Mortgage payers outspent on home improvement, not furniture, in 2024

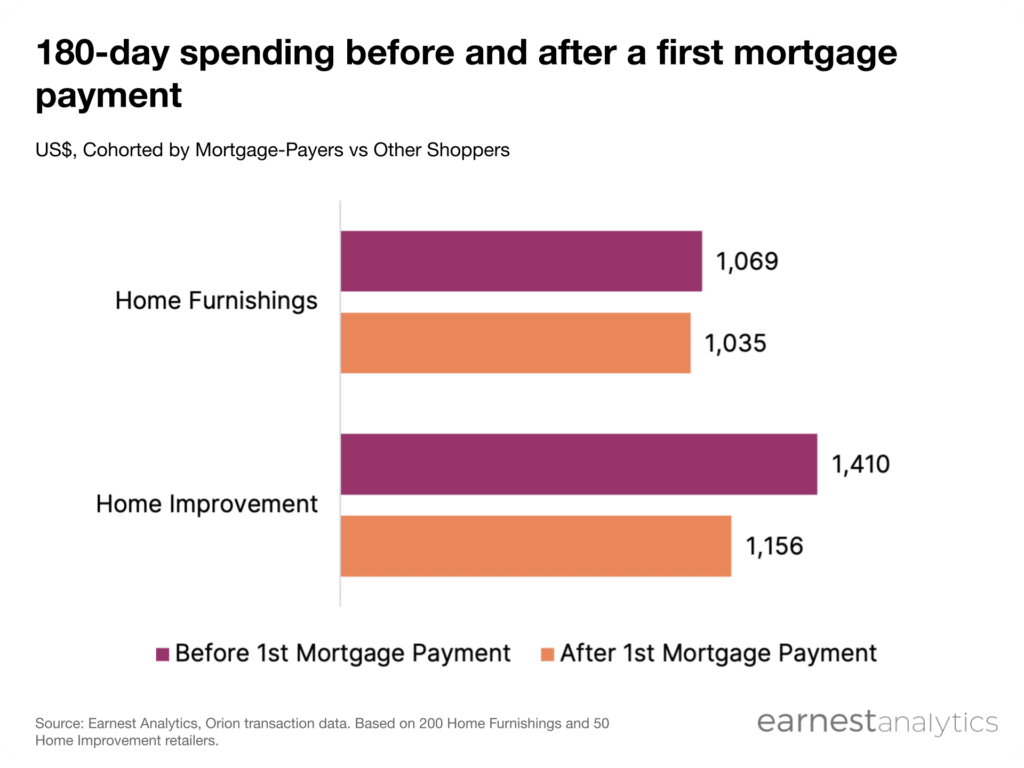

Future homeowners tend to spend more at home furnishings and improvement stores before their first mortgage payment

Home Improvement shoppers spend more in the 180 days before their first mortgage payment than in the 180 days after according to Earnest credit card data. Future homeowners spent $1,410 across major Home Improvement retailers in the 180 days before their first mortgage payment. The same cohort spent $1,156 in the 180 days after.

In contrast, Home Furnishings store shoppers spent only slightly more in the 180 days before their first mortgage payment. Future homeowners spent $1,069 across major Home Furnishings retailers 180 days before their first mortgage payment. The same cohort spent $1,035 in the 180 days after. This suggests that mortgage payments have an impact on shoppers’ home furnishings and improvement buying habits.

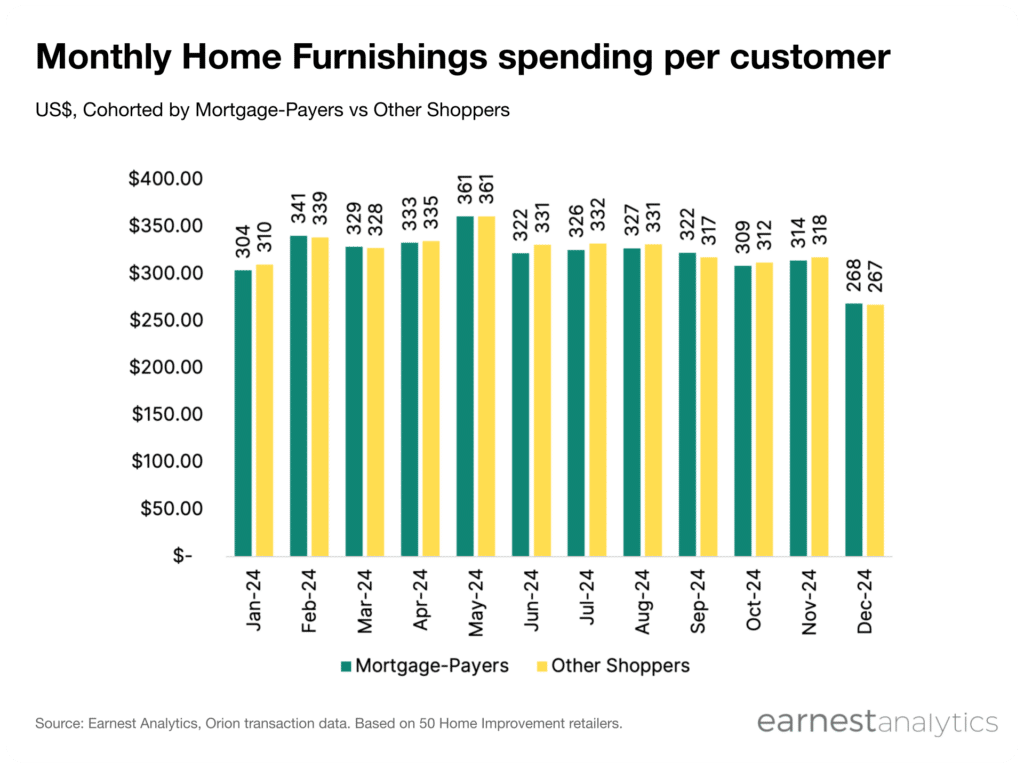

In the long-run, Mortgage-Payers and other shoppers spend similar amounts at home furnishings retailers

Mortgage-Payers do not spend meaningfully more per shopper than other shoppers at Home Furnishings stores. Of the roughly 40% of US adults who own homes, most spent between $260-$360 per month across major Home Furnishings stores in 2024. The peak months for spending are February and May. This could coincide with seasonal sales like President’s Day, and getting ready for summertime parties or moving.

The slowest month for Home Furnishings retailers across both cohorts is December, presumably when shoppers turn to other holiday categories. Nevertheless, the difference in spending between both cohorts is typically within a few dollars.

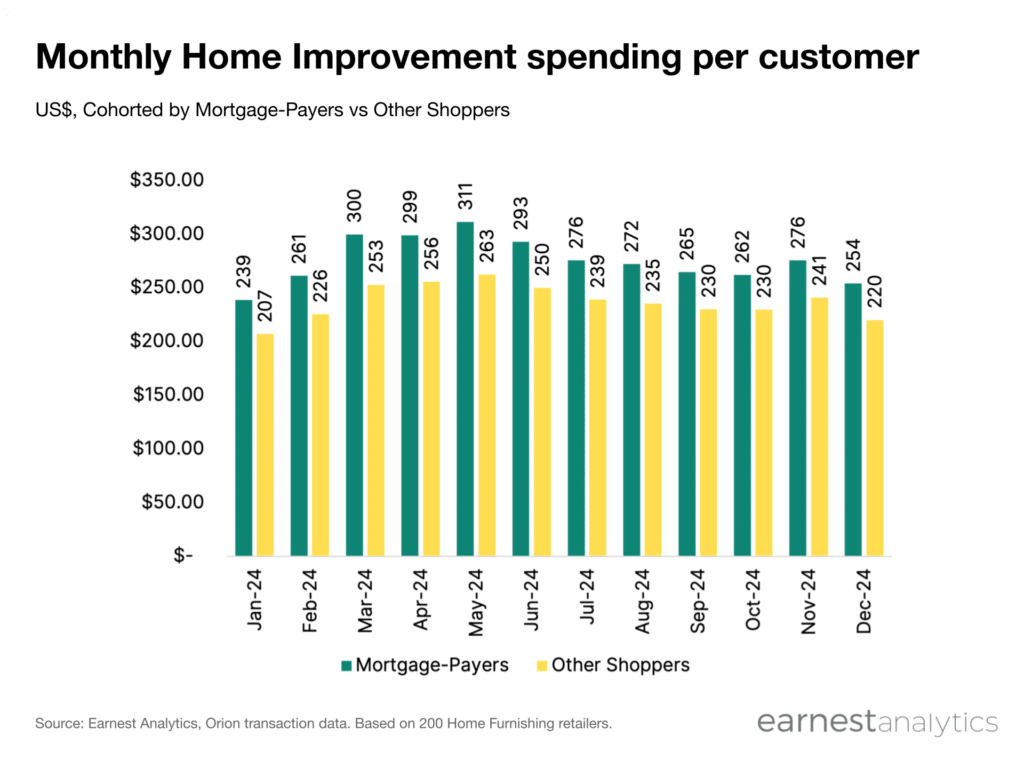

Mortgage-Payers can spend 20% more than other shoppers per month at Home Improvement stores

The biggest difference between Mortgage-Payers’ and other shoppers’ home spending is at Home Improvement stores. Mortgage-Payers regularly spent more than $50 more per month across major Home Improvement retailers in 2024. Similarly to Home Furnishings, Home Improvement store sales tend to peak around May. The slowest months are typically around the holidays.

The trend is logical as home owners and mortgage payers are more incentivized than other shoppers to maintain their dwellings. Still this data does not account for home owners who are no longer making mortgage payments. Actual spending differences between these two mortgage cohorts vary by brand.

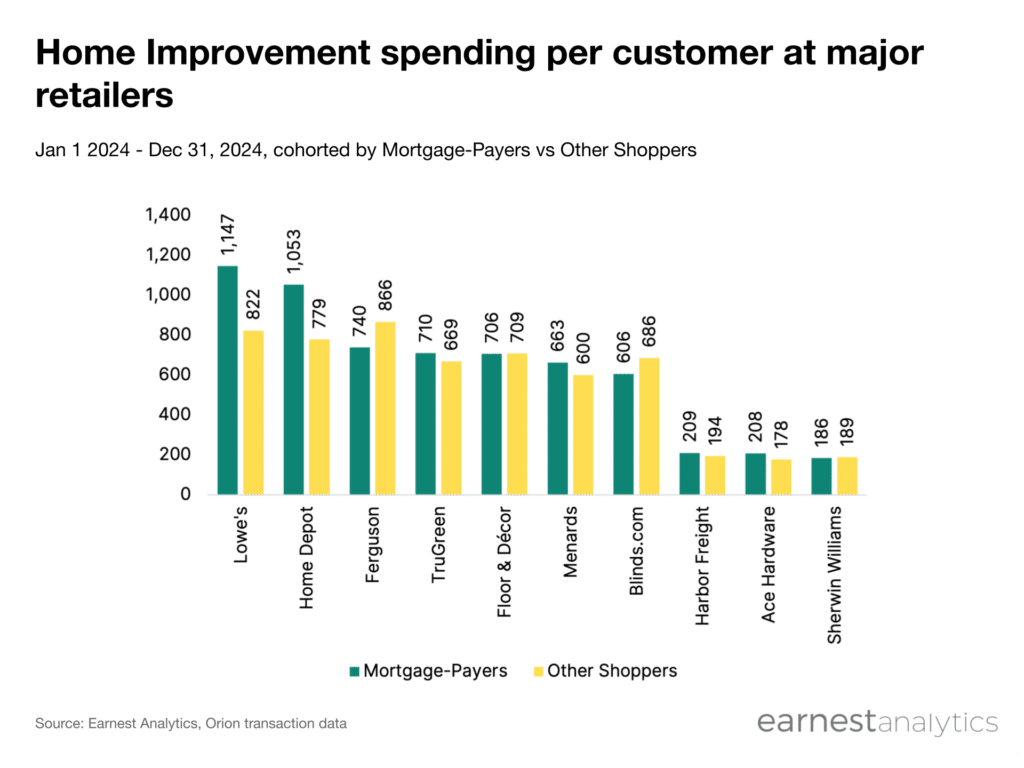

Mortgage payers spent more at Lowe’s and Home Depot

Mortgage-Payers spend more than other shoppers at many, but not all, Home Improvement retailers. This mortgage paying cohort outspent at Lowe’s (LOW), Home Depot (HD), TruGreen, Menards, Harbor Freight and Ace Hardware. However some brands like Ferguson (FERG), Floor & Decor (FND), Blinds.com, and Sherwin Williams (SHW) have similar or higher spending from other shoppers.

Customers without mortgages spend as much or more than Mortgage-Payers at many hardware and improvement retailers. This suggests other shoppers are still making capital improvements to their spaces, whether owned or rented.

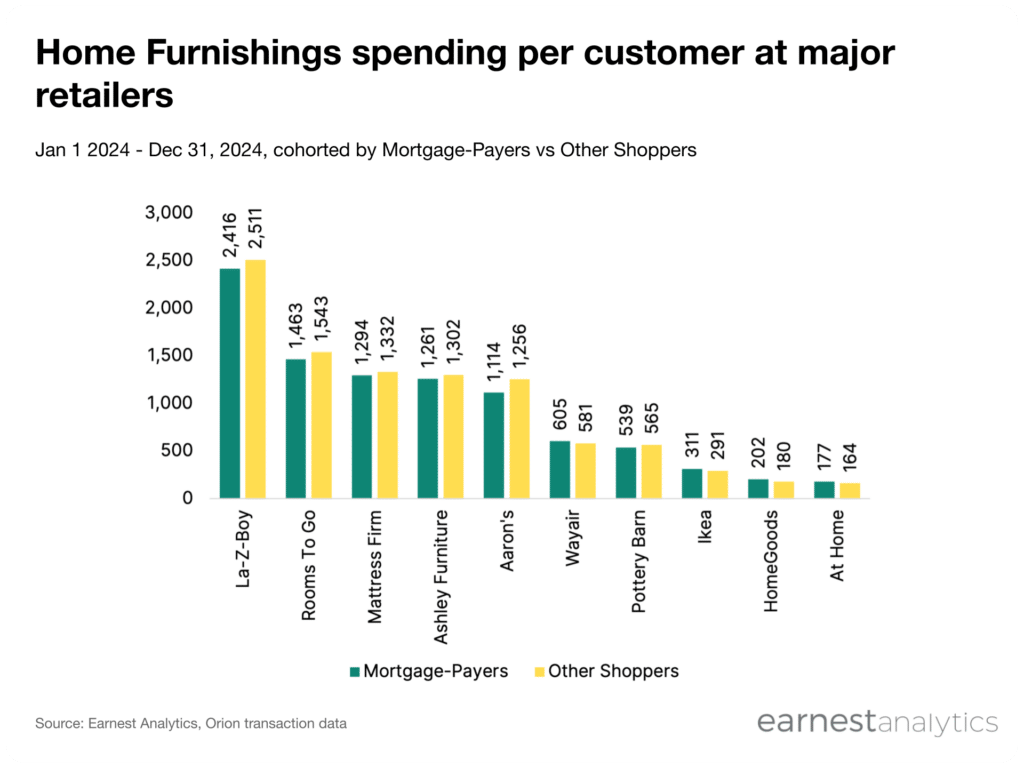

Mortgage payers spent less on average at furniture retailers

Interestingly, shoppers without mortgages spend slightly more at Home Furnishings retailers than Mortgage-Payers do. While this data does not quantify the contribution to sales by Mortgage-Payers vs other shoppers, it suggests shoppers without mortgages shopping for at furniture stores spend more on average. La-Z-Boy (LZB) customers without mortgage payments, for instance, spent $2,511 at the brand in 2024. Conversely, Mortgage-Payers spent $2,416.

This trend is repeated across some of the largest furniture brands and retailers in the US. The analysis includes Rooms To Go, Mattress Firm, Ashley Furniture, Pottery Barn, and Aaron’s. Only Wayfair, Ikea, HomeGoods and At Home have marginally higher average spending by Mortgage-Payers vs other shoppers.

This outperformance could be because shoppers without mortgage payments have more disposable income without down payments or maintenance expenses. Still, the data suggests furniture retailers should court both homeowners and non-owners to find growth.