FanDuel, DraftKings on top, BetMGM may win share headed into Super Bowl

The number of sports betters grew 18.6% YoY in January 2025 according to Earnest debit and credit card data (see chart in Dash). Sustained user growth and broadening legalization could make 2025 the biggest year yet for Super Bowl sports betting. However, not all betting platforms are set to benefit equally from the event.

FanDuel, DraftKings top sports betting site during Super Bowl

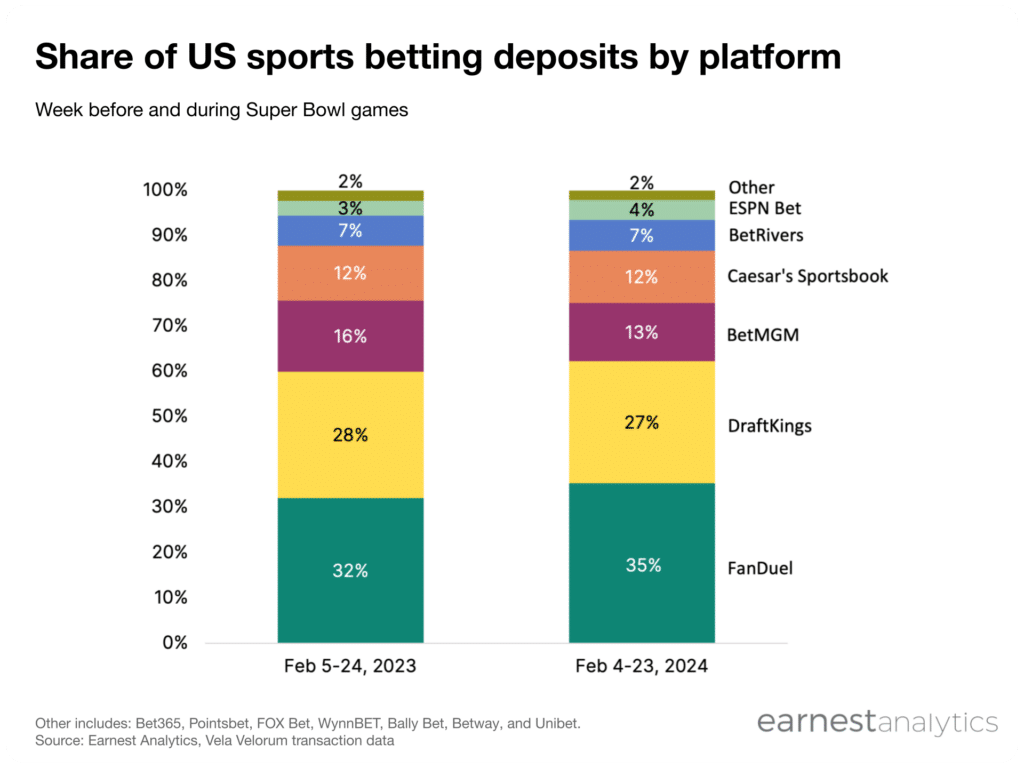

Evidence from debit and credit card market share data points to a consolidation of betting on Super Bowl into FanDuel and DraftKings.

FanDuel (FLUT) expanded its market lead by total dollars deposited onto the platform from the 2023 to 2024 Super Bowl seasons. The platform commanded 35% of all sports betting dollars in 2024, up from 32% the year before. DraftKings (DKNG) is the next largest platform by deposits during the Super Bowl, at 27% in 2024 and 28% in 2023.

BetMGM (MGM) lost 3 points of share, ending the 2024 Super Bowl season with 13% of betting dollars. Caesar’s Sportsbook (CZR, 12%) and BetRivers (7%) were flat during the same period. ESPN Bet grew its share slightly from 3% to 4%, while other small platforms maintained their combined share.

VGW, FanDuel users growing fastest headed into Super Bowl

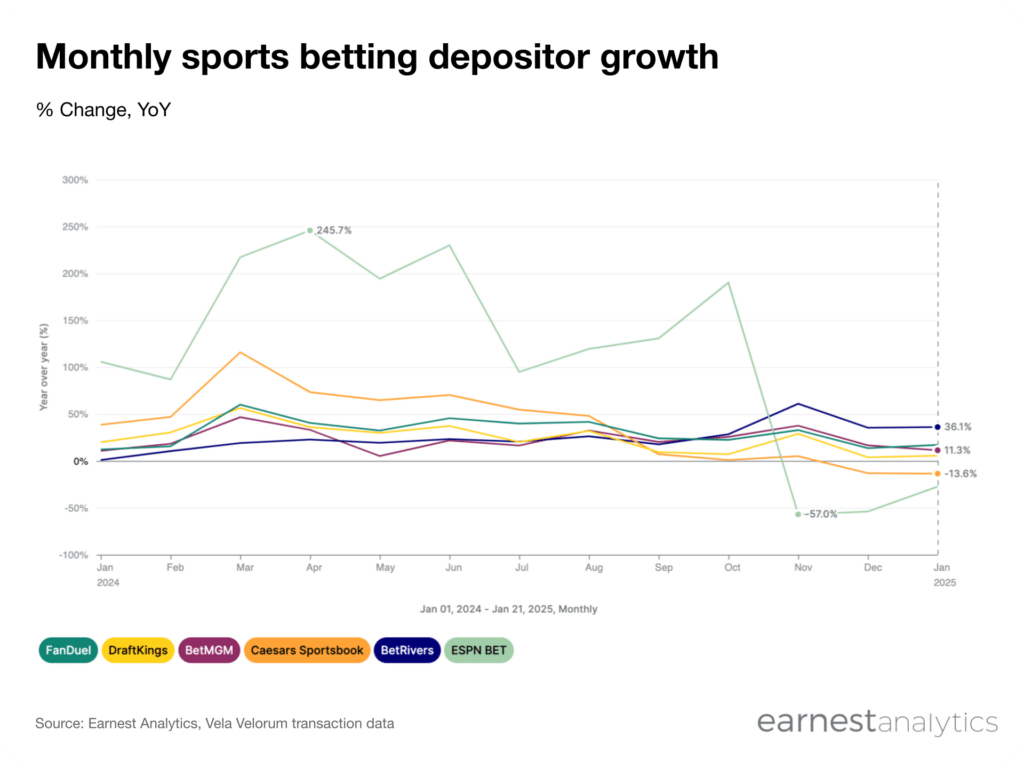

Sustained customer growth headed into the Super Bowl suggests a platform could pick up share of sports betting dollars. So far in January 2025, BetRivers (+36.1% YoY) and FanDuel (+16.1% YoY) are the fastest growing.

The next fastest growing platforms by monthly depositor growth are BetGM (+9.5 YoY) and DraftKings (+4.8% YoY).

ESPN Bet and Caesar’s Sportsbook were first and third fastest growing platforms by monthly depositors during the 2024 season. Both topped 86% YoY and 47% YoY growth in February 2024, respectively. However, monthly depositor growth decelerated faster on the two platforms over the last 12 months than at other platforms.

Falling monthly depositors in December 2024 and January 2025 suggest Caesars Sportsbook and ESPN Bet could lose Super Bowl share.

BetRivers, BetMGM could pick up Super Bowl sports betting share in 2025

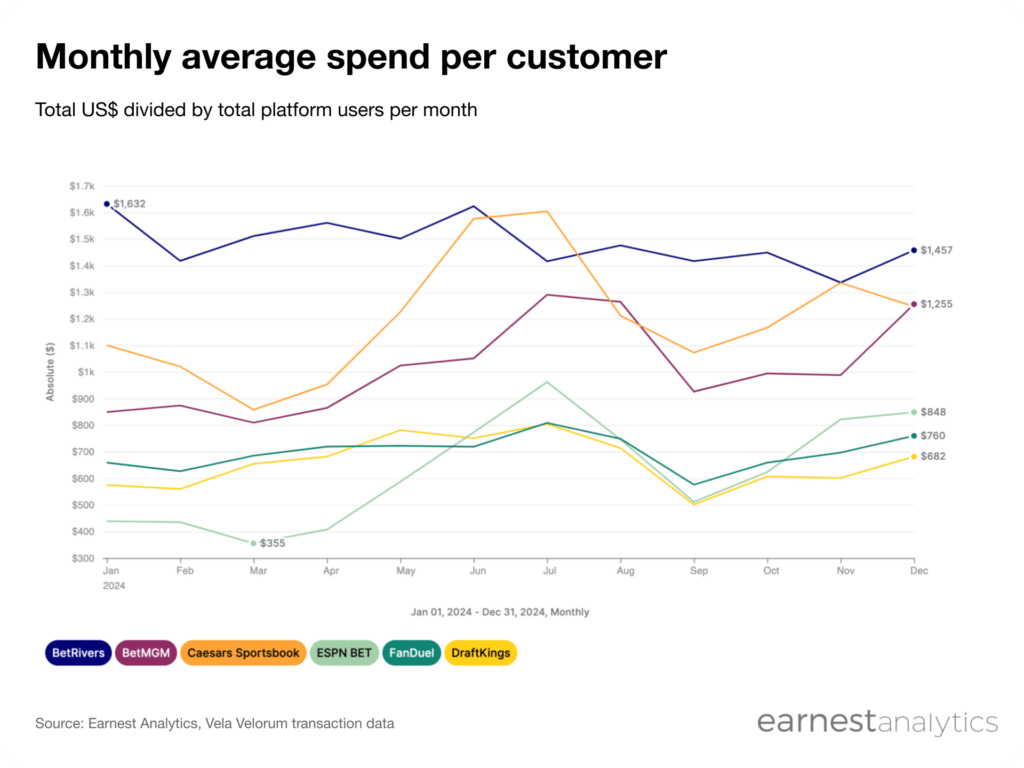

The highest platform by monthly average spending per customer is BetRivers at $1,457 dollars spent per user per month in December 2024. This high average spending combined with healthy depositor growth could point to the platform gaining share this Super Bowl season.

BetMGM is the next highest with $1,255 average dollars deposited in December 2024. The platform also has strong customer growth suggesting it could win share in 2025.

The third highest platform is Caesar’s Sportsbook, at $1,245 in December. But that platform’s overall slow depositor growth means it is less likely to gain share in the 2025 Super Bowl season.

FanDuel, DraftKings, and ESPN Bet average monthly spend per customer are all between $400 and $900. They are also flat or roughly in line with year ago levels.

Over 16% of sports bets made by credit card in 2024 Super Bowl season

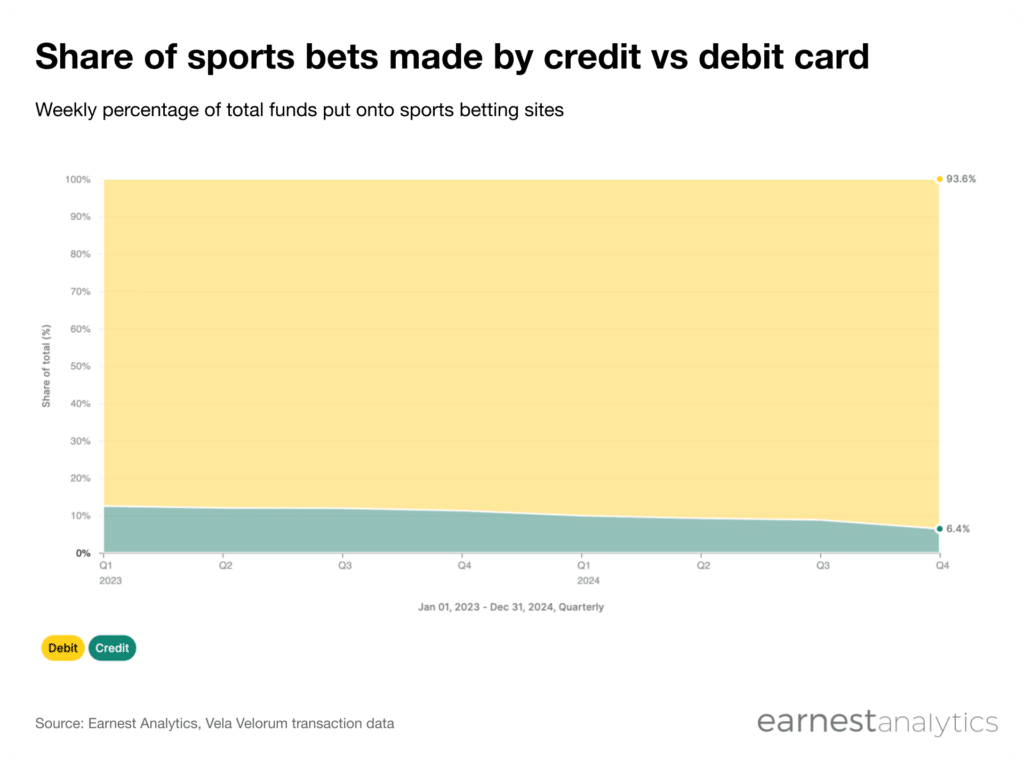

Unlike many state lotteries or casinos, sports betters are able to use credit cards to place bets. According to Earnest credit and debit card data, over 6% of sports bets were placed using a credit card in the fourth quarter of 2024.

The overall percentage of credit card sourced bets has fallen over the past 12 months. Around 10% of sports betting dollars were placed by credit card in the second quarter of 2024. But credit cards still represent a major source of betting dollars. This suggests that platform users could be taking on debt as they venture into sports betting.

Track betting and gambling data for free