Cultivating Customer Value: Gaining Greater Understanding of Customer Behavior Using Credit Card Data

by Jingjing Fan and Dan McCarthy

In today’s highly competitive e-commerce landscape, understanding and cultivating customer value is more critical than ever. After all, it is a given that all revenue comes from customers making purchases. Therefore, the ability to drill down and analyze customer behaviors at a transaction or unit level (e.g., retention, repeat purchase, and spending) to understand what (and who) drives the most significant proportion of value is paramount to understanding the health of your customer base and your company overall. One key metric to get absolutely right is post-acquisition value (PAV), which we define as the net present value of a customer‘s revenues after acquisition before deducting customer acquisition costs (CAC).

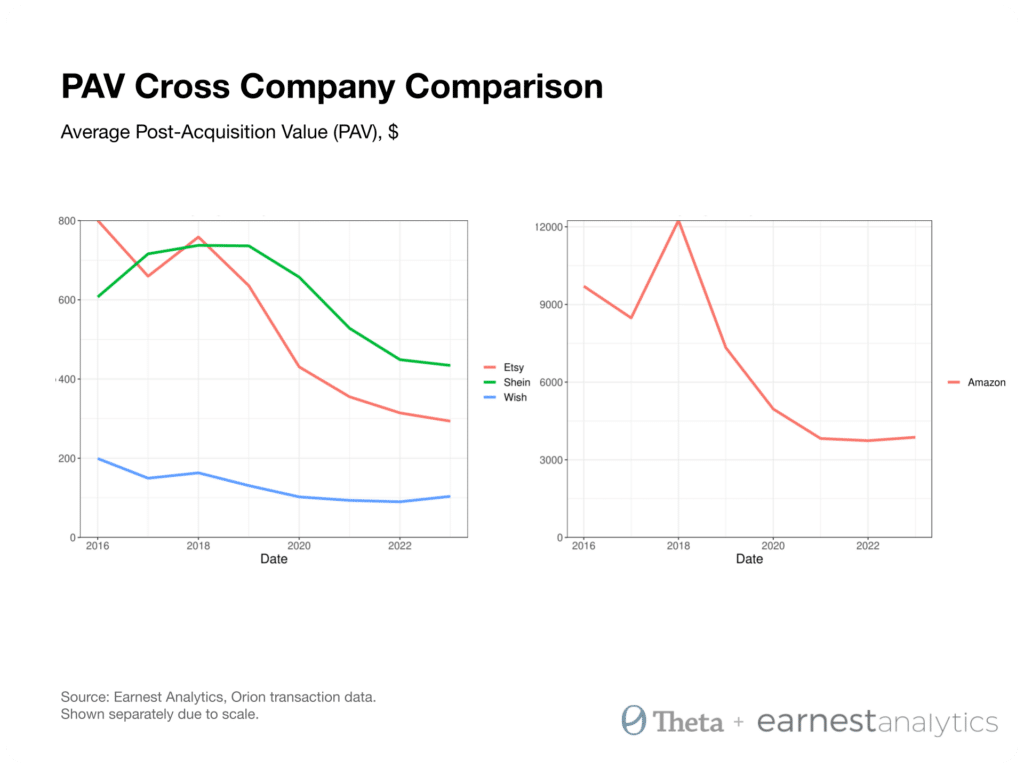

The essence of PAV lies in its ability to track and measure the ongoing value a customer brings to a business after their initial acquisition. If calculated accurately, this critical metric can determine what a company should be investing to acquire a customer based on the projected lifetime value of that customer. A recent study we did at Theta analyzing credit card data from Earnest Analytics capturing historical transactions with four major e-commerce players, Amazon, Etsy, Shein, and Wish, offered a unique look ‘under the hood’ at the specific customer behaviors that affect PAV.

Using a state-of-the-art combination of statistical models, we could see trends in customer behavior affecting PAV for each company. While these firms all show declining trends in PAV, a closer look at their unit economics revealed unique insights, leading to distinct strategic opportunities.

We could see a consistent decline in PAV for each firm, but the cause varied. Etsy and Wish, for example, when analyzed at a transactional level, both suffer from higher churn and a decrease in repeat purchases, causing a decline in PAV. For Wish, there was a rather steep 48% decline in PAV between 2016 and 2023. Wish also has a near-zero residual lifetime value (RLV), which implies a high likelihood that their existing customers have churned. For Etsy, this PAV decline could be the underlying cause of their 2022 net loss of $694M. Customers at Shein increased their repeat purchasing but churned faster, resulting in a declining PAV. Shein’s unit economics have been historically strong, indicating effective customer value generation. However, a notable change is seen in customers acquired during 2022-2023, who show a lower average PAV than those acquired before 2022.

Amazon showed stable churn, but its decline in average PAV for the e-commerce portion of its business (excluding Amazon Prime subscriptions) since 2018 was mainly attributable to decreased repeat purchase rates. During the COVID-19 era, Amazon’s pre-pandemic customer cohorts saw repeat purchase rates two to three times higher than post-pandemic cohorts. Despite a decline for the latter, the average Amazon customer is expected to make about 50 repeat purchases in our projected 5-year time horizon, indicating robust and lasting customer loyalty and engagement, even post-pandemic. Amazon has acquired most of its applicable market in the U.S., so the impact of the PAV of recently acquired customers is likely smaller than that of Etsy, Wish, and Shein.

As this illustrates, the mechanisms driving changes in customer value enrich our understanding of the problems and opportunities available at companies like the four we analyzed above. This deeper analysis gives decision-makers a clearer picture of what strategies may be most effective to increase customer value and long-term profitability and the maximum investment to acquire a customer. By understanding which segments of their customer base have a higher PAV, businesses can tailor their efforts more effectively, focusing on high-value customers or working to increase the PAV of other segments.

In conclusion, post-acquisition value is a critical metric for e-commerce businesses to get right. It offers valuable insights into customer behavior and business health, guiding companies in refining their strategies for sustainable growth. Understanding and optimizing PAV can lead to more effective customer retention, higher profitability, and a more substantial brand presence in the competitive e-commerce landscape.

Theta will release a detailed paper on this analysis in February. Join us for a preview of the findings in our upcoming webinar scheduled for Thursday, February 1, at 1:00 pm EST, where Dan and Jingjing will discuss the findings.