2022 Retail Ranking: Black Friday and Cyber Monday

Key takeaways

- Almost 1-in-4 shoppers spent the most at Amazon during Cyber-5

- Home goods and furnishings retailers lost top wallet share lapping difficult pandemic comps

- Dollar stores and warehouse clubs gained top wallet share as consumers traded down on inflation

Earnest Analytics First Choice Retailer Methodology

The Earnest First Choice Retailer Rankings are based on the credit and debit card spend of millions of de-identified U.S. consumers from the Orion spend panel. Earnest identifies each shopper’s First Choice Retailer by comparing their spend across 1000 retailers between Thanksgiving and Cyber Monday. For example, if Shopper A spent $70 at Amazon, $50 at Walmart, and $30 at Target, their First Choice Retailer would be Amazon. Below, Amazon’s number one ranking means more customers spent the largest percentage of their retail wallet at Amazon during the holiday shopping period between Black Friday and Cyber Monday in 2021 than at any other merchant. Historical numbers should be taken from the data presented because historic figures can shift as a result of panel adoption and churn.

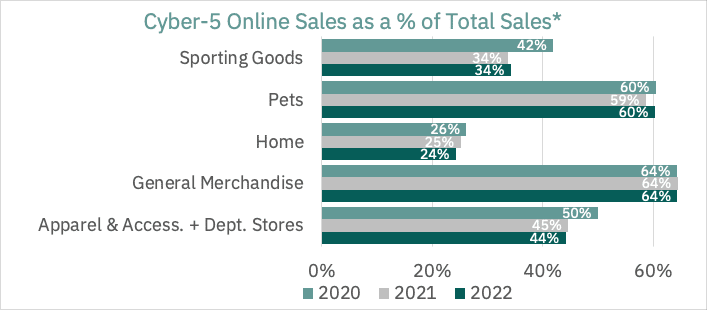

Online spending share little changed vs 2021

Black Friday 2022 came among a sluggish November for consumer spending growth and shifting consumer preferences on high inflation. Overall Cyber-5 sales grew 4% YoY, down from 22% in 2021. Among major Black Friday and Cyber Monday categories, General Merchandise online sales share, including sales from Amazon, Target, and Walmart, remained stable over the last three years, after surging from 2019. Online sales were a smaller percentage of overall sales than in 2021 for Apparel & Accessories + Department Stores and Home categories as shoppers returned to in-store, especially for high ticket items. Pets and Sporting Goods both marginally grew their percentage of online sales, with Pets sales returning to pandemic-era levels.

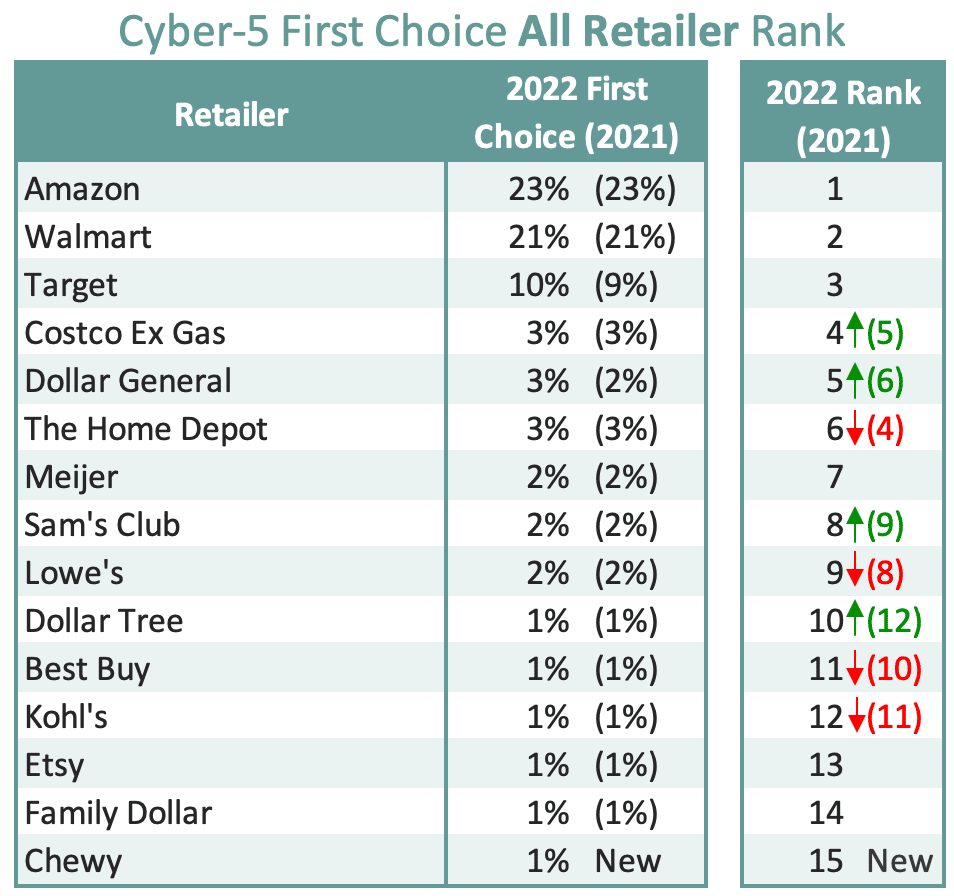

Amazon led, home retailers fell, dollar and warehouse gained

Amazon retained its lead in the top wallet position despite its relatively slow start to the holiday season. Amazon has held the top position since unseating Walmart in 2019. Walmart and Target rounded out the top three spots. Warehouse clubs Costco and Sam’s Club both climbed in the ranking since 2021, as Costco in-store sales benefited from higher fuel prices driving more customers to their stores and pumps. The Home Depot, Lowe’s, and Best Buy all fell in the rankings as home goods and furnishings declined early this holiday season after robust pandemic era growth. Chew is new to the top 15 list for 2022.

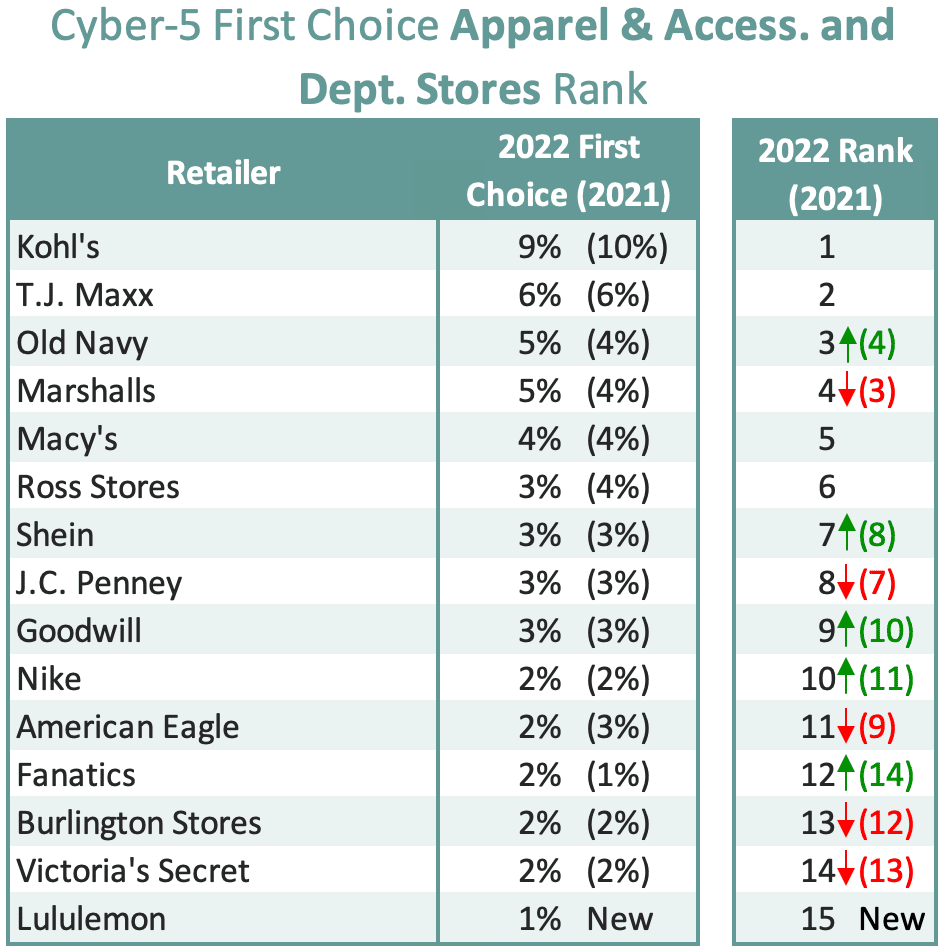

Kohl’s led apparel, Lululemon joined the top 15

Kohl’s remained at the top of the Apparel and Accessories + Department Store list by a wide margin despite some shoppers moving to other brands. This after losing share post-pandemic as Kohl’s core cohort of stimulus recipients drove YoY sales declines compared to department stores with less middle and lower income exposure. Lululemon was new to the list in 2022, on the tail of a very successful back-to-school season that saw their premium customers continue to spend despite macroeconomic concerns. American Eagle was the biggest mover on the list, falling two spots as Nike and Goodwill both gained. Victoria’s Secret continued to fall in the rankings, though sales from its intended acquisition target AdoreMe were not included.

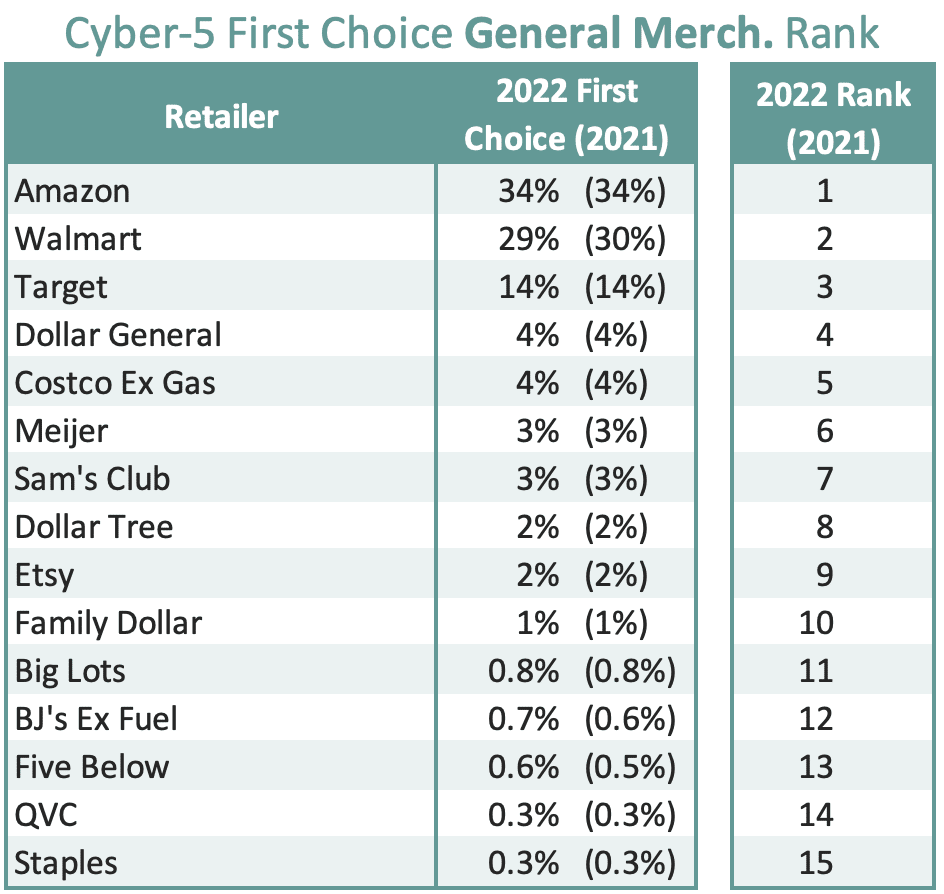

Amazon remained on top of gen merch, Walmart shoppers defected

A third of General Merchandise shoppers spent more at Amazon than any other General Merchandise brand during Cyber-5, unchanged since 2021. Second in the list Walmart saw its share of top wallet fall slightly, though it kept its rank from the prior year. The list remains largely unchanged, though both warehouse club BJ’s and discounter Five Below picked up some shoppers’ top share of wallet during the holiday.

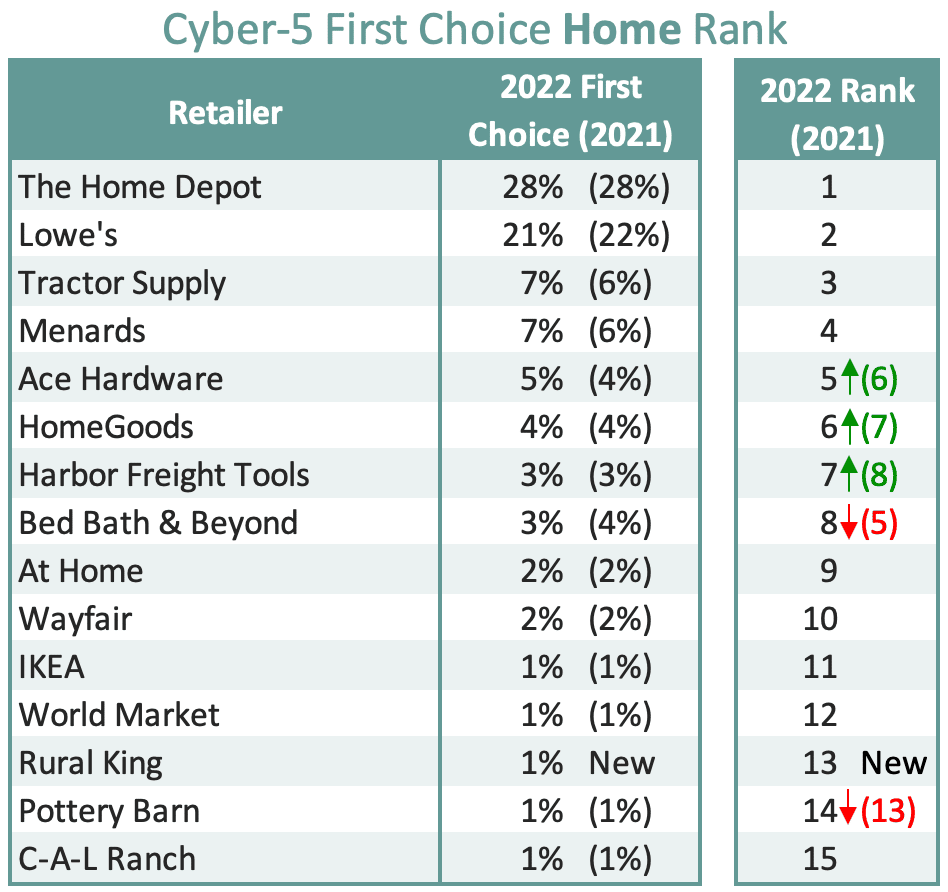

Bed Bath & Beyond and Pottery Barn fall

The Home Depot and Lowe’s accounted for almost half of all top ranked home wallet share during 2022, unchanged from 2021. The category overall struggled in the early half of November as it lapped historically strong pandemic growth in 2021. Bed Bath & Beyond slipped three spots, making way for Ace Hardware, HomeGoods, and Harbor Freight Tools to rise in the rankings. Pottery Barn fell a single spot, displaced by Rural King, which is new for 2022.

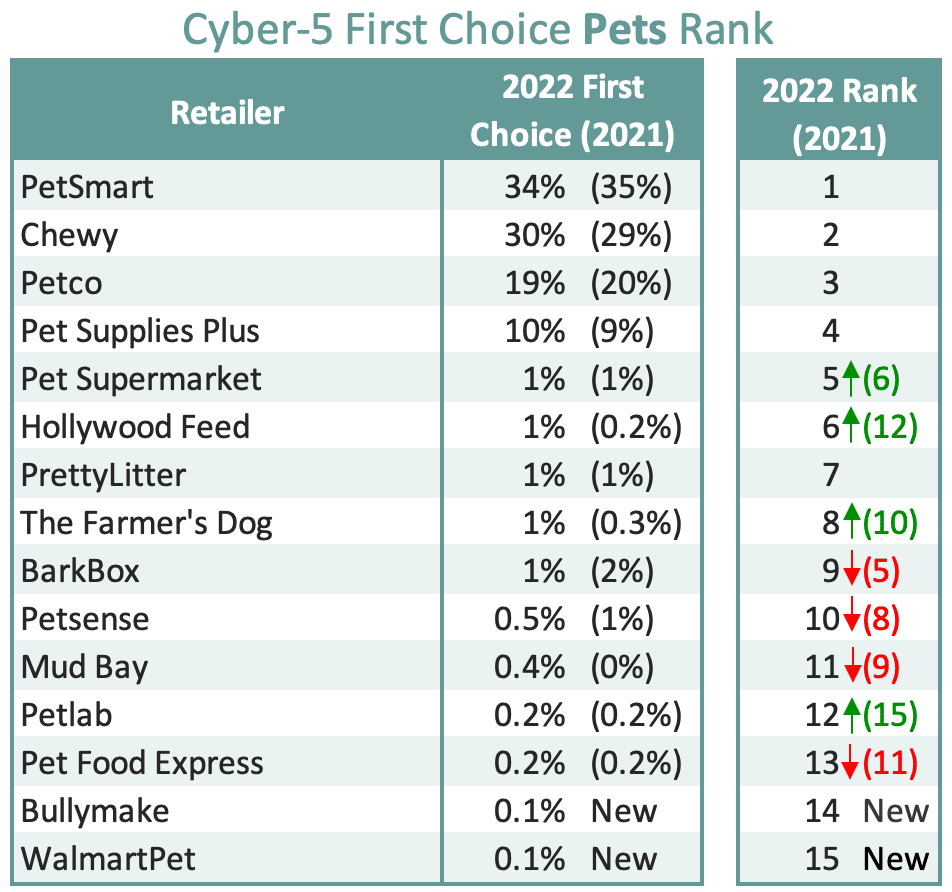

PetSmart and Chewy on top, Hollywood Feed jumps up the rankings

PetSmart and Chewy remained at the top of the list, followed by Petco after a relatively strong holiday sales start. Pet Supermarket displaced BarkBox while Hollywood Feed jumped six spots to the top ten. The list was very dynamic this year, with ten of the top 15 names changing places. Petsense, Mud Bay, and Pet Food Express all fell in the rankings while The Farmer’s Dog and Petlab rose. Bullymake and WalmartPet are both new for 2022.

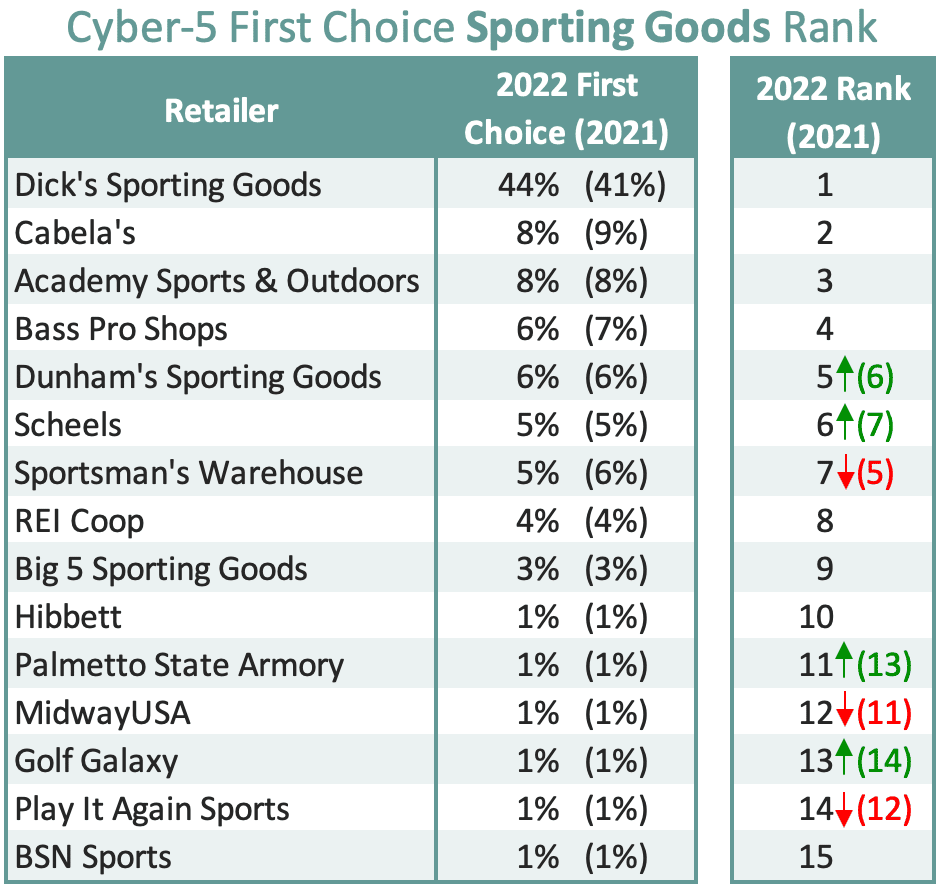

Dick’s and Cabelas led, Sportsman’s Warehouse fell

Perennial Sporting Goods retailer Dick’s Sporting Goods led the rankings with one of the widest margins of any category–its percentage of first place wallet shoppers also rose notably. Outdoor focused Cabela’s and Academy Sports & Outdoors rounded out the top three spots. Former top five retailer Sportsman’s Warehouse fell two rankings, while hunting goods dealer MidwayUSA and reseller Play It Again Sports also fell. Ammunition seller Palmetto State Armory and golfing brand Golf Galaxy both gained.

Notes

- *Does not include spend made on store-branded cards that will likely not be paid down until after the Cyber-5 period.

- Cyber-5 analysis includes 7 days spanning Thursday, November 26, 2020, to Wednesday, December 2, 2020; Thursday, November 25, 2021, to Wednesday, December 1, 2021 and Thursday, November 24, 2022, to Wednesday, November 30, 2022 to account for credit card and shipping processing lag.

- “Total purchases” references combined online and in-store purchases, excluding purchases made on captive and cobranded store cards.

- Analysis conducted over the largest retailers in Earnest coverage, excluding subscriptions and retailers that primarily sell groceries.

- Walmart’s sales do not include sales made through Walmart’s Online Grocery platform.

- Analysis excludes Apple and eBay retail sales.

- Subcategories included in each analysis as follows:

All Retailers: Active & Athleisure, Apparel Subscriptions, Children’s Apparel, Fashion Resale, Fast Fashion, Footwear, General Apparel, High-End Department Stores, Intimate & Swimwear, Jewelry & Watches, Luggage & Bags, Luxury Apparel, Mid-Tier Department Stores, Off-Price Department Stores, Outdoor, Plus Size, Professional & Dress Attire, Specialty Apparel, Teen Apparel, Big Box Retailers, Discount & Dollar Stores, Office Supplies, Online, Marketplaces, Warehouse Clubs, Farm & Ranch, Garden & Outdoor, Home Furnishings, Home Improvement, Household Goods, Pet Supplies, Hunting & Fishing, Sports Gear

Apparel & Accessories + Department Stores: Active & Athleisure, Apparel Subscriptions, Children’s Apparel, Fashion Resale, Fast Fashion, Footwear, General Apparel, High-End Department Stores, Intimate & Swimwear, Jewelry & Watches, Luggage & Bags, Luxury Apparel, Mid-Tier Department Stores, Off-Price Department Stores, Outdoor, Plus Size, Professional & Dress Attire, Specialty Apparel, Teen Apparel

General Merchandise: Big Box Retailers, Discount & Dollar Stores, Office Supplies, Online, Marketplaces, Warehouse Clubs

Home: Farm & Ranch, Garden & Outdoor, Home Furnishings, Home Improvement, Household Goods

Pets: Pet Supplies

Sporting Goods: Hunting & Fishing, Sports Gear