Turning Gut Instinct into Data Driven Store Expansions with Transaction Data

Recorded March 9, 2023.

Living Spaces’ Sr. Director of Media & Analytics Cameron Alverson shares how his team takes the guesswork out of marketplace expansion, identifies competitors in new markets, finds customer journey opportunities, and tracks share of wallet during inflation with Earnest Analytics transaction data.

Cameron Alverson on identifying competitors: “One of the things that the Earnest data gives us that we don’t really have full visibility to otherwise is regarding what sort of immediate presence a company may have. How big are they? What kind of an influence are they really having in a marketplace? And that has uncovered for us companies that we ought to be paying attention to and keeping an eye on, where otherwise we might not have just based on media spend. There are ways that the companies can spend on media that maybe would go under our radar.”

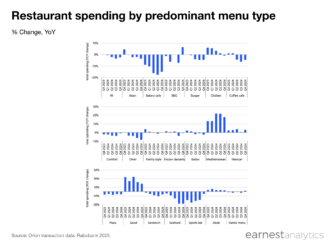

Cameron Alverson on informing new market expansion: “We just went into Salt Lake City, which demographically is a unique market with some key differences. We looked at what some of our competitors are doing. Some were closed on Sundays, for example, and we wondered, is that something that ought to impact how we think about our media and how we think about what that environment looks like, what consumers are expecting. And we were able to use the Earnest data to look at what revenue looks like for the category by day of week, which uncovered some very different trends than what we’re used to seeing in most of our other markets. Which then has led to some different decisions that we would make in terms of media. Led to a lot of internal discussions about our story hours on a look like, and whether they ought to be different in that market compared to others. So it was with Earnest data that we really began to uncover some of those kinds of opportunities for us that we didn’t have any other good way of being able to see before, without it being really kind of a gut call.”

Cameron Alverson on using transactions with survey data: “From an analytics perspective, there’s this constant tension between qualitative and quantitative data and how those two ought to interact with each other. The Salt Lake City example, I think, is a really good one, actually, of how quant and can inform each other and create this virtuous loop of analysis. So, seeing in the hard data, data behaviors and trends that were different than what we expected, informed, for example, qualitative data that we would go and try to get. It informed surveys or questions that we wouldn’t have thought to go ask. But then we went and asked in the market to try to understand and really validate. What else is going on here?”

Cameron Alverson on the decision to bring Earnest data on board: “The Earnest data also provides us an opportunity to get a more holistic picture from that quantitative perspective, because it layers in a view that we wouldn’t have with other kinds of data. We can see website trends, foot traffic, or what our own sales look like. But Earnest data—and this for us was one of the biggest use cases that led us to bring it on board—allows us to put all of that in some kind of context.”

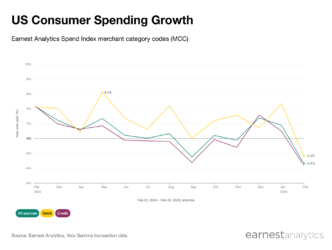

Cameron Alverson on putting company trends in a competitive context: “Looking at our own performance, whether it’s growth, or whether there are areas that maybe year over year are not quite as strong as we would like them—to be able to use things like Earnest’s data that allows us to put that into perspective. To say, well is this what we would have expected. Is this what everyone else is seeing? Are we doing better than competitors? Does that mean we’re still taking market share? Even if this metric is now quiet. You know what we would hope it would be. From that perspective, it also helps us in terms of forecasting in terms of not just not just understanding how to evaluate current or or recent performance, but also looking forward and trying to project.”

Cameron Alverson on identifying missing opportunities in the customer journey: “It’s really important to understand well what triggers that when we need to get in front of people. And then how big and how long of a window do we have? Are they in that furniture buying process for days, for hours, for months. Because that’s going to impact what we decide to do in terms of how to target, when to target, with what kind of messaging. Understanding things like if someone comes and buys a piece of furniture from us today, does that mean they’re done or did they just get started and we need to stay in front of them. There are multiple data sources, and Earnest certainly allows for this, to understand what that buying cycle looks like. And if we don’t bring in that third party data, then we’re limited to only what transactions look like within our own walls. But if somebody buys something from us today, and they’re still in the market for some other complementary piece of furniture, perhaps they’re willing to go buy from somewhere else. We won’t know that unless we bring in third party data. And we won’t know whether that continuing purchase process, if it exists, whether that continues for another 6 months.”

Cameron Alverson on tracking share of wallet with inflation: “One thing that Earnest has done for us that we’ve not been able to get anywhere else is really [provided] a quantifiable view of what inflation is now and to see not just how it impacts us. We know how it impacts us. We know what our own costs and prices look like as a result of it. But to understand, how is it shifting things for competitors? How is it shifting things from a consumer perspective? How is it shifting things in terms of share of wallet? The pandemic changed dramatically from our industry’s perspective of what share of wallet looks like. And now, as we come out of that, and inflation is high and there’s whisperings of recession, or just downturn in the economy. That also has huge implications for what share of all it means. And we’re able to monitor and quantify that with this kind of third party macro data that otherwise we would be completely blind to.”

For additional information on how Earnest Analytics data can power your decision-making, please request a demo.