Holiday Retail 2021 Full Performance: More Apparel and Early Shopping

The final installment of our 2021 holiday shopping series—subscribe to receive our upcoming reports.

Key takeaways for holiday retail performance in 2021:

- Consumer spending and store visits soared in November despite less retailer discounting, but slowed in December as Omicron spread

- Apparel, footwear, and sports gear displaced online marketplaces and home furnishings as top growth categories in 2021

- Online sales penetration was below 2020 levels for most categories, but significantly higher than 2019, suggesting the new normal is somewhere in between

November shopping drove record sales

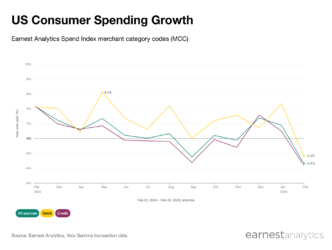

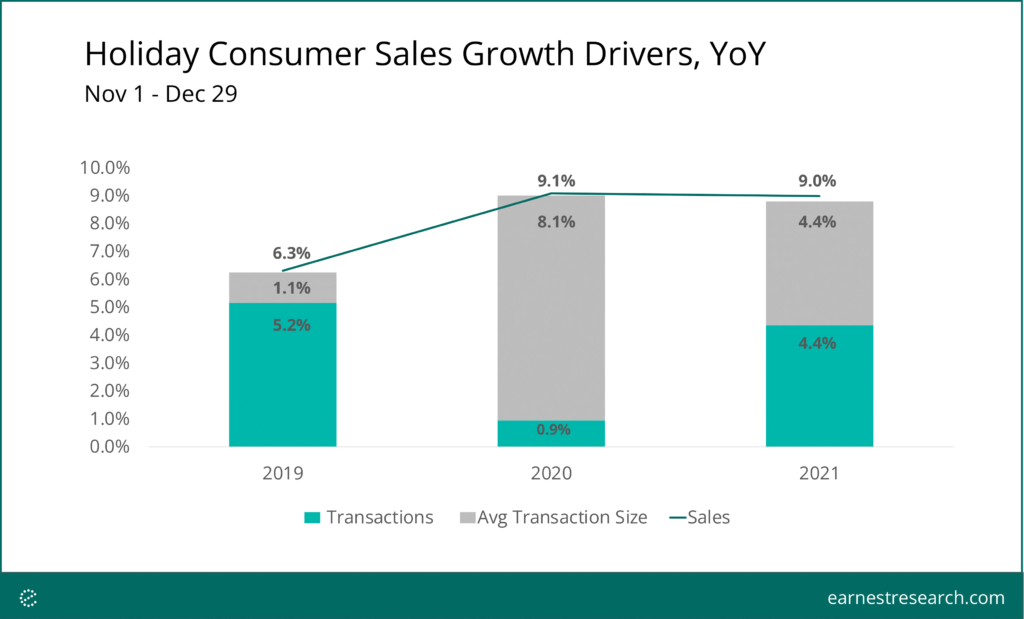

Consumer holiday retail spending increased 9% YoY according to the Earnest Analytics (FKA Earnest Research) Spend Index (ERSI*), a measure of sales growth for 2,500+ U.S. consumer discretionary and staples businesses. In contrast to 2020 sales, sales growth between Nov 1 – Dec 29 2021 was driven equally by more transactions and larger transaction sizes (likely due to both fewer discounts and inflation).

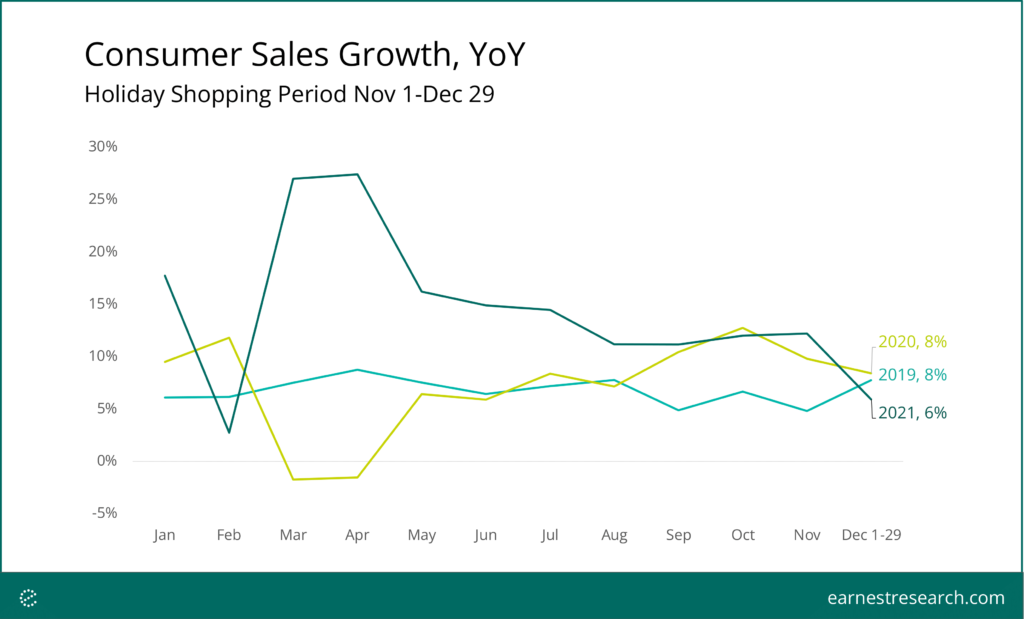

Despite initially robust growth, YoY consumer sales decelerated from November to December, possibly due to tougher December 2020 comparisons as well as Omicron related headwinds. Additionally, earlier promotional activity likely pulled some holiday spending back into November, driving 12% YoY growth in that month.

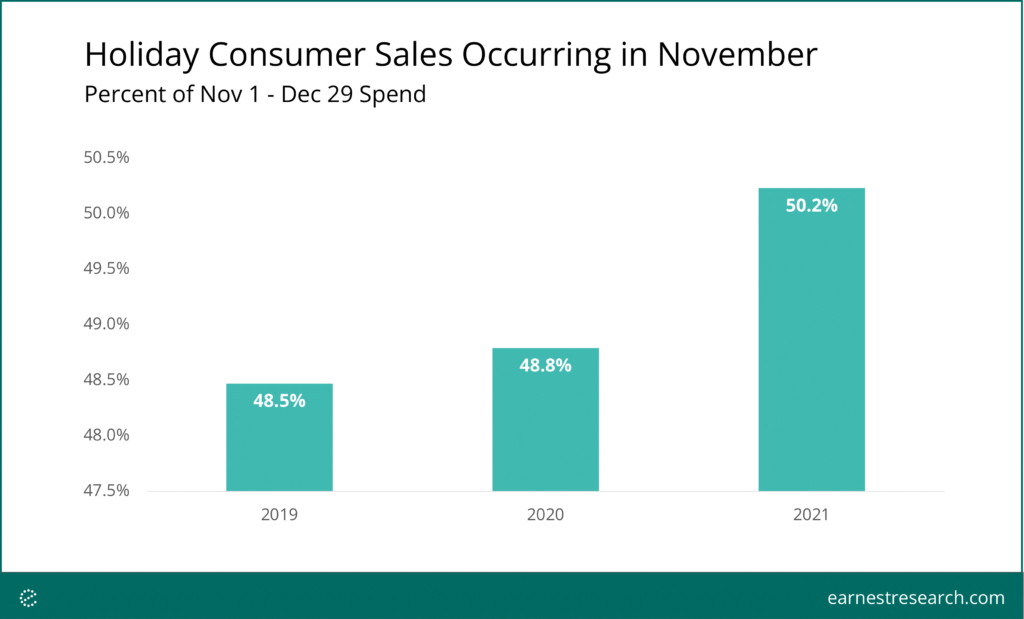

As a result of this shift in spend, the percentage of sales dollars spent in November topped 50% for the first time in ERSI history in 2021. The share gain of nearly 2 points compared to pre-pandemic levels suggests November could become the most important holiday shopping month going forward.

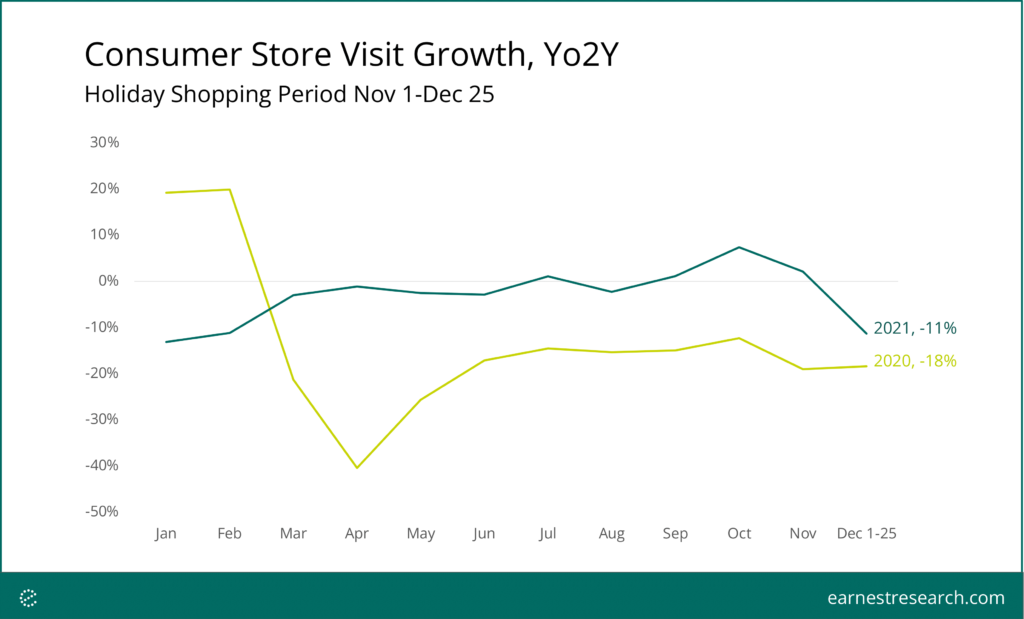

Foot traffic also tapered during the holiday retail season after a robust November

Holiday shoppers’ visits to stores exceeded pre-pandemic levels by 2% during November, further suggesting that earlier promotional activity drove consumers back into physical stores despite fewer discounts. Visit growth receded after Thanksgiving, falling 11% below pre-pandemic levels in the shopping period from Dec 1 to Dec 25.

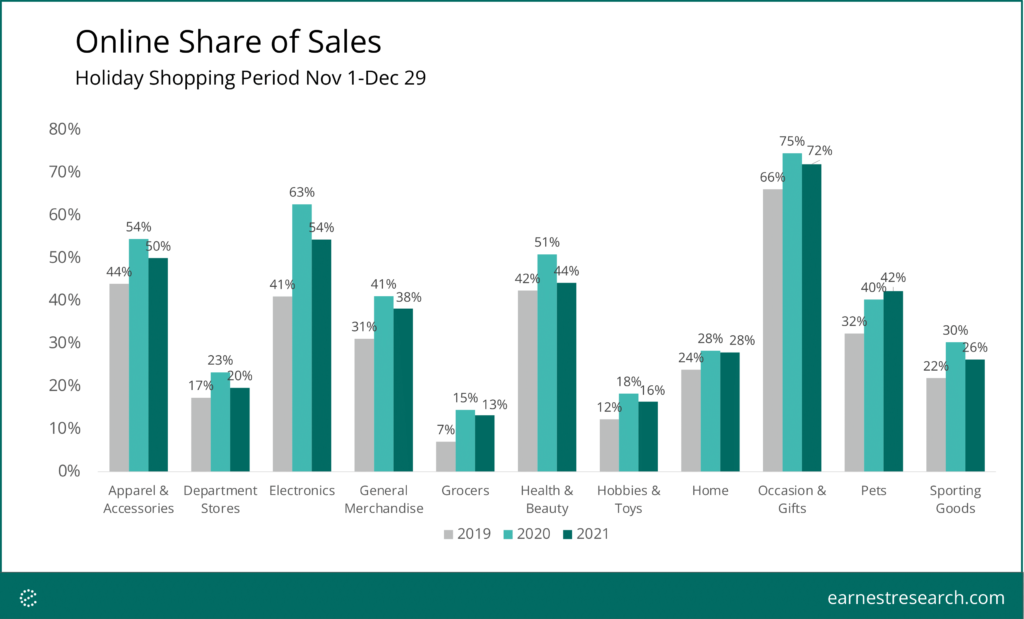

Online sales share during the holiday season was below 2020 levels but above pre-pandemic

The holidays are the biggest online shopping period of the year, with preliminary mid-November holiday data showing many categories with higher online sales penetration in 2021 than any year prior. However online sales eased up after Cyber Monday. Most categories wrapped up the 2021 holiday season with lower online sales penetration than in 2020.

Still, the shift to online in the last three years is noteworthy. Consumers spent more than half of their Apparel & Accessories and Electronics dollars online during the holiday shopping period. Even the online share of sales in large ticket categories like Home were closer to 2020 levels than 2019 levels, suggesting 2021 was the first glimpse of the new normal holiday season.

Apparel retail, resale gained ground from Online Marketplaces

Holiday shopping trends in the preliminary November data largely continued into the rest of the season, with resale and apparel posting the largest YoY gains. Home-centric subcategories such as Home Improvement, General Electronics, Home Furnishings, and Home Fitness were the biggest losers of the season as consumers pivoted from the pandemic induced home spending that defined 2020.

Online Marketplaces, which includes Earnest Retail Rankings winners Amazon and Etsy, swung from positive growth in the preliminary period to YoY declines in the full holiday season. The reversal was likely due to tough 2020 comparisons and a broader shift back to physical and traditional retailers like Department Stores and General Apparel brands.

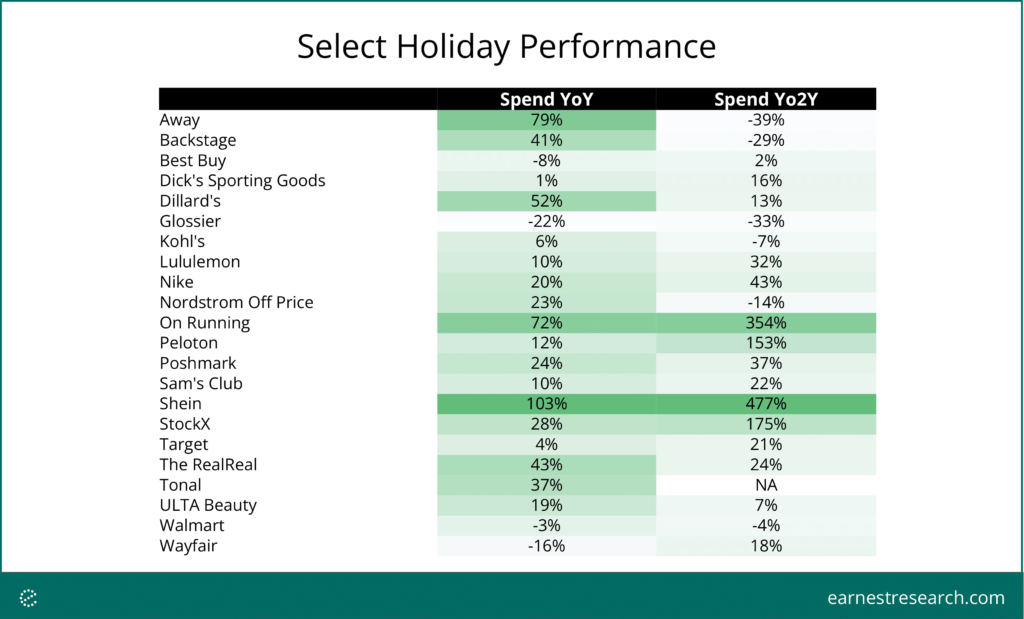

Shein topped apparel, Target and Sam’s Club stood out

Shein continued to lead among Apparel brands, growing triple digits YoY. Dillard’s, Dick’s Sporting Goods, Nike, and Lululemon all surpassed both 2020 and 2019 sales levels. Other major apparel retailers such as Backstage, Nordstrom Rack, and Kohl’s grew meaningfully YoY but remained below pre-pandemic levels. Resellers Stockx, Poshmark, and The RealReal all grew double digits both YoY and Yo2Y during the holidays, suggesting that gifters were possibly buying used items during the holiday season as sustainable fashion gains more notoriety.

Target and Sam’s Club outperformed other general merchandise and big box retailers with mid-single digit growth YoY compared to negative growth for Walmart. Furnishings and electronics retailers Best Buy and Wayfair saw meaningfully lower sales in 2021 than 2020 as consumers eased their quarantine-related home goods spending.

Notes

*The Earnest Analytics (FKA Earnest Research) Spend Index (ERSI) is an alternative data-driven measure of consumer spending that tracks spending across 2,500+ large national brands in major consumer discretionary and staples subcategories. The near real-time data is derived from the credit and debit spend of millions of de-identified U.S. consumers. Advantages of using ERSI include better representation of e-commerce spend, disaggregation by geography, and online versus in-store breakouts.