Abercrombie’s young millennial strategy won the holiday shopping season

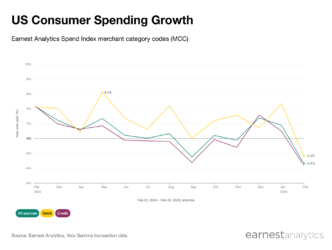

Access chart in Dash.

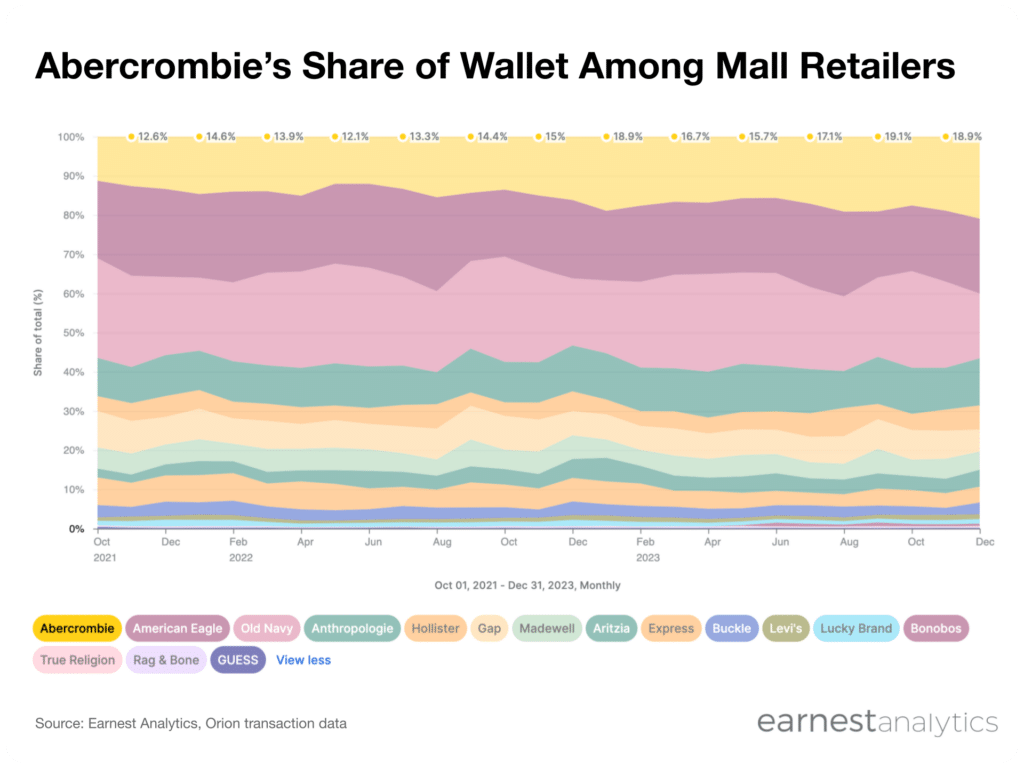

Abercrombie shoppers spent 1 in 5 of their mall dollars at the retailer in December 2023, up from 1 in 6 in December 2022 according to Earnest credit card data. Abercrombie outperformed other mall retailers by a wide margin during the holiday season, growing sales 10% YoY. The only major brands that outgrew Abercrombie were relative newcomers Shein and Temu. The key to Abercrombie’s success: growing its share of wallet among the right shopper.

As recently as 2021, Abercrombie was losing share of wallet among its own customers against the largest mall brands including American Eagle, Express, and Madewell. A series of turnaround efforts and a decision to shift their focus to younger millennials seems to be working. An August Earnest report showed that shoppers between 25 and 34 accounted for 45% of Abercrombie customers, up from 18% in 2017, with a decline in shoppers over 35–many of whom were parents shopping for teens. Management successfully repositioned the brand from “just another US mall-based teen retailer” dependent on teen allowances and parent spending, to one with broad appeal to an older and more affluent shopper buying for themselves. As this holiday season’s success suggests, Abercrombie may just have written the playbook on mall brand transformations.

Track General Apparel for free