Value, chicken fast casual chains buck lower restaurant traffic in 3Q24

Contact Sales for details.

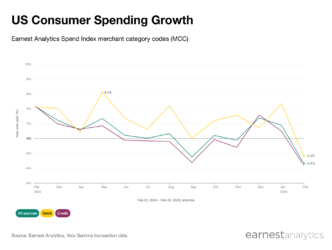

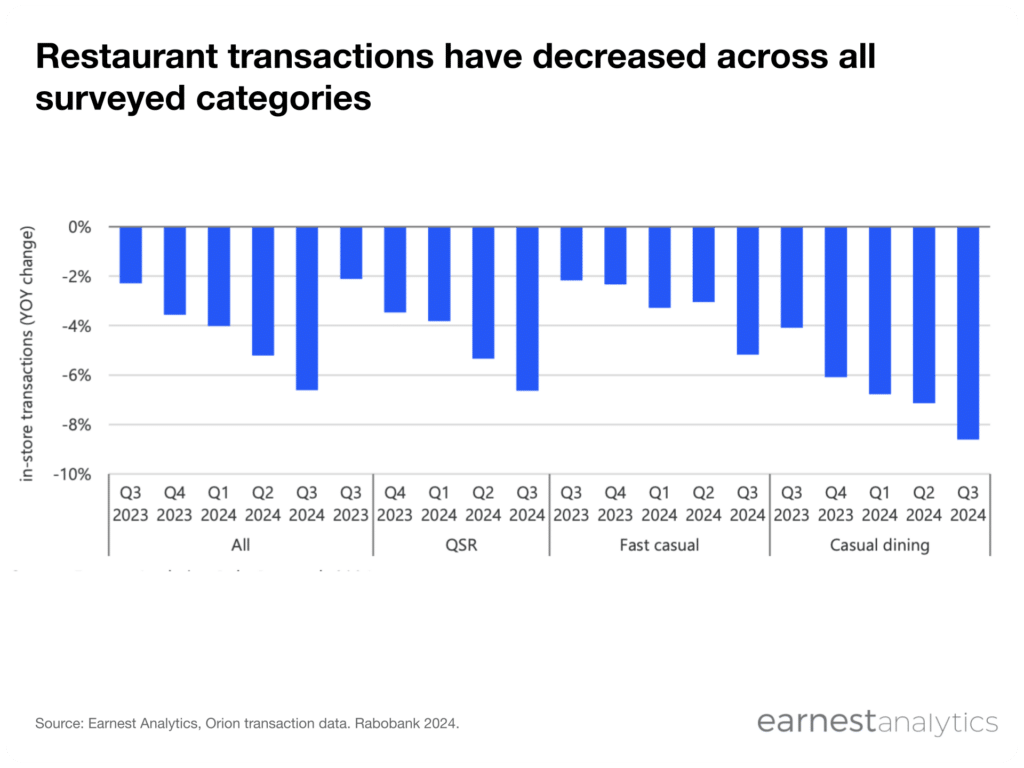

According to Earnest Analytics, credit and debit card transactions at US restaurants dropped by 6.6% YOY in Q3 2024 (see figure 1), adding to successive drops in restaurant visits that have been in place since spring 2023. Although concerning, this trend is not entirely surprising given the financial strain on consumers and continual rise in foodservice prices.

As a result of the weakened consumer position, restaurant performance is suffering, with declining traffic across all formats (QSR, fast casual, and casual). However, there is a discrepancy in the levels of decline. Higher-value restaurants (primarily casual dining) experienced an 8.6% YOY decline in the past quarter, followed by QSRs at -6.6%. Fast casual has suffered the least, with a – 5.2% decline this quarter after an attempted recovery in Q2.

While restaurant traffic is down, average check sizes have continued to grow, albeit slower due to the consumer pressures mentioned. In Q3, average check sizes increased by 2.5% compared to Q3 2023 (see figure 2). This growth rate is below inflation for food-away-from-home during the same period (4%).

Download foodservice and food retail 3Q24 report