Valentine’s Day flower sales could shift to FTD, other brands in 2025

1-800-Flowers still leads in US, FTD is gaining share

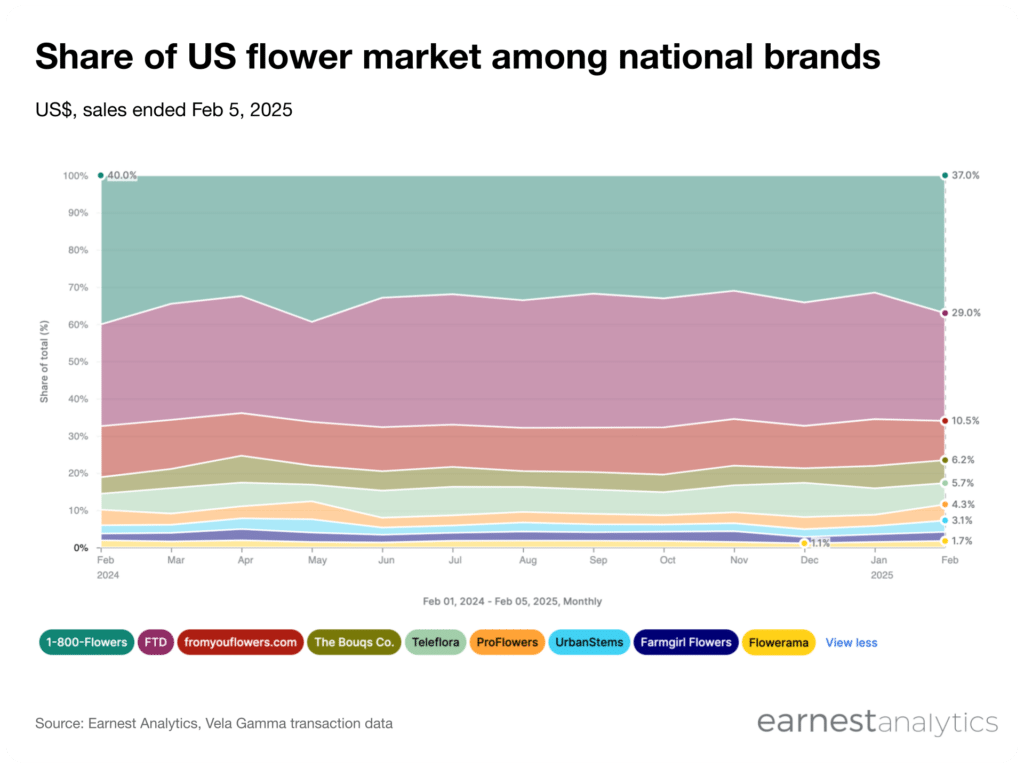

1-800-Flowers is the largest flower service by sales headed into Valentine’s Day 2025, according to Earnest credit card data. However, the industry stalwart is likely to lose share this season if recent trends continue.

1-800-Flowers commanded 37.0% of Valentine’s Day flower sales across flower services in the first five days of February 2025. This represents a 300-basis point decline from the full month of February 2024. The next largest flower service, FTD, controlled 29.0% of sales in the same period, up from 27.4% in 2024. Fromyouflowers.com is the third-largest player in the US flower space. The brand held 10.5% of the market in early February 2025,down from 13.7% in February 2024.

The Bouqs Co. was the fourth-largest at 6.2%. Bouqs was followed by Teleflora (5.7%), ProFlowers (4.3%), UrbanStems (3.1%), Farmgirl (2.5%), and Flowrama (1.7%).

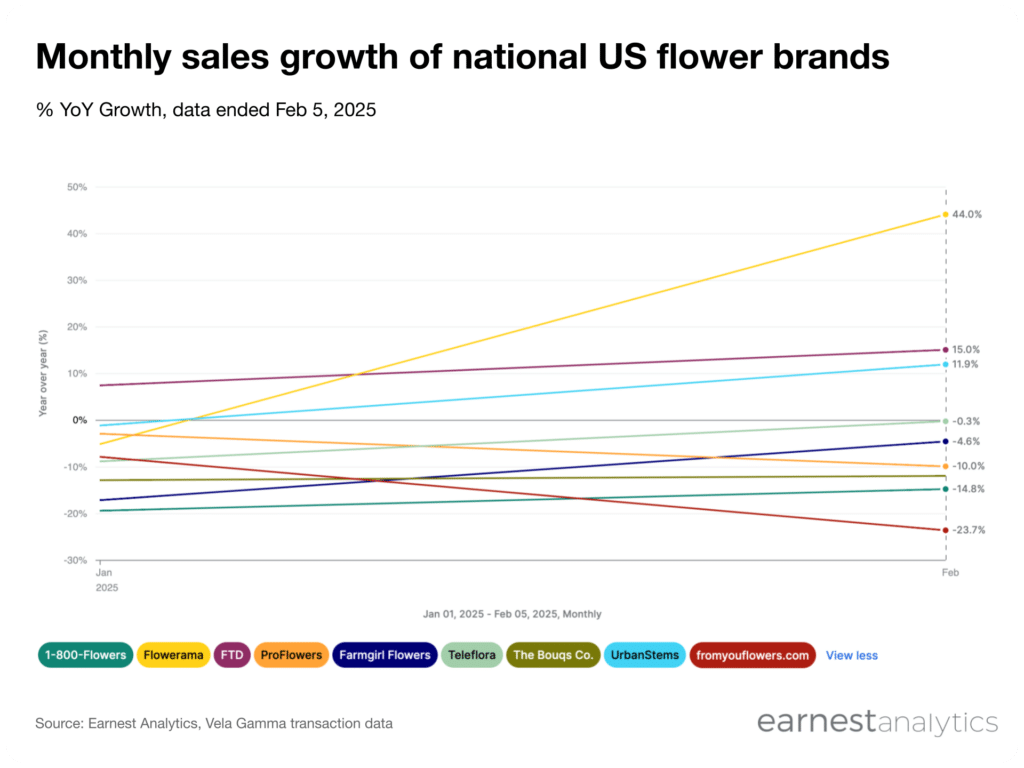

FTD, Flowerama are fastest-growing brands in 2025

The 1-800-Flowers-owned Flowerama brand is the fastest-growing brand so far in February 2025, up +44% YoY. However, FTD is the fastest-growing brand in 2025 YTD, up +8.7% YoY (see chart in Dash). FTD is also up 15% YoY so far in February, suggesting it is poised to gain share during Valentine’s Day.

UrbanStems was the third-fastest-growing flower company by sales so far in 2025. The brand grew 11.9% YoY in the first five days of February.

All other flower companies’ sales are at or below the prior year’s levels according to credit card data. Those include Teleflora (-0.3% YoY), Farmgirl Flowers (-4.6% YoY), Proflowers (-10% YoY), The Bouqs Company (-12% YoY), and Fromyouflowers.com (-23.7% YoY).

1-800-Flowers continue to fall mid-teens in 2025. The growth of its cousin brand Flowerama could offset some of 1-800-Flowers’ sales declines, though the brand remains much smaller.

Partnerships with third-party delivery services like Uber could also make 2025 Valentine’s Day flower sales data look weaker. However, Uber’s 1-800-Flowers partnership had not yet started as of the data presented ending February 5.

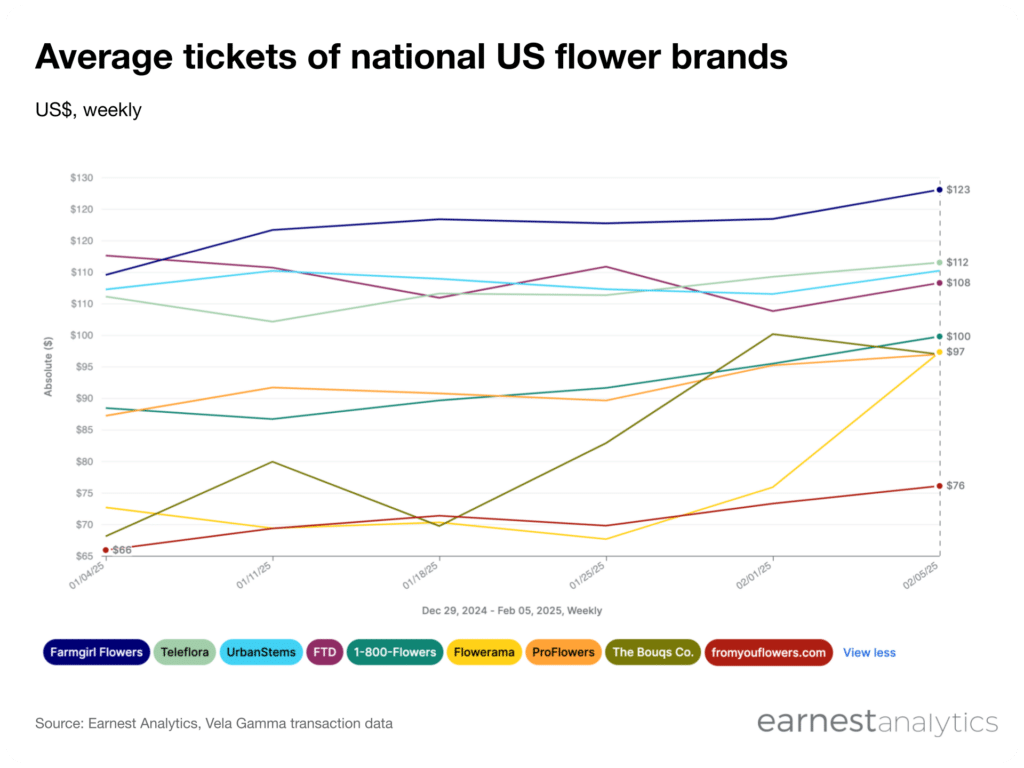

Farmgirl Flowers has highest average ticket, Flowerama and Bouqs increased most

Flowers from a large national brand will likely cost between $76 and $123 this Valentine’s Day according to credit card data. Average tickets were up around 6.2% YoY in the first week of February (see chart in Dash). However, price points vary widely across the industry.

Farmgirl Flowers remains the priciest option in 2025 YTD, with an average ticket of $123 in the first week of February. Teleflora ($112), UrbanStems ($110), and FTD ($108) follow as the next most expensive. 1-800-Flowers and FTD-owned ProFlowers both averaged about $100 in the first week of February.

Both Flowerama and The Bouq’s Co.’s average ticket increased the most in the lead up to Valentine’s Day. Customers spent under $73 per checkout the first week of January, and nearly $100 in the first week of February. Fromyouflowers.com remained the most affordable in the first week of February at $76.

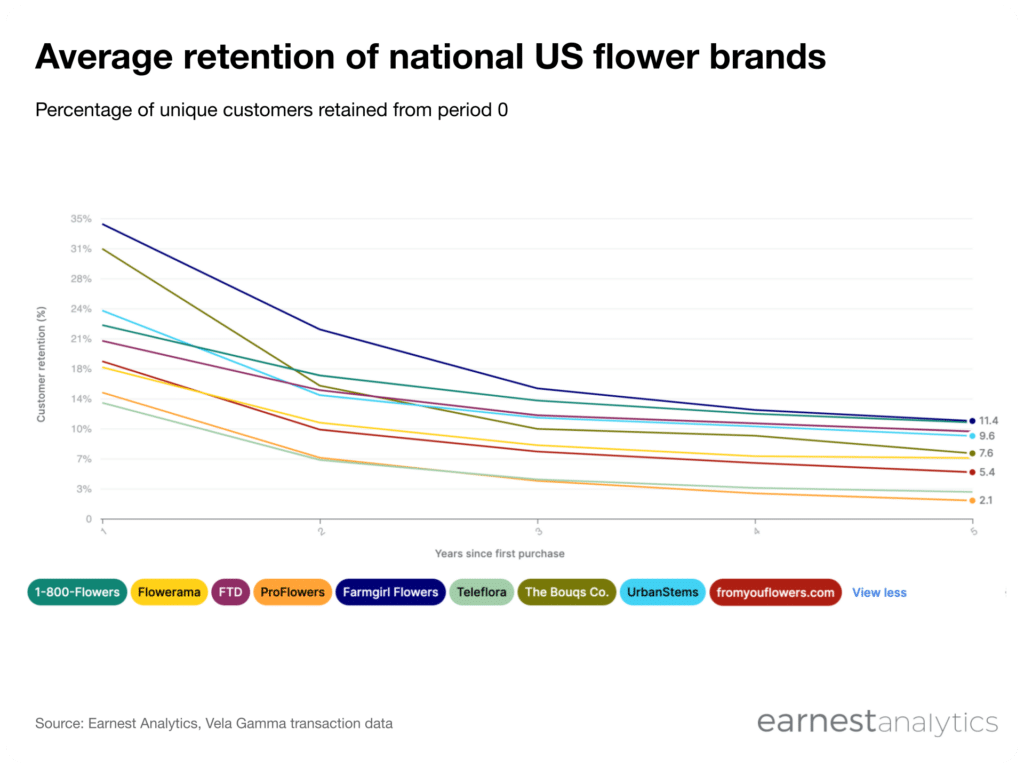

Farmgirl Flowers, Bouqs leads in short term retention

Flowers are not a high frequency purchase compared to other consumables. But some flower services have higher customer loyalty than others. Despite its high price point, Farmgirl Flowers leads retention. Around 34.3% of Farmgirl customers returned a year later and 11.4% 5 years later. The Bouqs Co. has the second highest annual retention, 31.5%, but the fifth highest five years out, 7.6%.

Fast-growing FTD’s retention is middle-of-the-pack in the short term, with 20.7% of customers returning a year later. Longer term however, its retention of 10.2% makes it a brand with the third highest loyalty.

ProFlowers and Teleflora have the lowest retention in both the long and short terms.

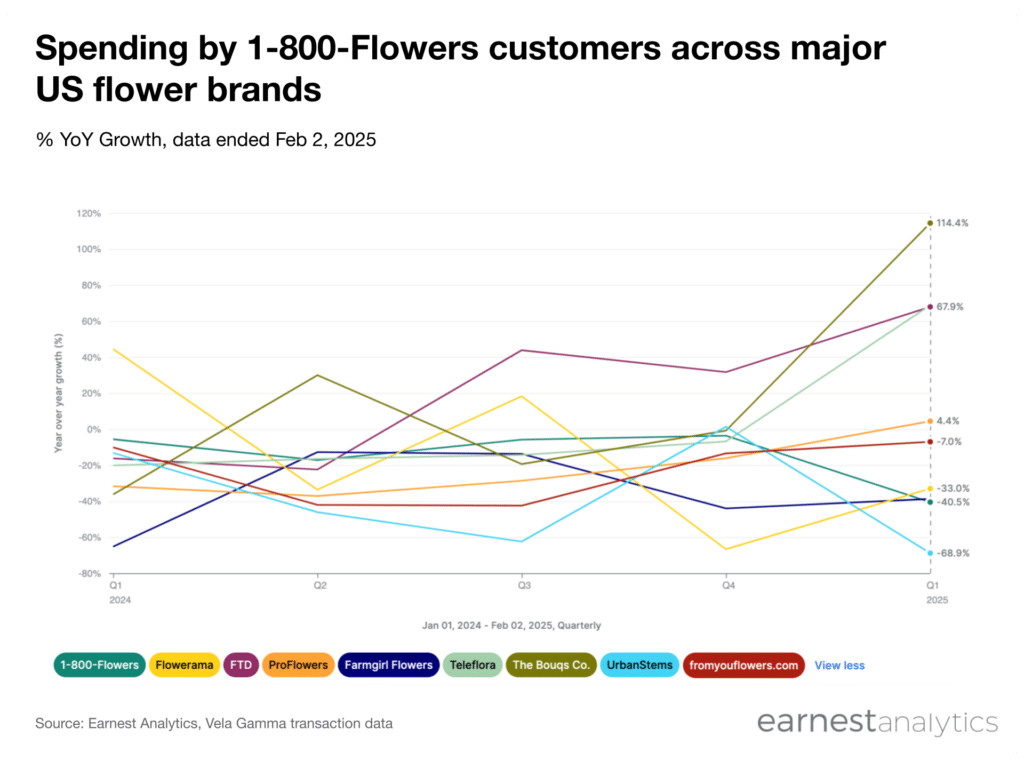

1-800-Flowers customers going to Bouqs, FTD, Teleflora

Despite being the largest flower service, 1-800-Flowers is losing market share. Its customers are increasingly shopping at other DTC services according to Earnest credit card data. 1-800-Flowers customers spent 114.4% YoY more at The Bouqs Co. so far in the first quarter of 2025. They also spent 68% more at FTD and Teleflora during the same period.

Meanwhile, 1-800-Flowers customers spent 40% less YoY at 1-800-Flowers itself. Valentine’s Day flower sales so far in 2025 show a marked shift towards FTD and other DTC brands–even if some of those brands are struggling to surpass 2024 sales figures during Valentine’s Day.