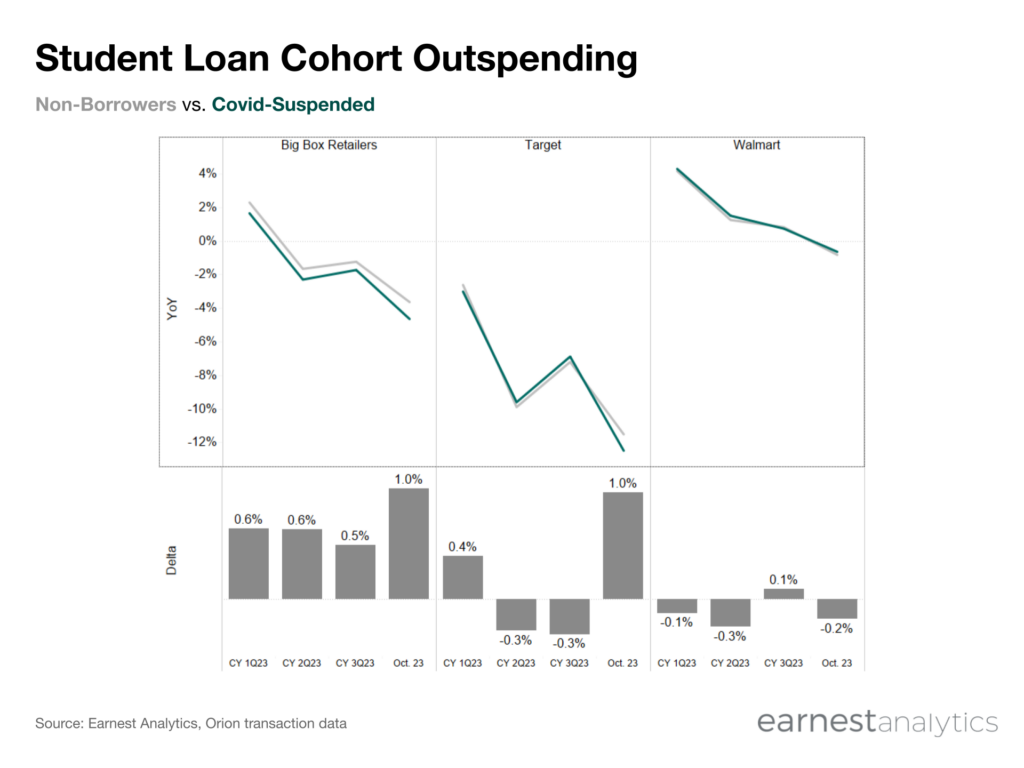

Big Box, especially Target, feeling negative impact of student loan payment resumption

Non-student loan borrowers outspent borrowers who previously took advantage of the now-expired payment pause (i.e. the Covid-Suspended cohort) by 100bps at Target and most Big Box Retailers in October, according to Earnest transaction data. Importantly, this borrower underperformance grew 130bps at Target and 50bps among all Big Box retailers from the end of CY 3Q23 to October. The wider spending gap comes after Target recently noted the resumption of student loan payments this October, among other macroeconomic factors, left households with less disposable income and forced them to make trade-offs.

Interestingly, Walmart spending trends remained relatively stable over the same period.

While consumer spending has remained rather resilient in 2023 despite multiple headwinds, the data indicates the end of the 3.5 year student loan payment moratorium may have already started to negatively impact spending levels.