Earnings by Earnest: 2Q 2019

Earnings by Earnest highlights recent examples of how Earnest tools tracked business health per management’s commentary on earnings results.

For 2Q 2019, we looked at Lululemon, Kirkland, Chico’s, and L Brands.

Lululemon 2Q 2019 | Earnings Call 09.05.2019

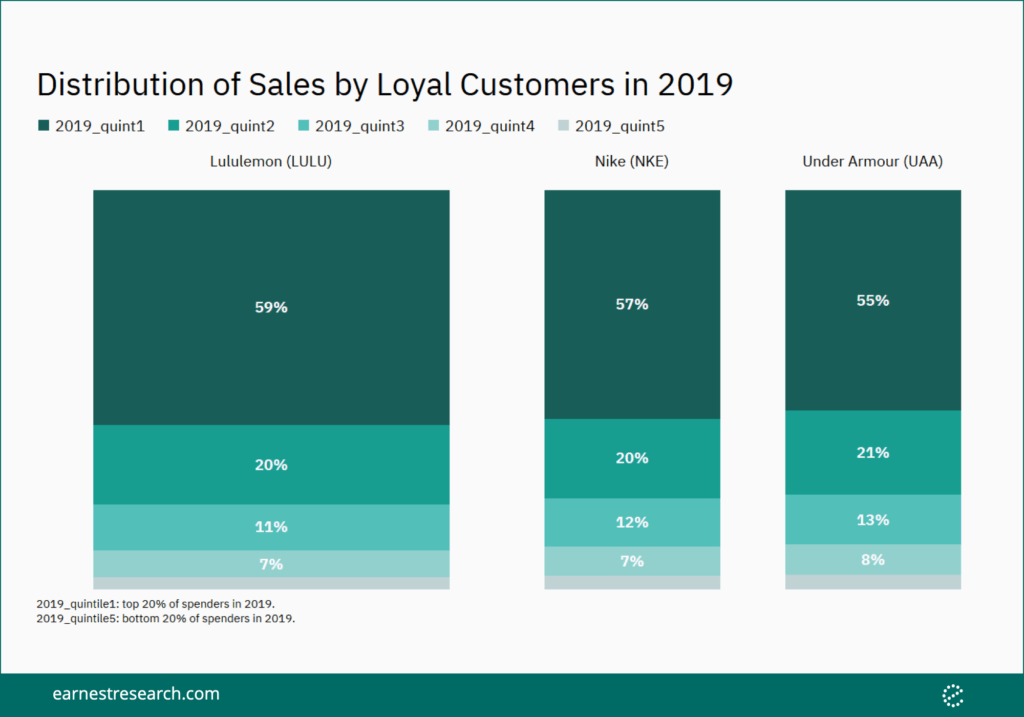

“We continue to see very healthy metrics with our loyal or our high-value guest, in terms of retention and engagement in the brand. Equally, our new guest acquisition remains very strong quarter-to-quarter and they are a big part of the conversion number that you’re seeing and we’re celebrating across both store and on e-commerce.” – Calvin McDonald, CEO

Earnest looked at all Lululemon customers from 2019 and followed the top quintile of the most loyal customers by spend. This cohort (20% of all customers) made up 59% of Lululemon sales in 2019. For comparison, Nike’s most loyal customers made up 57% of Nike 2019 sales and Under Armour’s most loyal customers made up 55% of Under Armour 2019 sales.

Earnest data reflects double-digit unique customer growth for the last six quarters.

Kirkland’s 2Q 2019 | Earnings Call 09.05.2019

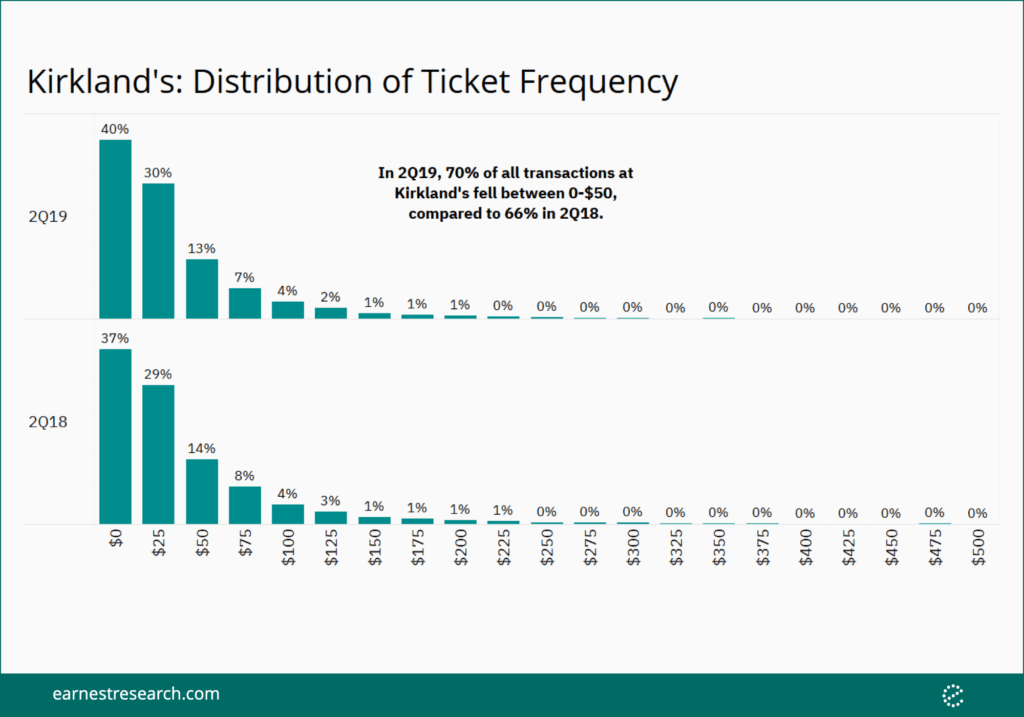

“Gross profit margin in Q2 decreased 530 basis points from the prior year to 22.2%. And that was primarily driven from de-leverage and store occupancy and distribution costs and a decline in merchandise margin…driven by a decrease in product margin from both product mix and incremental discounting.” – Nicole Strain, CFO

Earnest can track the distribution of ticket frequency as an insight into a company’s discounting trends. In 2Q19, 70% of all transactions at Kirkland’s fell between $0-$50, compared to 66% in 2Q18, corroborating management’s commentary regarding the incremental discounting.

Chico’s 2Q 2019 | Earnings Call 08.28.2019

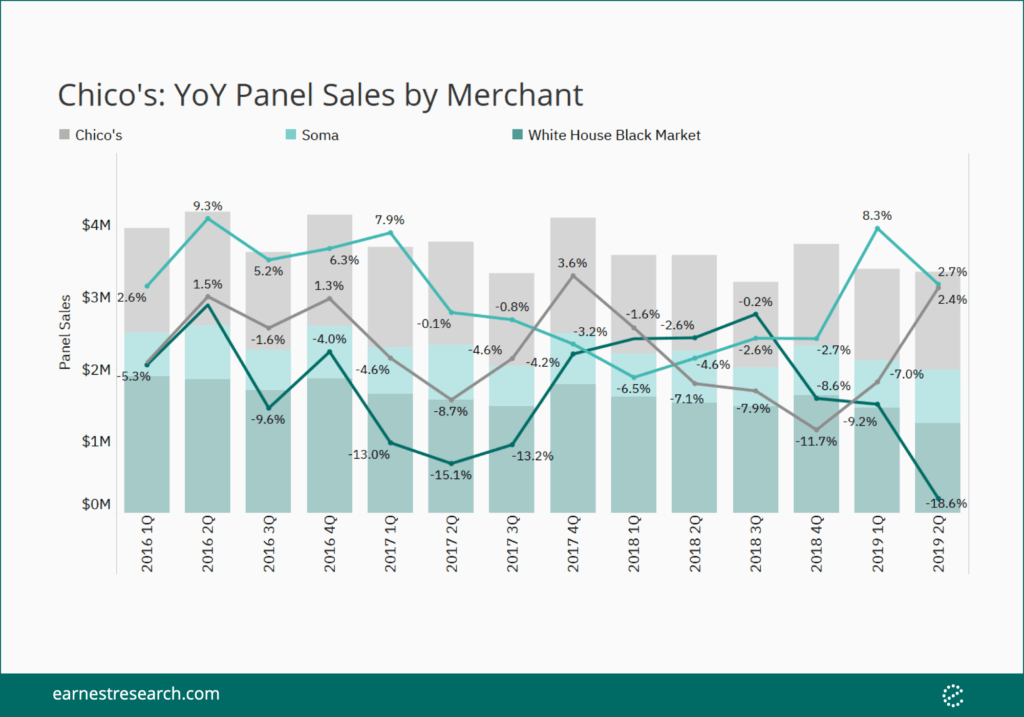

“Consolidated comparable sales improved over the first quarter, driven by sequential improvement in Chico’s and strong double-digit comparable sales at Soma… In contrast, the near-term challenges we identified in Q1 and discussed last quarter for White House Black Market also impacted our second quarter results with misses in print and color.”Bonnie Brooks – CEO & President

Earnest data tracked these trends well for 2Q, showing continued strong sales for Soma, sequential acceleration in Chico’s, and continued deceleration for White House Black Market.

L Brands 2Q 2019 | Earnings Call 08.21.2019

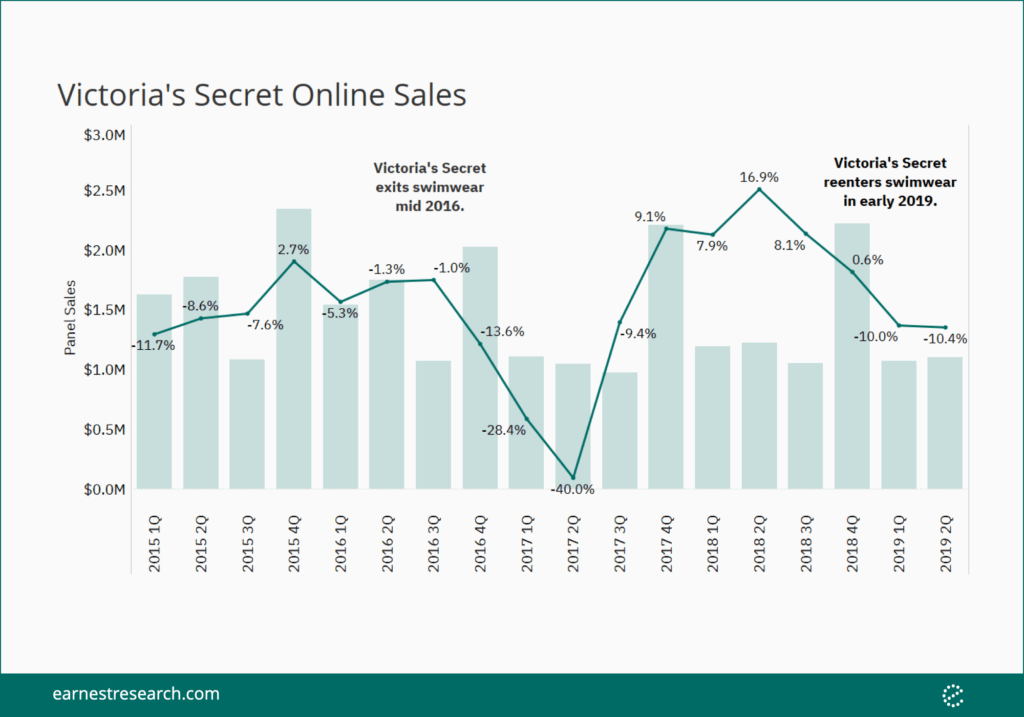

“We reentered the swim business this year. Our focus, as we’ve conveyed previously, is to pursue that business online… The most important thing we’ve done in the digital business is a project that we went live with, in the last few months, which was a full re-platforming of victoriassecret.com.” – Stuart Burgdoerfer, EVP and Chief Financial Officer

Earnest data tracked the decline in online sales following Victoria’s Secret’s (VS) exit from swimwear. Earnest panel sales do not yet show positive effects from VS reentering the swimwear market or the company’s revamped website.

For more details about this analysis or our EarnestQuery product, please schedule a demo or reach out to [email protected]