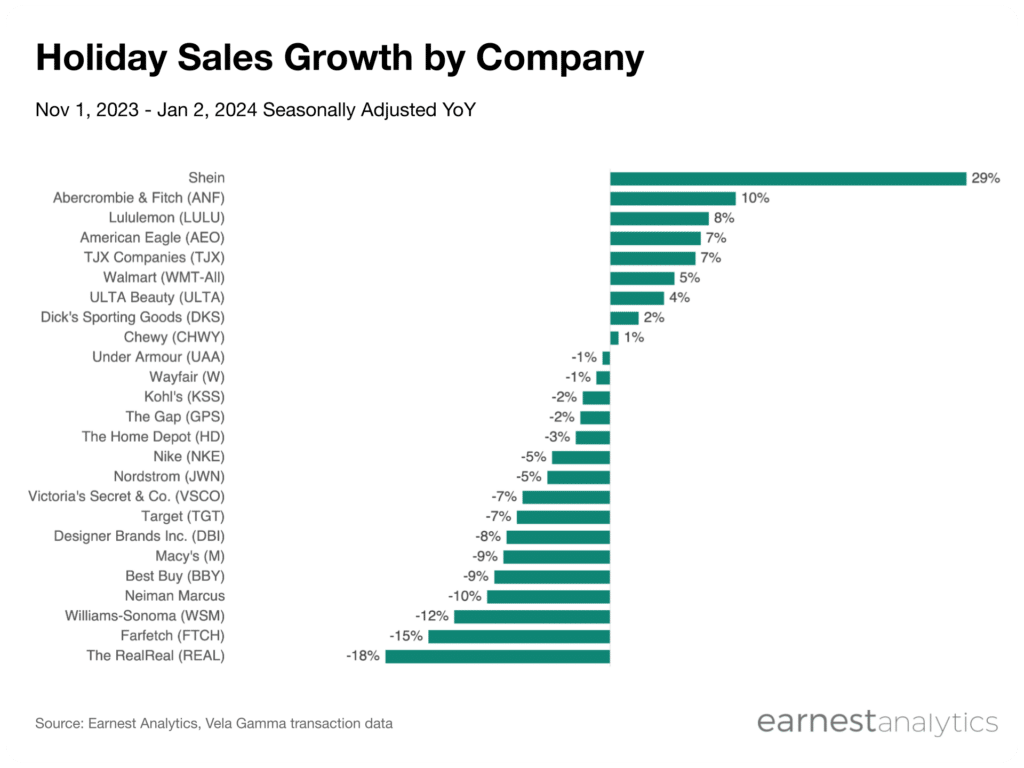

Temu, Shein, Abercrombie, Lululemon, and American Eagle posted fastest holiday sales growth

Contact Sales for more details.

Shein was the clear winner of the 2023 holiday period among major brands, growing 29% YoY. Shein, which recently acquired brick-and-mortar retailer Forever 21, defended its sales growth lead despite TikTok Shop making inroads with Shein’s share of wallet and a sales deceleration earlier in the year.

Abercrombie & Fitch (+10% YoY), Lululemon (+8% YoY), American Eagle (+7% YoY), and TJ Maxx owner TJX (+7% YoY) rounded out the top five fastest growers in the season. Fashion resellers The RealReal (-18% YoY), and Farfetch (-15% YoY) joined other luxury retailers like Williams-Sonoma (-12% YoY) and Neiman Marcus (-12% YoY) as the largest brands with major declines from 2022, suggesting consumers eschewed luxury across the board, regardless of resale or retail.

Walmart (+5% YoY) was the fastest growing Big Box Retailer, outperforming Target (-7% YoY). Mid-Price Department Stores like Kohl’s (-2% YoY) and Macy’s (-9% YoY) largely fell vs year ago sales levels, as did Nike (-5% YoY) which historically grew double digits during the holiday season.

Pinduoduo-owned Temu (not pictured) grew 910% YoY from its small base in 2022. With twice as many active monthly users as Shein in December 2023 (access chart in Dash), Temu could be the retailer to watch during the 2024 holiday season.

Notes

Seasonal adjustment includes sales from 11/6/19 to 1/7/20, 11/4/20 to 1/5/21, 11/3/21 to 1/4/22, 11/2/22 to 11/3/23, and 11/1/23 to 1/2/24 to maintain an equal number of shopping days.

Track retail sales for free