Falling Home Prices in West Suggest Challenge for Home Goods Retailers

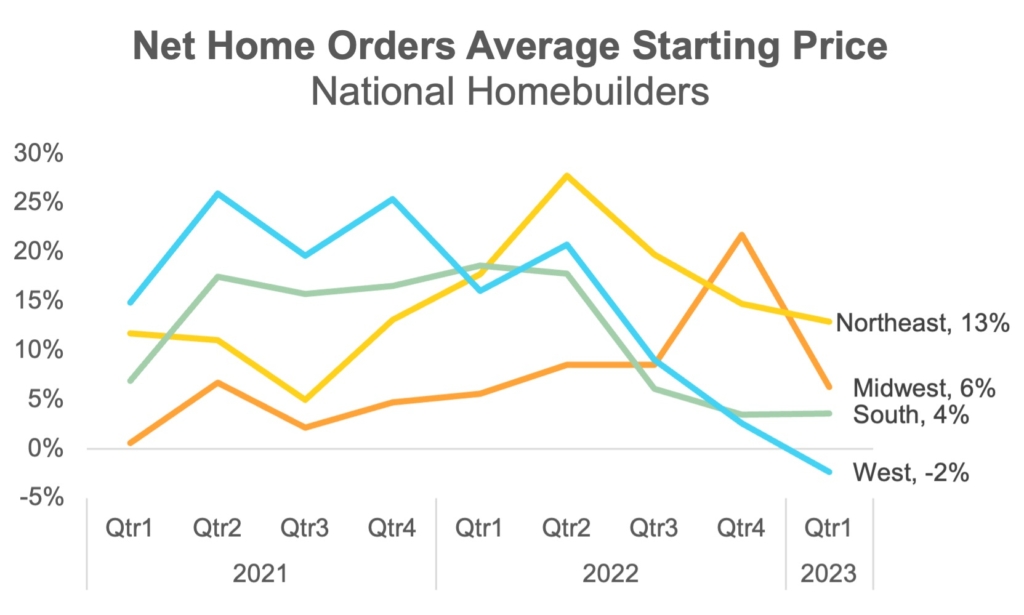

New home prices are rising fastest in the US Northeast according to Earnest Homebuilders web data. Net orders’ average starting price, a measure of new home costs excluding custom add-ons, among PulteGroup, Richmond American, and Toll Brothers national builders rose 13% YoY in 2023 Q1 in the Northeast. This represented a slight deceleration from 15% YoY growth in 2022 Q4. In contrast, prices in the West fell 2% YoY in 2023 Q1. Home orders for new homes from the same builders grew the fastest in large western states like California in the early pandemic days as urban consumers looked for more space during lockdown. Arizona stood out in 2020 and 2021 with some of the fastest growing prices, while California prices slowed their years-long decline during the pandemic.

Now rising rates and a cooling economy are slowing demand and, in turn, price increases. Buyers canceled their new home purchases at historically high rates in 2022, prompting builders like Richmond American to increase their spec house mix to tamp down on price increases. Builders are also frequently asking for higher down payments to ensure buyers are more committed to their purchase. Efforts to reduce cancellations, in concert with economic headwinds, succeeded in slowing price increases in most regions. The South, where prices grew 18% YoY in 2021 Q2, inched up 4% YoY in 2023 Q1, outpaced by the Midwest’s 6% YoY increase.

The overall slowdown in pricing could be the canary in the coal mine for falling demand and fewer moves, impacting various industries from home furnishings to moving and storage. For now, at least, there are still regional bright spots where relatively strong housing demand could signal healthy demand for home goods retailers.

Contact Sales for more details on Earnest Homebuilders web data.