Grubhub’s market share fell to 6% before Wonder acquisition

Grubhub market share shrunk to 6% nationally

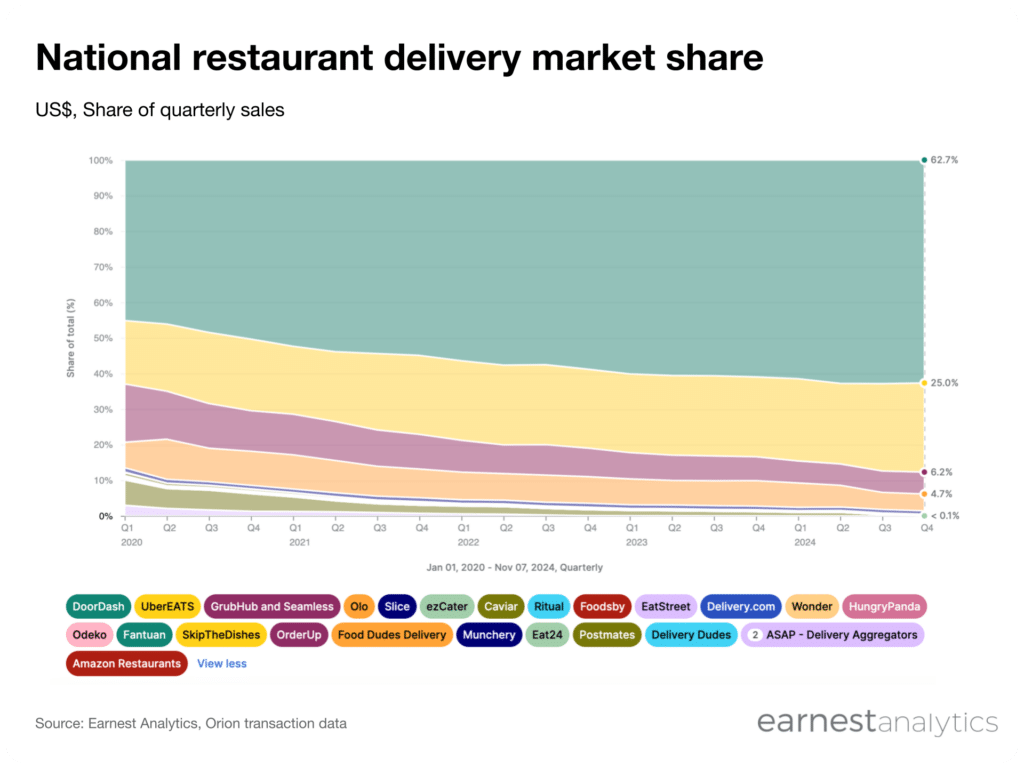

Headed into the pandemic, Grubhub’s market share, including Seamless, was 16.7% according to Earnest credit card data. The same year, Uber bought Postmates, further expanding its already rapidly growing market share.

Nevertheless, DoorDash ultimately widened its national market share lead among restaurant delivery companies. The Y-Combinator and SoftBank-backed company leveraged its significant funding to gain share through promotions and retention initiatives, despite losses.

As of November, DoorDash commands 62.7% of the delivery market nationally, followed by UberEats (25%) and Grubhub (6.2%). Grubhub’s share loss could help explain its sale to Wonder for a fraction of its 2020 valuation and recent layoffs.

Industry-wide, a series of recent wage hikes for gig workers is putting further pressure on restaurant delivery companies.

DoorDash gains control of NYC’s restaurant delivery market

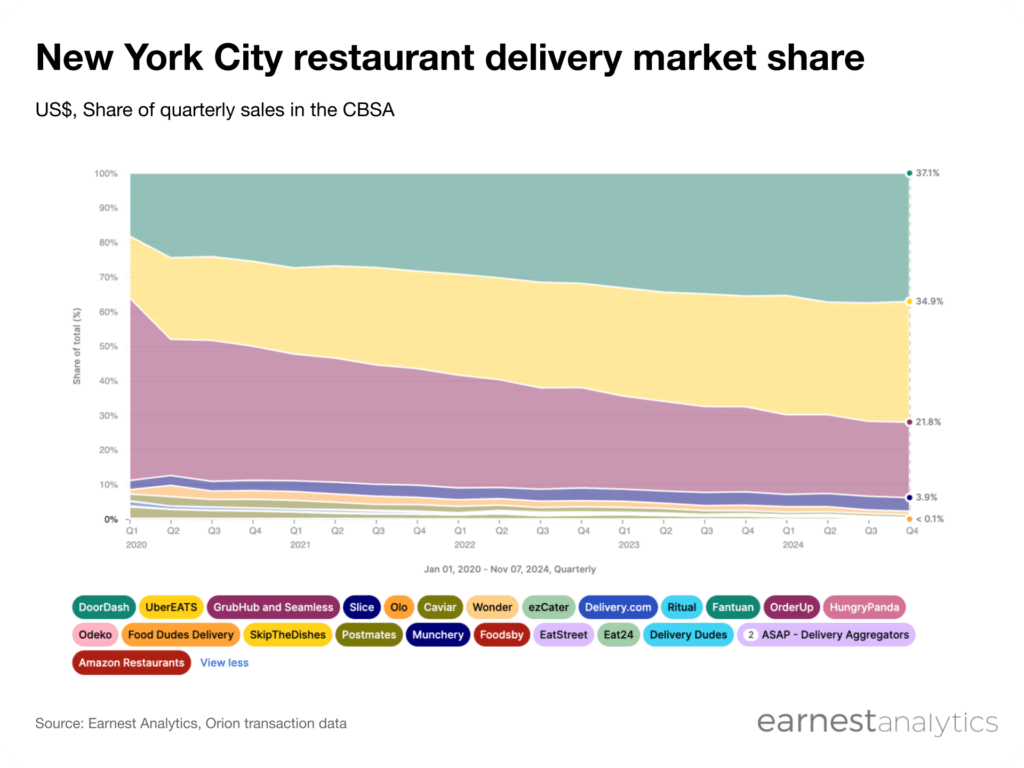

Despite DoorDash’s market share lead nationally, competition remains stiff in the largest US delivery market. DoorDash (37.1%) and UberEats (34.9%) are neck-and-neck in New York City as 2024 comes to a close. Grubhub (21.8%) follows closely, likely benefiting from its legacy Seamless brand, which helped popularize office lunch delivery.

Beyond restaurant delivery, Wonder operates ghost kitchens and food halls in New York, New Jersey, Pennsylvania, Rhode Island, and Connecticut. Wonder offers food from various partner chefs and restaurants at its locations. These food halls offer pickup, delivery, or dine-in, in contrast to the delivery-only models of most restaurant delivery services.

Wonder’s Grubhub acquisition makes it the third largest player in the New York City restaurant delivery market.

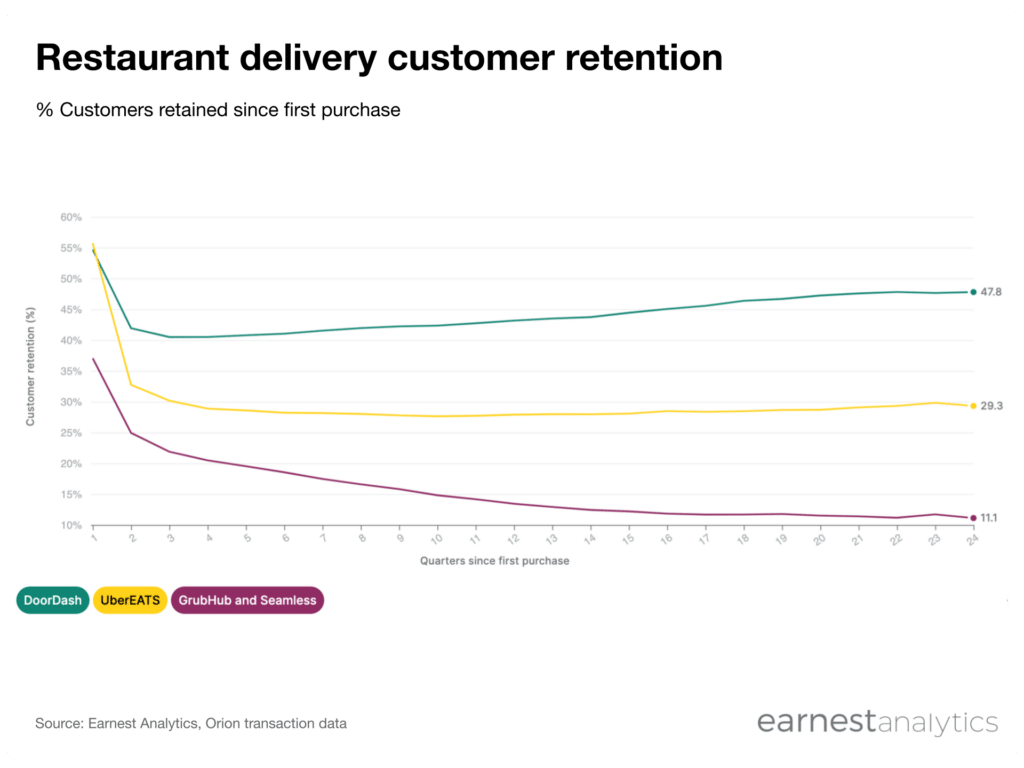

DoorDash leads in restaurant delivery customer retention

From early on, DoorDash outpaced its rivals in customer retention. Over 47% of DoorDash customers return in the long-term, according to Earnest credit card data. This is nearly double UberEats’ long-term retention rate of 29%.

Both services retain customers at much higher rates than Grubhub, which keeps 11% of its customers in the long-term. Wonder’s acquisition could bring new customers to the platform and increase retention by leveraging its in-store eaters.

Track restaurant delivery spending for free