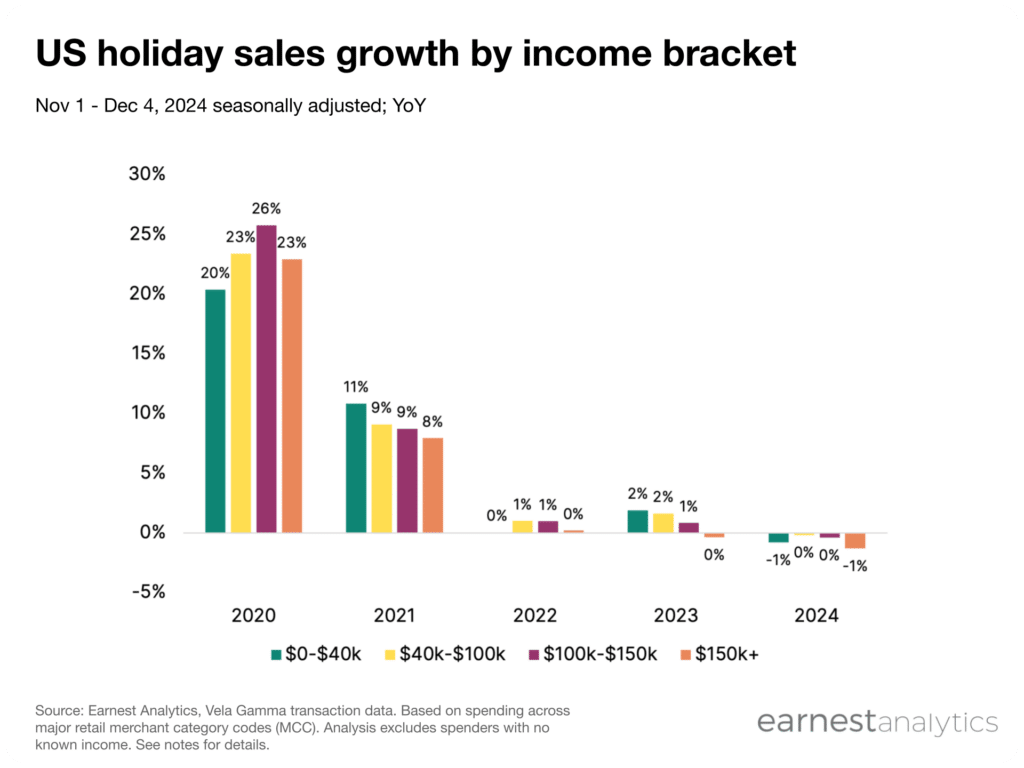

High income shoppers pull back in 2024 holiday season

High income earners are pulling back in 2024

Holiday spending was flat for earners making between $40k-$150k so far in 2024 (see chart notes for details). The lowest and highest earners, below $40k and over $150k, both declined around 1% YoY.

High income shoppers spending less is in-line with recent trends. Shoppers making over $150k have been the slowest growing cohort of holiday shoppers every year since 2021. However, lower income shopper spending decelerated the most, which is a reversal from last year. Shoppers making under $40k outperformed all other cohorts by this time in the 2023 holiday season. This decline could also be attributed to the mix of companies offering promotions in the early season. Download report for details.

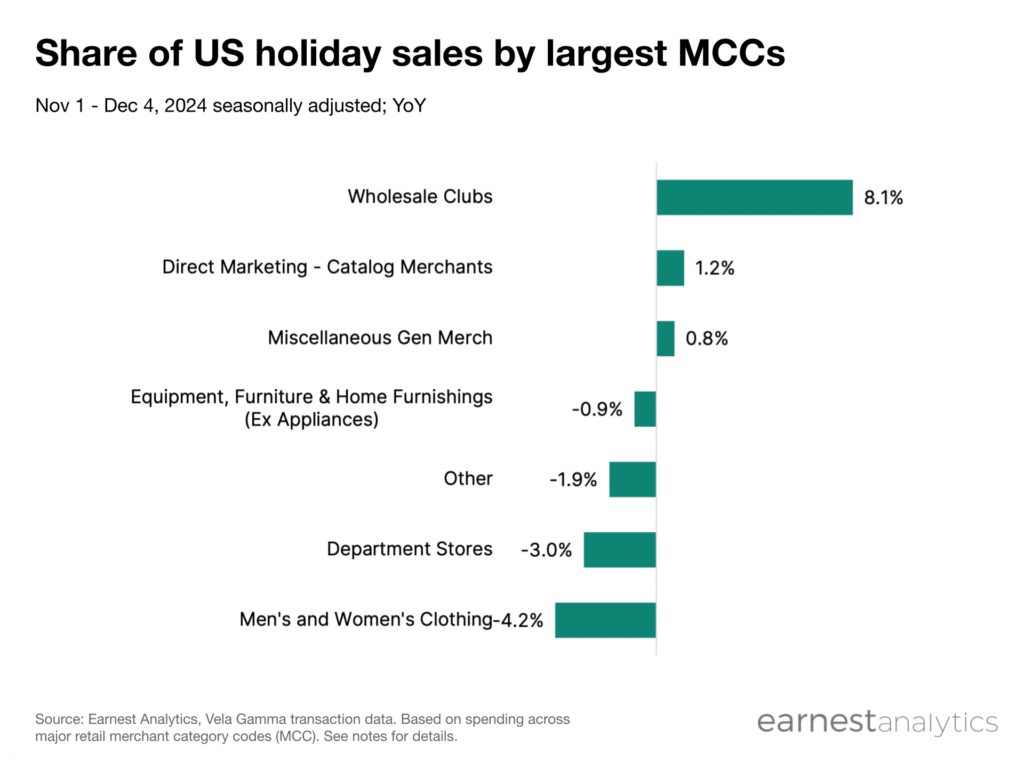

Wholesale clubs pull ahead, apparel struggles

Wholesale Clubs, Direct Marketing (ecommerce), and General Merchandise categories drove almost all the growth in the 2024 holiday season so far. The 8.1% growth could also be attributed to non-holiday spending in states impacted by Hurricanes Milton and Helene.

Direct Marketing (mostly ecommerce) grew 1.2% roughly halfway through the holiday shopping period. General Merchandise grew 0.8% YoY. Home, Department Stores, and Men and Women’s clothing all lost sales compared to 2023.

Online shopping continued to expand its share of holiday spending this year. Consumers spent 22.2% of their holiday wallet in the Direct Marketing – Catalog Merchants MCC between November 1st and December 4th. The category includes Amazon and Temu. This is up from 11.6% in 2016 when the data began. Download report for details.

Miscellaneous General Merchandise including Walmart and Target controlled 17.8% of spending, down from 19.0% in 2016. Wholesale Clubs had 9.9% of consumers’ holiday spending wallets, up from 6.7% 8 years ago. Download report for details.

Department Stores and Home stores continued to decline in share of holiday spending since data began. Both controlled 6.2%, and 5.4% of the 2024 prelim period, down from 9.5% and 6.4%, respectively. Other smaller MCCs also further declined in 2024 as large retailers in the above categories continue to consolidate spending. Download report for details.

Download 2024 mid-holiday spending report