Black Friday and Cyber Monday post slow sales growth; Online Marketplaces outperform

Key Takeaways

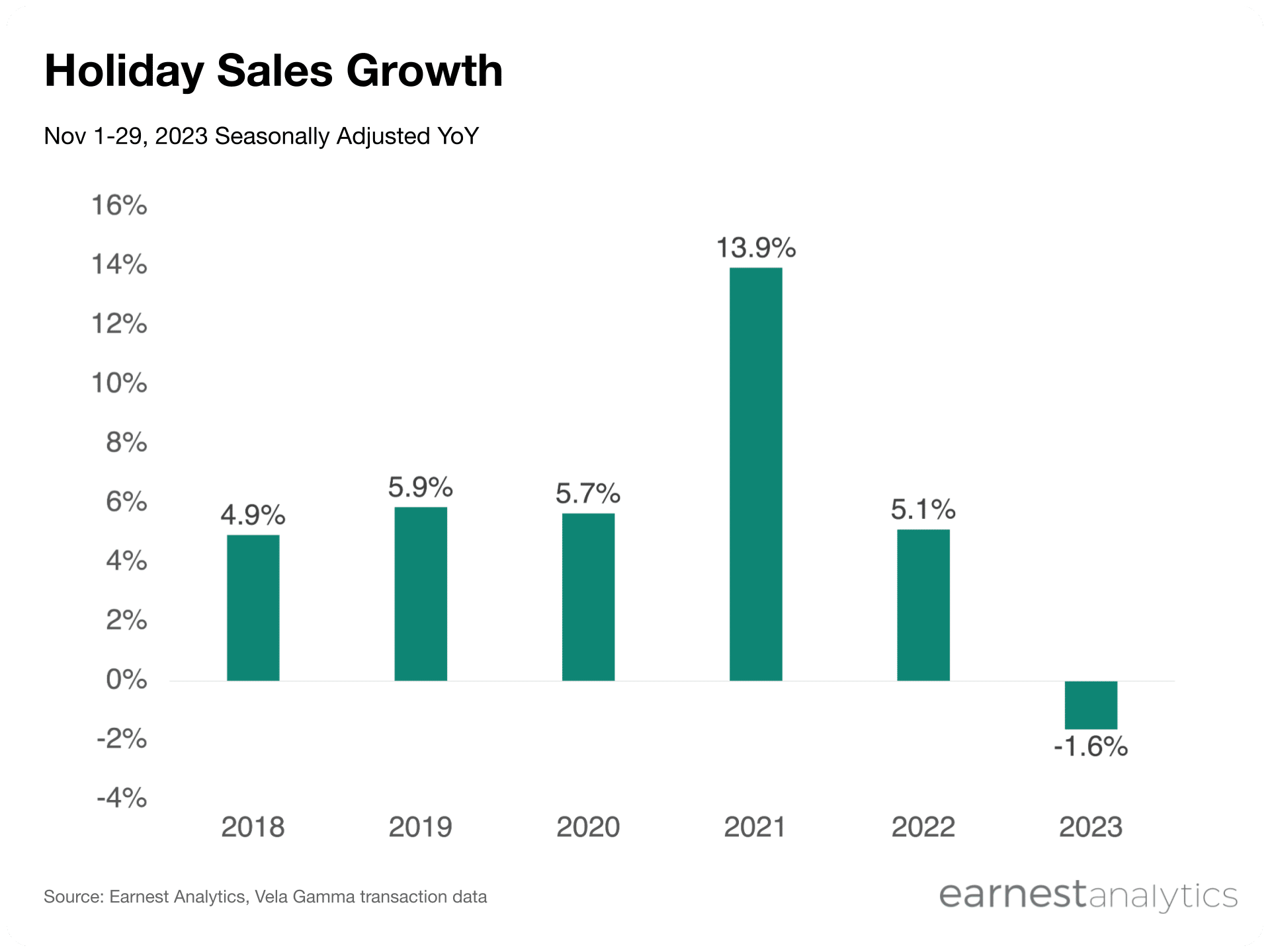

- Holiday sales declined 1.6% YoY in the first 29 days of the holiday season

- Black Friday to Cyber Monday sales grew 1.0% YoY

- Amazon and Walmart were shoppers’ favorite Black Friday-Cyber Monday brands

Holiday sales remain weak after Black Friday, Cyber Monday

Contact Sales for more details.

Holiday sales fell 1.6% YoY in the first 29 days of the holiday season according to the Earnest Analytics Spend Index (EASI), based on Vela credit card data. The year on year decline is a sharp drop from the mid single to low double digit ranges of the past five years, but is consistent with preliminary data that tracked similar weakness in the early days of November.

Part of this sales weakness could be due to demand pull-forward as Online Marketplaces and big box retailers like Amazon and Target started their promotions early. This also comes as retailers are beginning to feel negative effects from the resumption of student loan payments.

Online share of sales surge at General Merchandise brands

Contact Sales for more details.

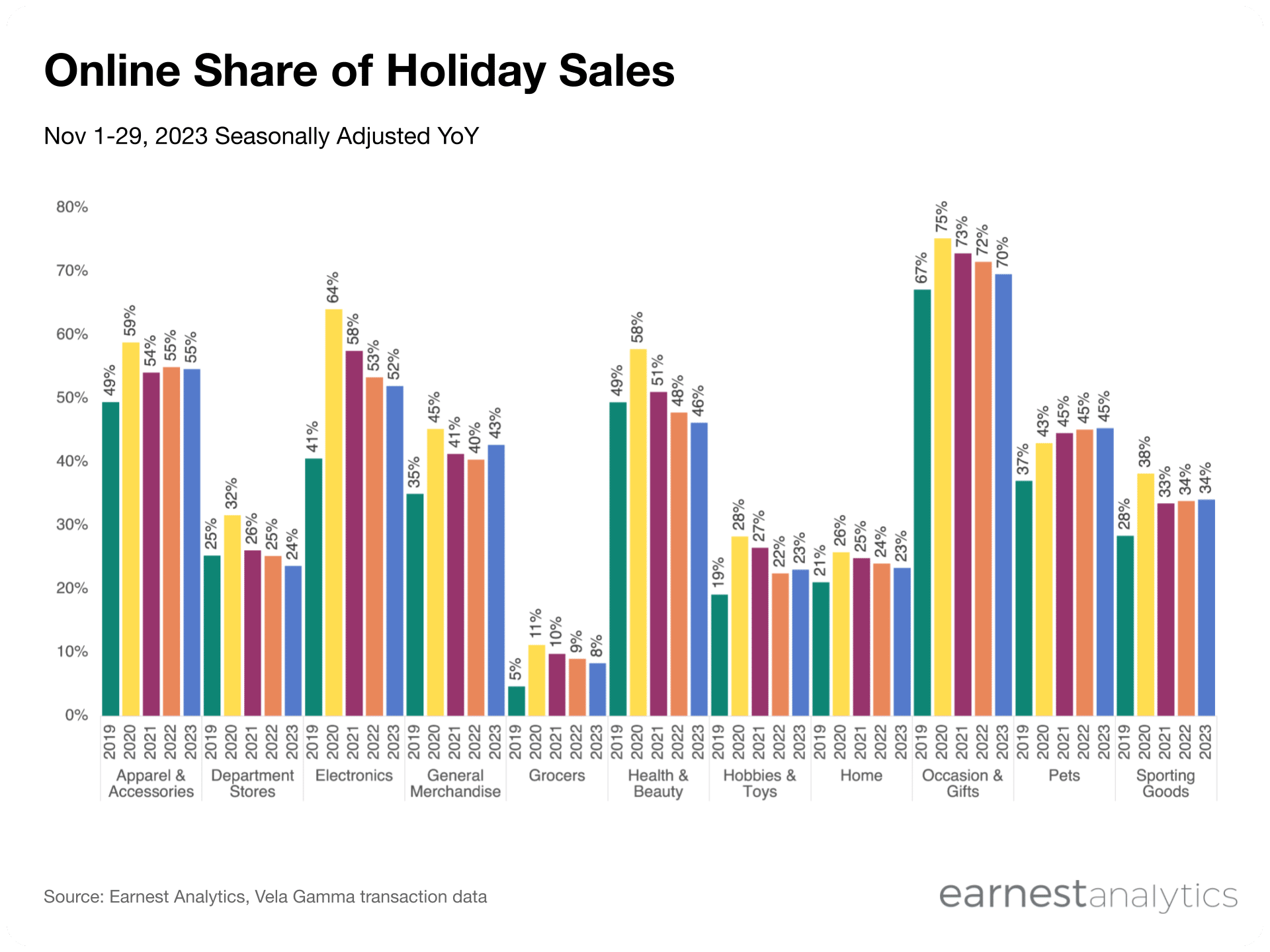

Online share of sales peaked for most categories during the lockdowns of 2020, but remained above pre-pandemic levels in recent years. One major exception is General Merchandise, a category that includes Walmart, Target, and Costco, which gained three points of online sales share from 2022 to 2023. Online General Merchandise sales reached 43% of total sales–the highest increase among major categories so far this year.

Hobbies & Toys and Pets also have a slightly higher share of online sales than in 2022 in the first 29 days of shopping. Otherwise, online share of sales is largely at or slightly below 2022 levels.

Online Marketplaces is outperforming broader sales slowdown

Contact Sales for more details.

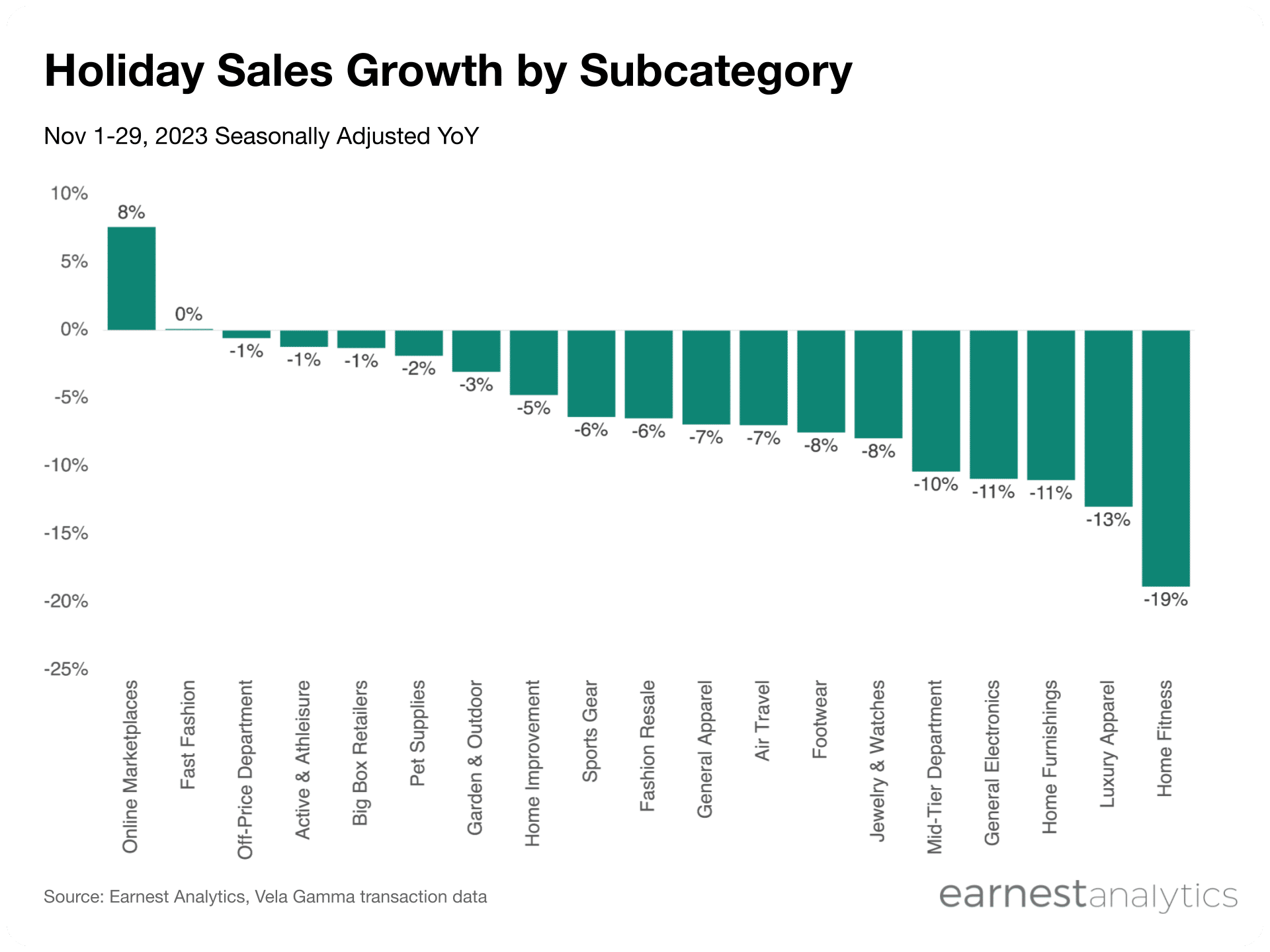

Online Marketplaces, a category that includes Amazon and Etsy, grew 8% YoY in the first 29 days of the holiday season, vastly outperforming other subcategories that largely fell mid-single double digits. Fast Fashion, including Shein, was flat YoY, while Off-Price Department Stores, Active & Athliesure, and Big Box Retailers all outperformed the overall 1.6% YoY sales decline despite falling vs year ago levels.

Home Fitness, Luxury Apparel, Home Furnishings, and General Electronics posted the largest YoY declines as consumers continued to move away from post-pandemic related home investments and aspirational luxury buying.

Garden & Outdoor and Pet Supplies both slipped from positive to negative growth compared to the early days of the holiday shopping season.

Shein, Lululemon, ULTA, and American Eagle lead small group of growers

Contact Sales for more details.

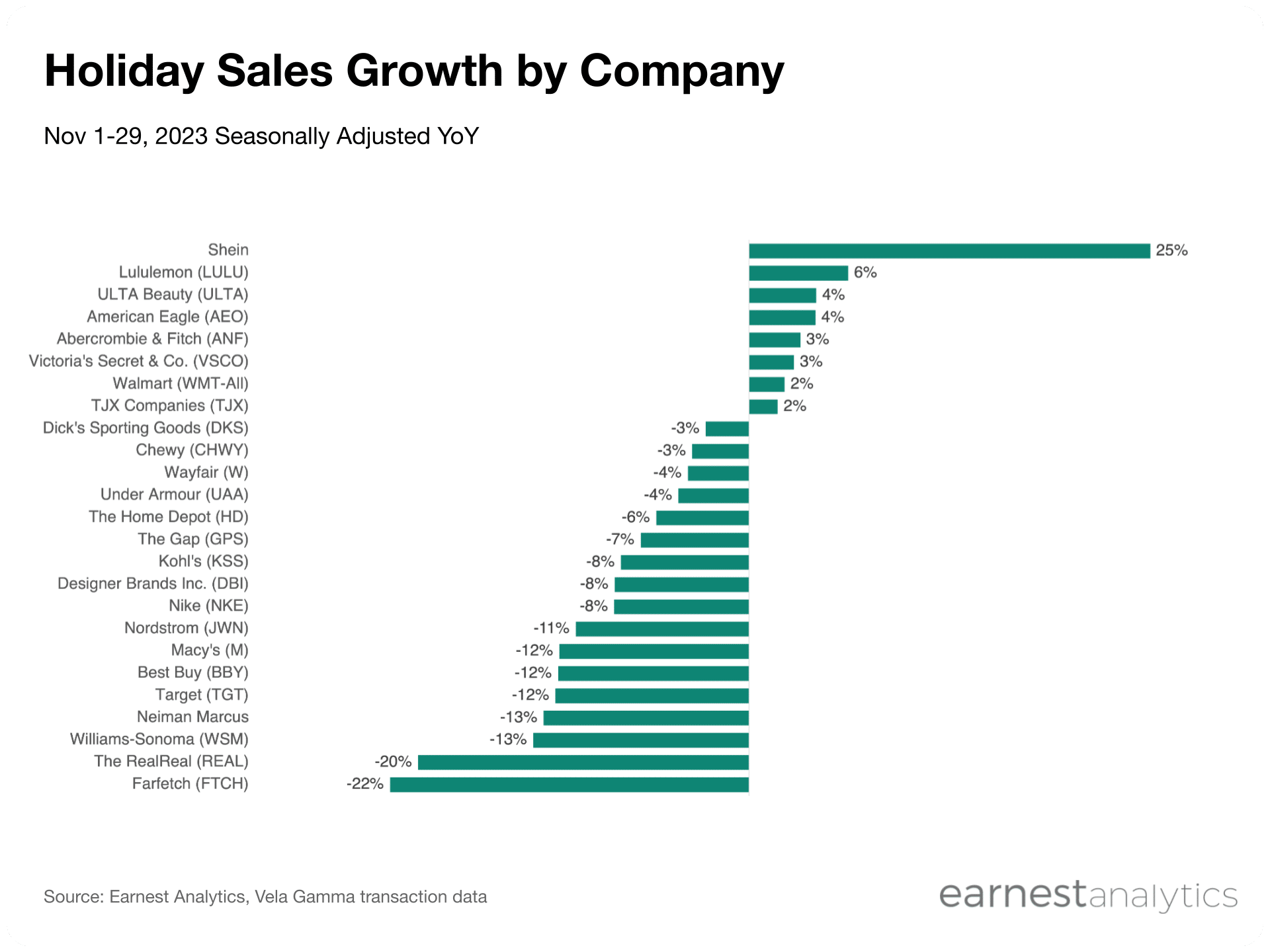

Online fast fashion retailer Shein continued to outperform major retail brands in the first 29 of holiday shopping despite being surpassed earlier in the year by Temu to become the largest Chinese e-commerce company in the US. Since then TikTop Shop (not shown) is also making inroads into online sales, especially among Shein customers.

Lululemon’s growth accelerated to 6% YoY since the first days of the holiday shopping season, followed by beauty brand ULTA. American Eagle, Abercrombie & Fitch, Victoria’s Secret, Walmart, and Target round out the major brands with positive YoY growth so far.

Discount Online Marketplace Temu (not shown) grew over 1,000% YoY in the holiday season so far, compared to its fourth month of US operations in 2022.

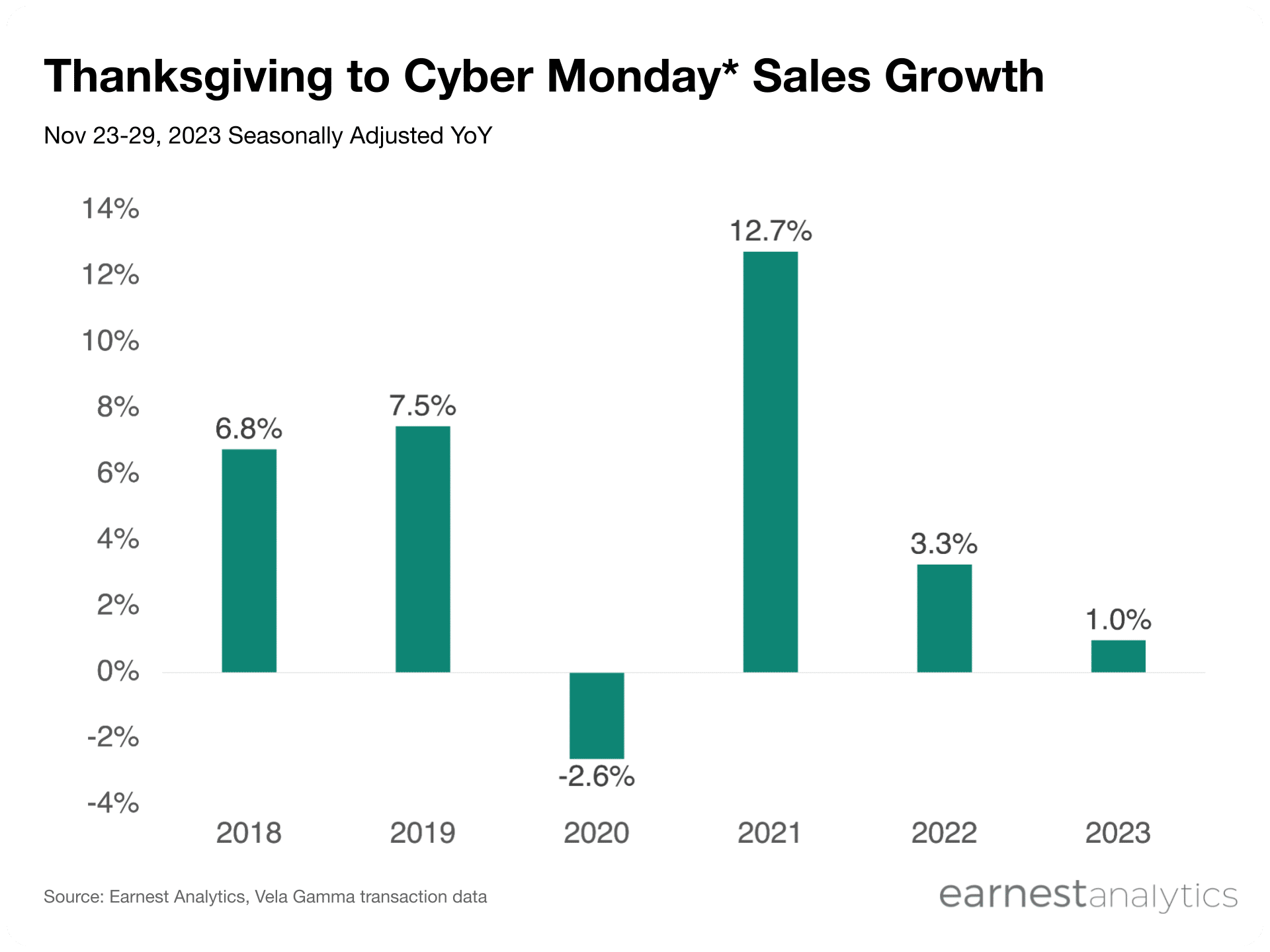

Black Friday to Cyber Monday sales barely grew

*Data includes two days following Cyber Monday in order to include sales data for online purchases that are not billed until shipped in the following days. Contact Sales for more details.

Sales during the shopping period from Thanksgiving to Cyber Monday, also known as Cyber-5 and including Black Friday, rose 1.0% YoY, the smallest growth since the pandemic, and well below mid-single digits trends. Still, positive growth during the 7-day period could suggest shoppers plan to spend more during the entire holiday season than they did last year, even if only modestly.

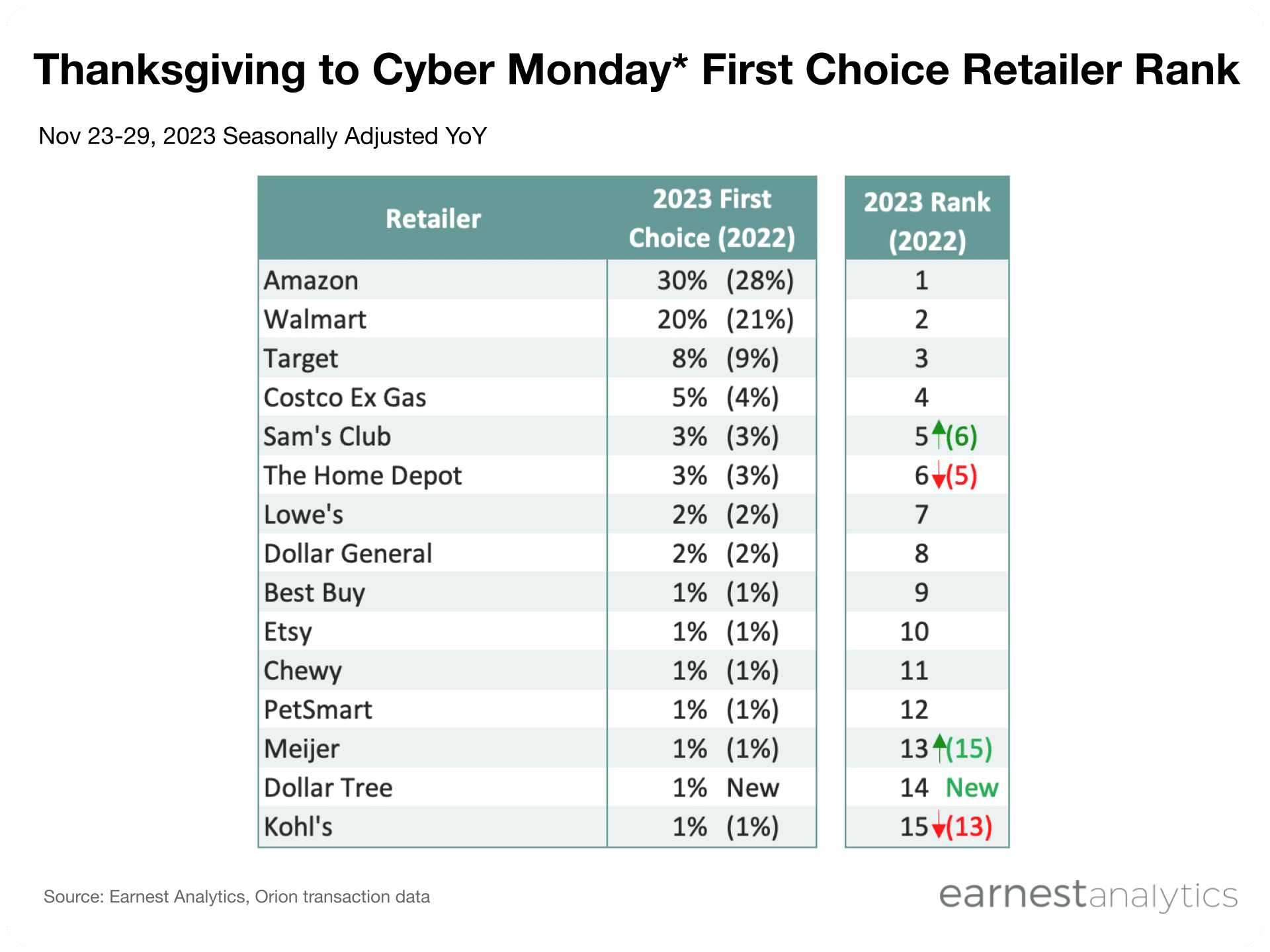

Amazon and Walmart were shoppers most preferred Cyber-5 Brands

*Data includes two days following Cyber Monday in order to include sales data for online purchases that are not billed until shipped in the following days. Historical numbers should be taken from the data presented because historic figures can shift as a result of panel adoption and churn. Contact Sales for more details.

Amazon retained its lead in the top wallet position, as measured by the number of shoppers’ who spent the most at that brand among over 1,000 major retailers between Thanksgiving and Cyber Monday. Amazon has held the position since unseating Walmart in 2019. The online retailer also gained two points of share, consolidating its lead as shoppers’ preferred retailer during Cyber-5. Target lost a point of share, while Costco (excluding gas purchases) and Dollar Tree gained share. Sam’s Club gained a spot in the rankings, while The Home Depot fell compared to 2022. Midwest big box retailer Meijer rose two ranks in 2023 to 13, as Kohl’s fell to 15. Brick-and-mortar discounter the Dollar Store is new to the list in 2023.

Sam’s Club gained a spot in the rankings, while The Home Depot fell compared to 2022. Midwest big box retailer Meijer rose two ranks in 2023 to 13, as Kohl’s fell to 15. Brick-and-mortar discounter the Dollar Store is new to the list in 2023.

Notes

Seasonal adjustment includes sales from 11/6/19 to 12/4/19, 11/4/20 to 12/2/20, 11/3/21 to 12/1/21, 11/2/22 to 11/30/22, and 11/1/23 to 11/29/23 to maintain an equal number of shopping days.

Track retail sales for free