Holiday sales below year-ago levels as 2023 season begins

Key Takeaways

- Online Marketplaces like Temu and Amazon are outperforming

- Share of sales online is stable or rising across most categories

- Luxury and home goods are underperforming

Holiday sales decline for first time in years

Contact Sales for more details.

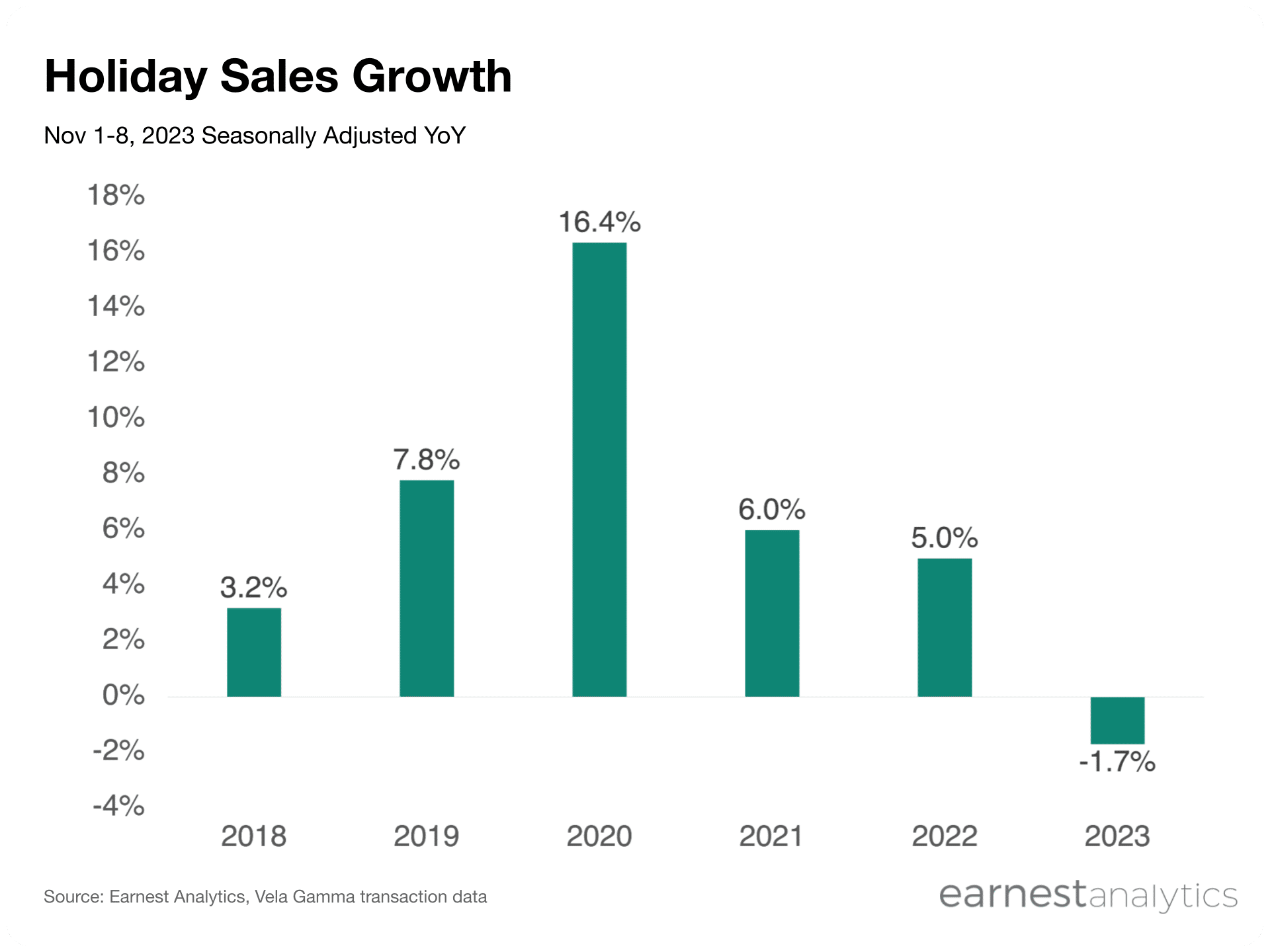

Holiday sales are down 1.7% YoY in the first 8 days of the holiday season according to the Earnest Analytics Spend Index (EASI), based on Vela credit card data. This decline follows a broader decline in consumer spending in October across most major categories. Online Marketplaces stood out in October headed into the holiday shopping season as some retailers like Amazon started their promotions early.

The decline in sales in the first 8 days of the season compares to mid-single digit growth during comparable period in 2022. Overall, the 2023 early holiday shopping trend represents a continued normalization post-Covid.

Online share of sales stable, rising for Electronics, Gen Merch, Hobbies, and Toys

Contact Sales for more details.

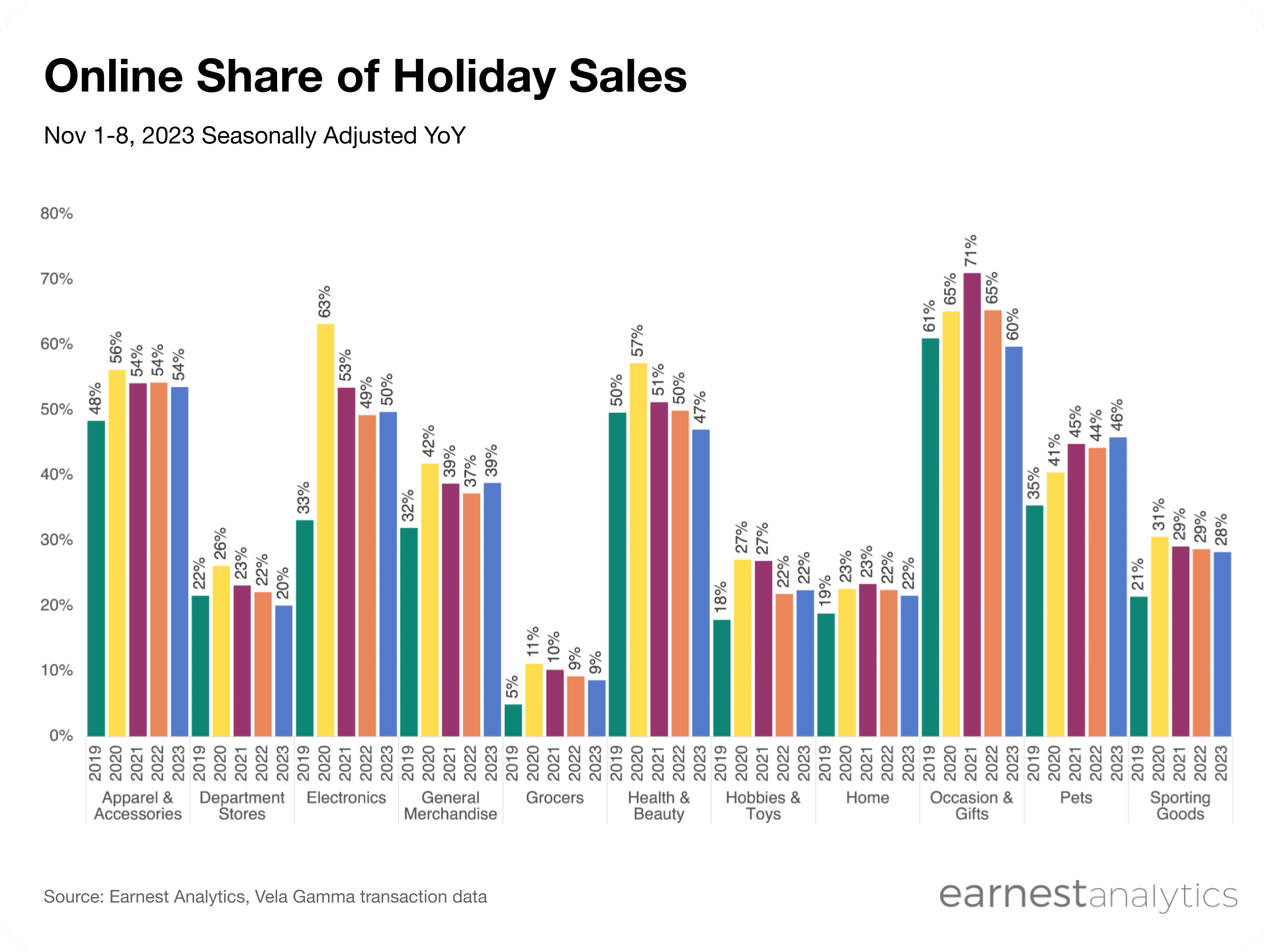

Online share of sales peaked for most categories during the lockdowns of 2020, falling slightly in subsequent years with the return of in-person shopping but remaining above pre-pandemic levels in recent years. Online share in some categories, however, has risen so far in 2023. Electronics, General Merchandise, Hobbies & Toys, and Pets all have slightly higher share of online sales than in 2022 in the first 8 days of shopping. Otherwise, online share of sales is largely at or slightly below 2022 levels.

Online Marketplaces outperforming, Luxury and Home struggle

Contact Sales for more details.

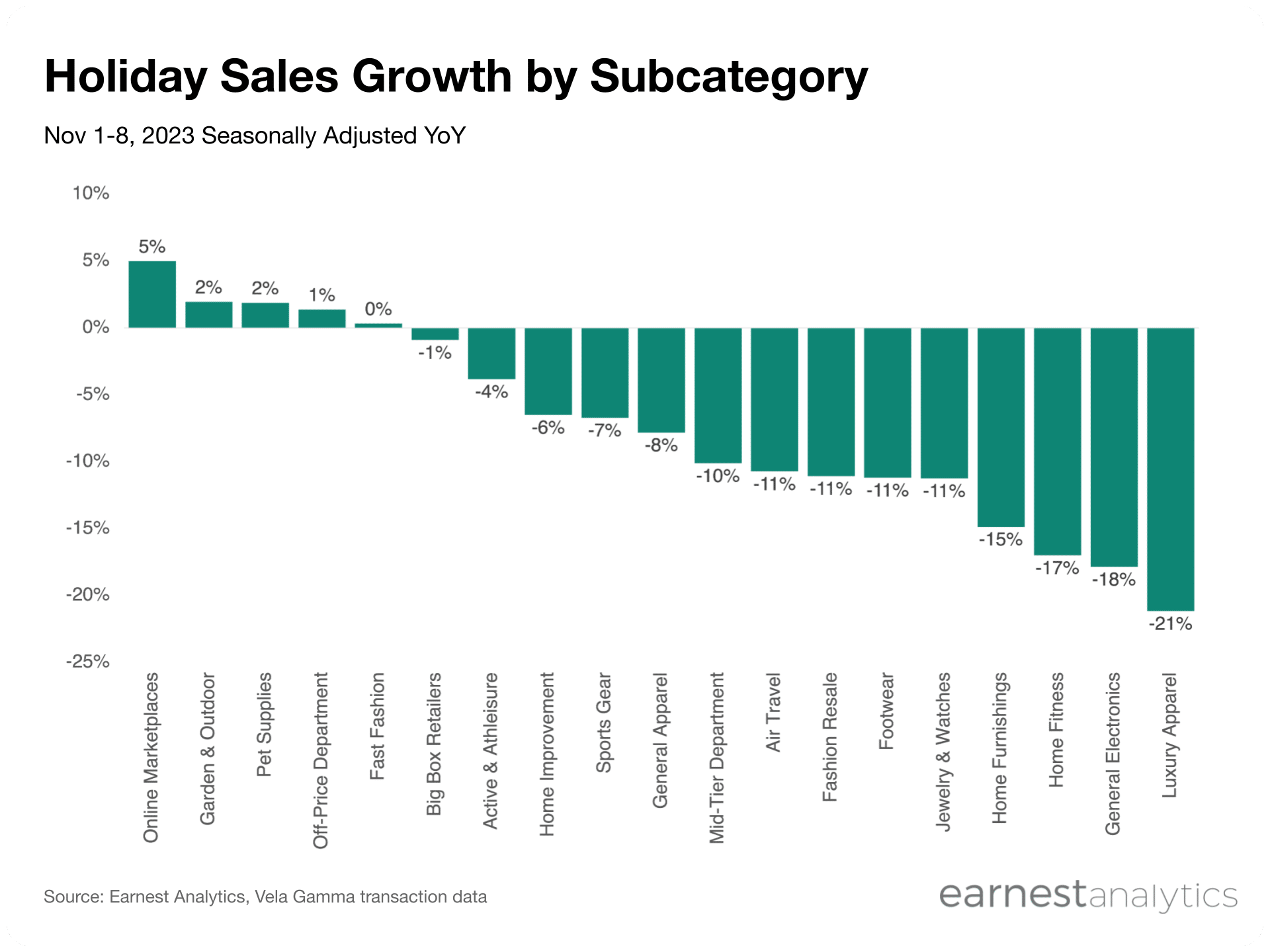

Online Marketplaces like Amazon dominated the first 8 days of holiday shopping in 2023. Earlier promotions not captured by this timeframe suggest they could already be having record setting holiday seasons. In prior years, Online Marketplace outperformance waned as the holidays continued and shoppers faced delivery dates that ran up against Christmas. Garden & Outdoors, Pet Supplies, and Off-Price Department Stores also grew modestly in the first 8 days compared to year ago levels.

Luxury Apparel is the most challenged subcategory so far this season, continuing a trend of declining aspirational shoppers Earnest first identified in July. Home related sales are also significantly down YoY, including General Electronics, Home Fitness, Home Furnishings, and Home Improvement.

Air Travel is also down in the first week of holiday spending, an early sign that shoppers’ post-Covid enthusiasm for experiences over goods may be waning.

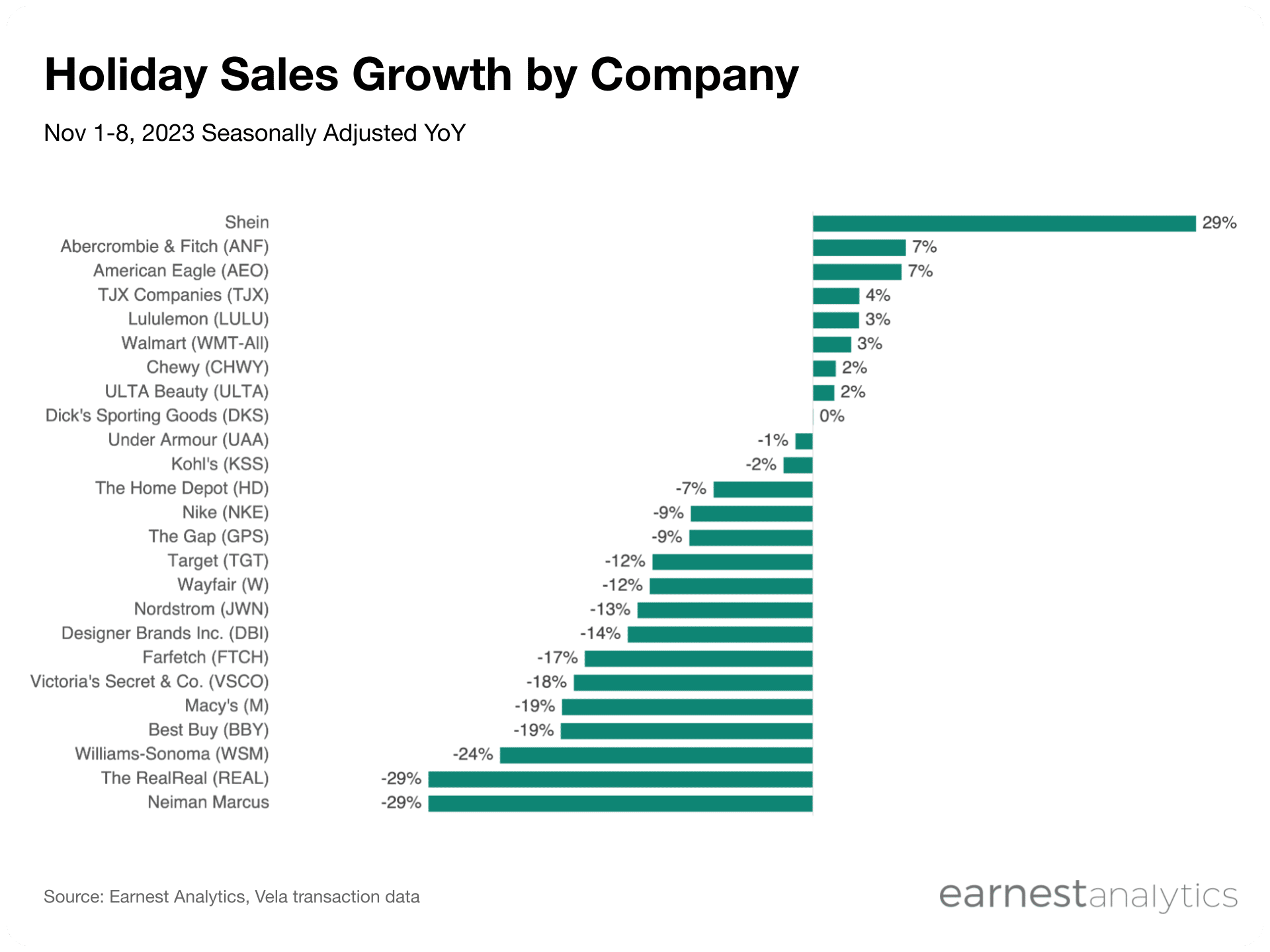

Shein, Abercrombie, American Eagle, and TJ Maxx shine; Temu breaks the charts

Contact Sales for more details.

Discount Online Marketplace Temu (not shown) grew over 1,800% YoY in the holiday season so far, compared to its only third month of US operations in 2022. The online retailer surpassed Shein earlier in the year to become the largest Chinese e-commerce company in the US and is poised for a blockbuster holiday season that could impact brick and mortar discounters and dollar stores.

Fast fashion market leader Shein outperformed apparel names at the start of the holiday shopping season on the heels of several major partnerships and acquisitions in 2023. Abercrombie & Fitch and American Eagle round out the top performing apparel names so far in the 2023 holiday shopping season, followed by Lululemon, Walmart, and Chewy.

Sporting goods brands Dick’s Sporting Goods and Under Armour are at or slightly below 2022 levels, while Kohl’s, The Home Depot, Nike, and The Gap are single digits below. Most department stores including Nordstrom are mid-teens below year ago levels.

So far, Neiman Marcus, The RealReal, Williams-Sonoma, Best Buy, and Macy’s are all low double digits below year ago sales levels.

Notes

Seasonal adjustment includes sales from 11/6/19 to 11/13/19, 11/4/20 to 11/11/20, 11/3/21 to 11/10/21, 11/2/22 to 11/9/22, and 11/1/23 to 11/8/23 to maintain an equal number of shopping days.

Track retail spending for free