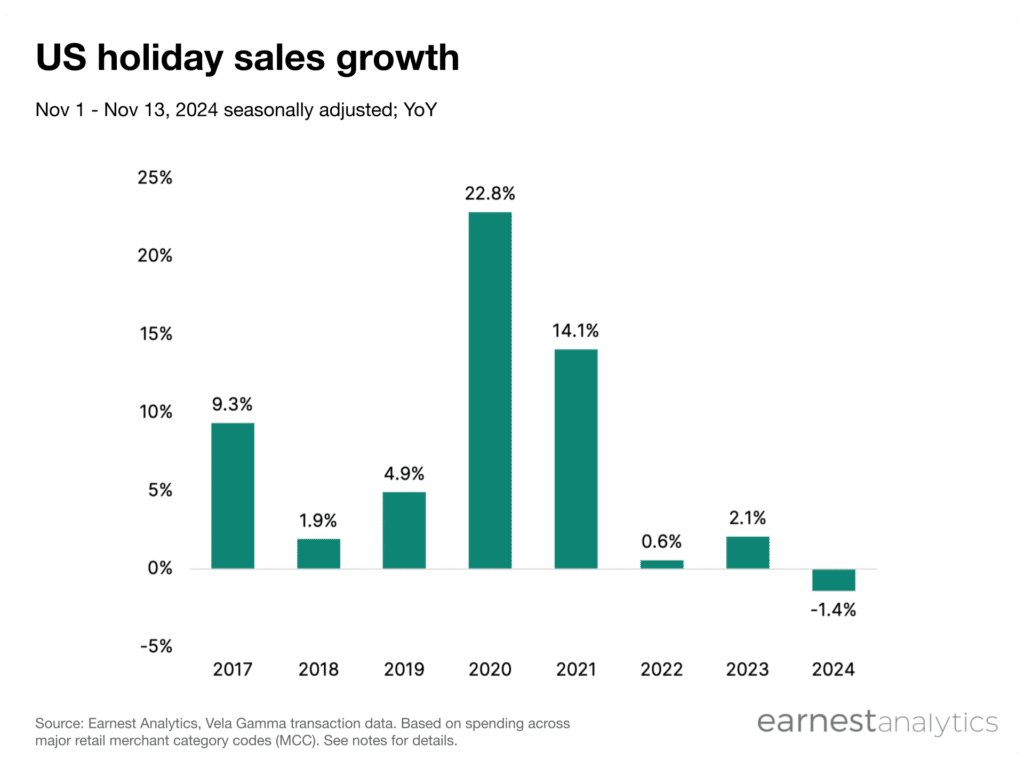

Early holiday spend falls compared to 2023 after early promotions

Early holiday spend is already down, but it could be due to October sales

Holiday consumer spending is down 1.4% this season compared to 2023 according to Earnest credit card data. Spending from Nov 1-13 shows that holiday consumer spending is slowing compared to the same period in recent years.

Slow spending growth in the early holiday period could be the result of lapping more difficult early period comps. Retailers began holiday promotions earlier during the pandemic to account for longer delivery times as more customers bought online. Many retailers continued to move their holiday promotions earlier and earlier in recent years. The resulting promotions likely pulled sales forward into October from the traditional start to holiday shopping in early November.

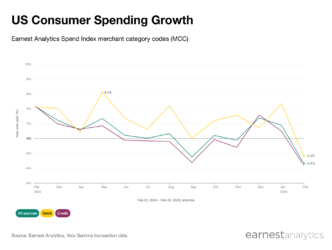

Slower spending could also signal slower overall growth this season, which will have fewer days than most. Consumers spent less across dozens of retail merchant category codes (MCCs), but some value-oriented merchants are seeing meaningful growth.

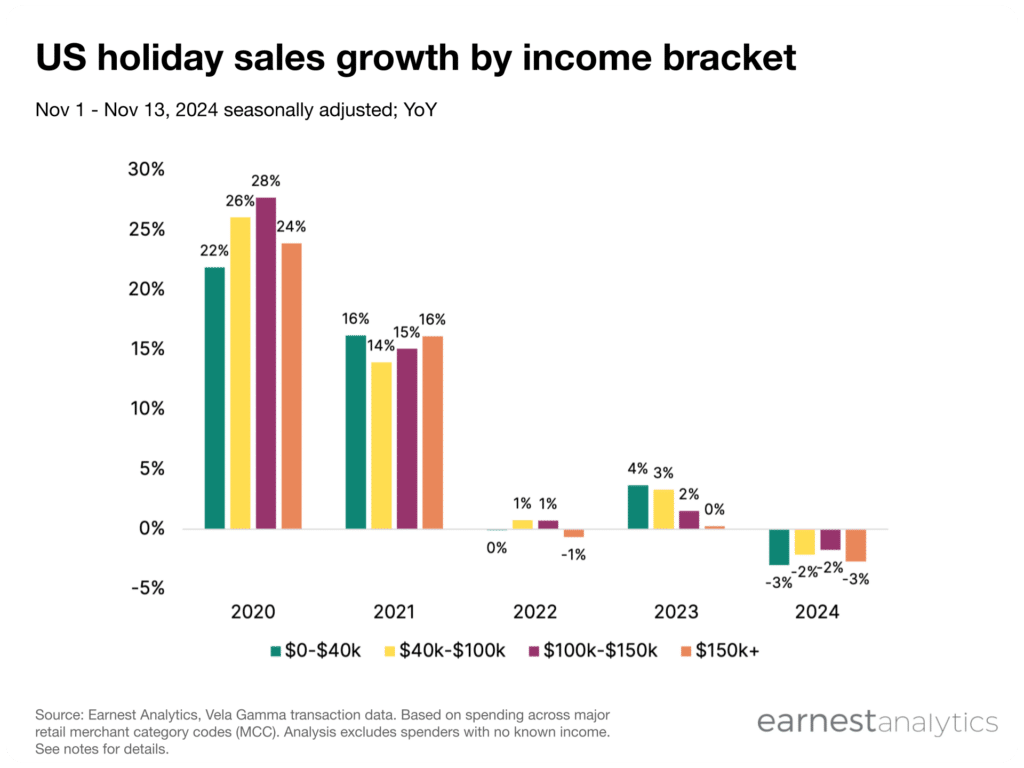

Spending declined across income groups

Holiday spending growth fell among shoppers regardless of their income so far in 2024 (see chart notes for details). The lowest and highest earners, below $40k and over $150k, both declined 3% YoY. Middle income earners from $40k-$150k spent approximately 2% less YoY.

This slowdown is in contrast to 2023, when the lowest income earners increased their spending more than any group. This decline could also be attributed to the mix of companies offering promotions in the early season. Holiday spending during Amazon’s October sale for example could have pulled forward demand from the holiday period beginning Nov 1.

Wholesale Clubs outperforming other retailers so far

Consumers’ holiday spending at Wholesale Clubs outgrew the next five largest MCCs by sales so far in 2024. The 8.1% growth could also be attributed to non-holiday spending in states impacted by Hurricanes Milton and Helene.

Direct Marketing (mostly ecommerce) grew 1.5% in the first 13 days of the holiday shopping period. General Merchandise, Department Stores, Home, and Men and Women’s clothing all lost sales compared to 2023.

Download full holiday report