McDonald’s CosMc’s locations resonate with drive-thru customers, take business from Sonic, Starbucks, and Chick-fil-A

CosMc’s customers most likely eat at Sonic

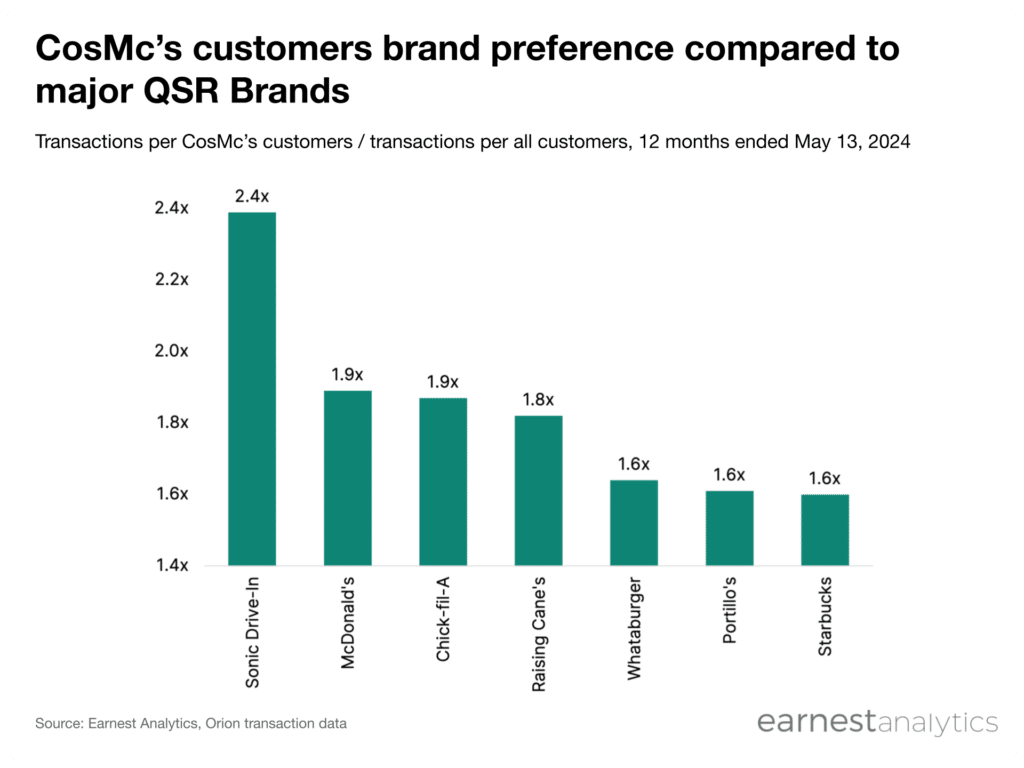

CosMc’s customers are 2.4 times more likely than the average person to make a purchase at Sonic Drive-In, according to Earnest credit card data. That is even more likely than for purchasing likelihood at McDonald’s, at 1.9 times. Chick-fil-A (1.9 times), Raising Cane’s (1.8 times), Whataburger (1.6 times), Portillo’s (1.6 times), and Starbucks (1.6 times) also have above average brand affinities among CosMc’s customers.

CosMc’s customers are least likely to buy food from Five Guys (0.8 times), Cold Stone Creamery (0.8 times), and Waffle House (0.8 times). This suggests that CosMc’s specialty drink-forward menu is resonating most with drive-thru customers.

See data in Dash.

CosMc’s customers are spending more at McDonald’s, Raising Cane’s, less at Sonic, Chick-fil-A and Starbucks

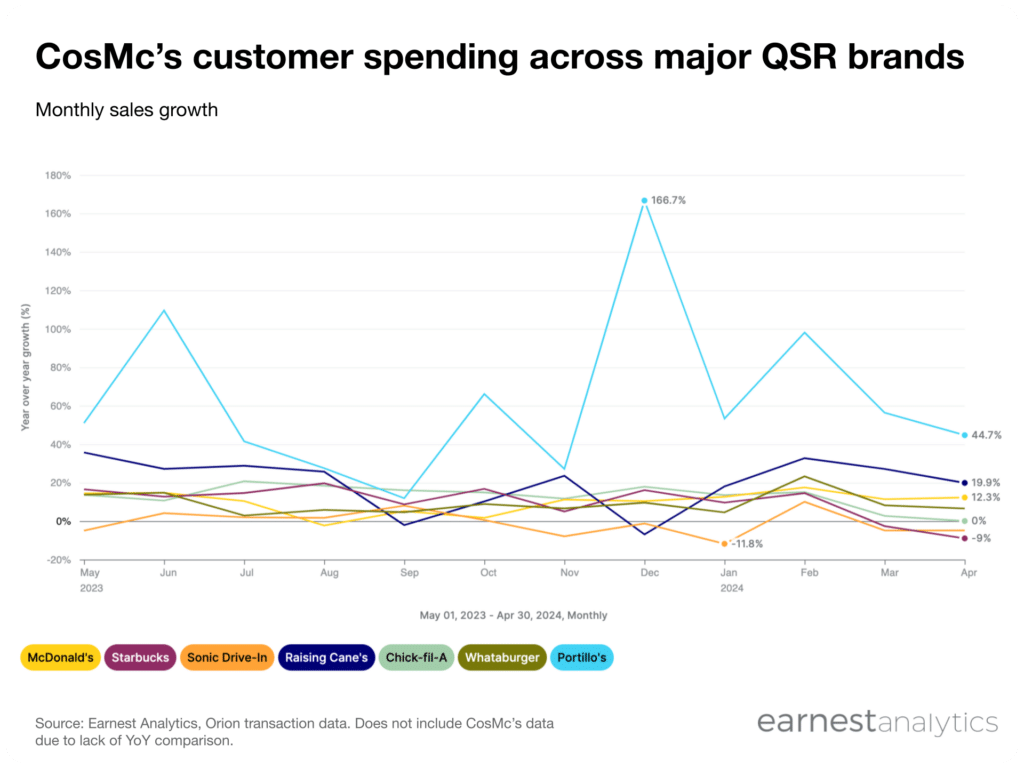

CosMc’s customers spent 12.3% more at McDonald’s in April 2024 than they did the year prior according to Earnest credit card data. They also spent more at Portillo’s (44.7% YoY) and Raising Cane’s (19.9% YoY), two fast-growing regional restaurant brands.

Data also shows CosMc’s customers spent 9.0% less at Starbucks in April 2024 than they did the year prior, and 4.8% less at Sonic Drive-In. Chick-fil-A spending also decelerated to flat sales YoY from double-digit growth months before. This suggests CosMc’s, while still a small footprint, could potentially disrupt other major drive-thru brands like Starbucks and Sonic, and potentially even QSR stalwarts like Chick-fil-A.

See chart in Dash.

Track QSR spending for free